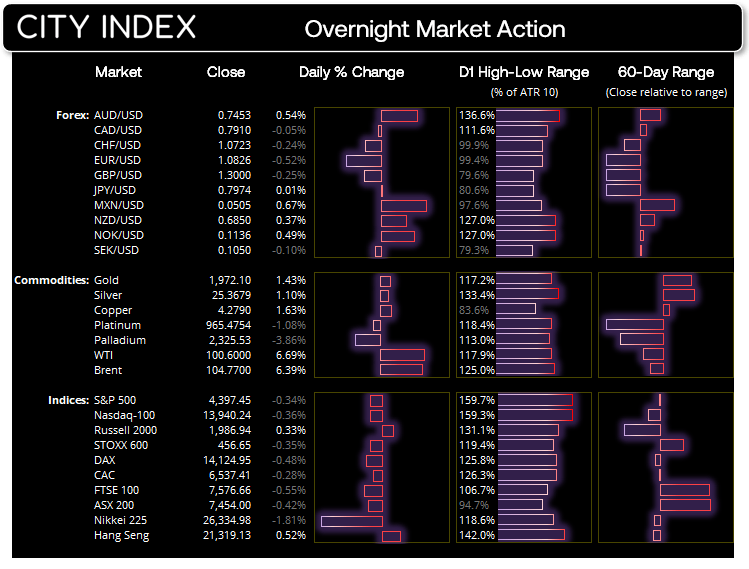

Tuesday US cash market close:

- The Dow Jones Industrial fell -87.72 points (-0.26%) to close at 34,220.36

- The S&P 500 index rose -15.08 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -49.965 points (-0.36%) to close at 13,940.24

Asian futures:

- Australia's ASX 200 futures are down 0 points (-0.49%), the cash market is currently estimated to open at 7,454.00

- Japan's Nikkei 225 futures are down 0 points (0%), the cash market is currently estimated to open at 26,334.98

- Hong Kong's Hang Seng futures are down -78 points (-0.37%), the cash market is currently estimated to open at 21,241.13

- China's A50 Index futures are up 31 points (0.22%), the cash market is currently estimated to open at 13,903.31

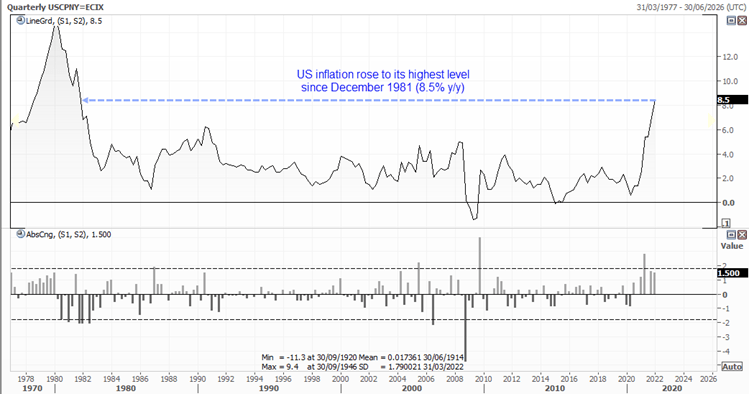

US inflation rose to a (near) 41-year high of 8.5% as expected, although the monthly read of core inflation undershot expectations. Regardless, a 50-bps hike is all but confirmed with Fed fund futures now pricing in an 86.6% chance of it happening in May. The Fed’s Brainard said they will continue on the path although mentioned signs of inflation “cooling”. We beg to differ.

Whilst the Fed are about to embark on an aggressive tightening cycle, higher rates won’t fix the supply chain bottlenecks which are a key driver behind the inflation they’re about to fight. So, whilst we think inflation will gradually decline over the next 12 – 18 months it remains debatable as whether we’ve seen peak inflation just yet.

Used gas and trucks account for around 4.2% of the index weighting and were one of the few components to decline in March. Yet shelter accounts for 33% and rose 0.5%. Gasoline, which rose 18.3%, has its own macro story and not a pleasant one to predict. But it is hard to see how inflation has peaked just yet looking through the data.

Wall Street lower, commodities higher

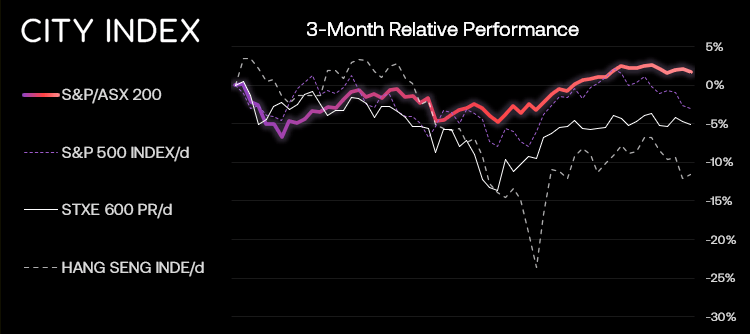

Despite a positive start, US equities delved deeper into the data and turned lower. The Nasdaq 100 once again led the declines although it was only around -0.4% lower, the S&P and Dow Jones down around -0.3%. AUD and NZD were the strongest majors as they tracked commodities higher. The Thomson Reuters commodities index closed to a 2-week high, helped with stronger oil prices. Gold hit a high of 1980 and now trades around 1966, whilst silver also rose in line with our bias from yesterday’s video on its way to our initial target around 26.

ASX 200:

ASX 200: 7454 (-0.42%), 12 April 2022

- Materials (-0.03%) was the strongest sector and Health Care (-1.4%) was the weakest

- 11 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 130 (65.00%) stocks advanced, 54 (27.00%) stocks declined

Outperformers:

- +2.85% - Elders Ltd (ELD.AX)

- +2.73% - Meridian Energy Ltd (MEZ.AX)

- +2.56% - Uniti Group Ltd (UWL.AX)

Underperformers:

- -7.54% - Lake Resources NL (LKE.AX)

- -5.84% - Pilbara Minerals Ltd (PLS.AX)

- -5.81% - Core Lithium Ltd (CXO.AX)

Oil supported by demand hopes

News that Shanghai had eased lockdown restrictions bolstered oil prices overnight. Whilst WTI fell just over -20% from its March high, it held above the March low on Monday ahead of yesterday’s rebound.

We can see on the hourly chart that a strong bullish trend has developed since its false break below 94. Prices have broken above the 50-day eMA and weekly pivot point which places a potential zone for support around 98.50 should prices pull back. Alternatively, a small flag is forming so we’re also on guard for a break higher towards the 105 resistance zone.

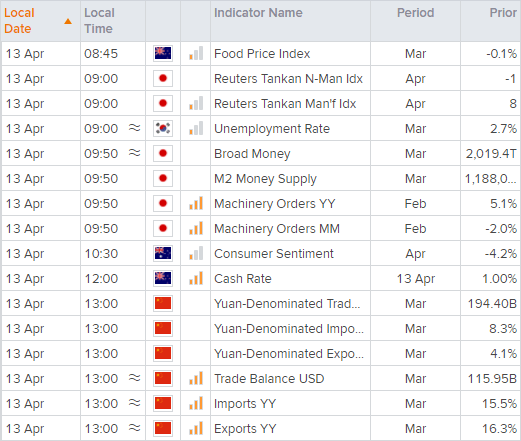

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade