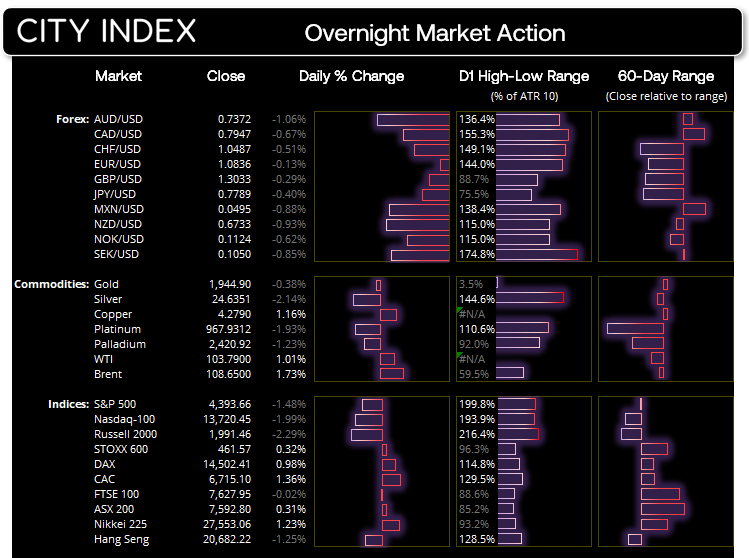

Thursday US cash market close:

- The Dow Jones Industrial rose 368.03 points (1.05%) to close at 34,792.76

- The S&P 500 index rose -65.79 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -278.076 points (-1.99%) to close at 13,720.45

Asian futures:

- Australia's ASX 200 futures are down -13 points (-0.17%), the cash market is currently estimated to open at 7,579.80

- Japan's Nikkei 225 futures are down -390 points (-1.42%), the cash market is currently estimated to open at 27,163.06

- Hong Kong's Hang Seng futures are down -377 points (-1.82%), the cash market is currently estimated to open at 20,305.22

- China's A50 Index futures are down -91 points (-0.68%), the cash market is currently estimated to open at 13,306.62

Speaking at an IMF meeting on the global economy, Jerome Powell said he thinks “it is appropriate to be moving a little more quickly” regarding rate hike and that “50 bps will be on the table” at their next meeting in May. Considering markets have all but fully priced this in anyway (along with further 50-bps hikes) then the bigger surprise is that markets reacted as if this was new news. But then finally hearing it from the big man himself seems to have been the confirmation markets sought.

Wall Street was broadly lower with the NYSE FNAG+TM index falling -2.8% and the SOX semiconductor index down-2.7%. Bearish engulfing candles formed on all three major indices, with the Nasdaq leading the way lower by -2% and closing below 14,000. The S&P 500 is back below its 200-day eMA and all of its sectors posted losses, led by energy stocks.

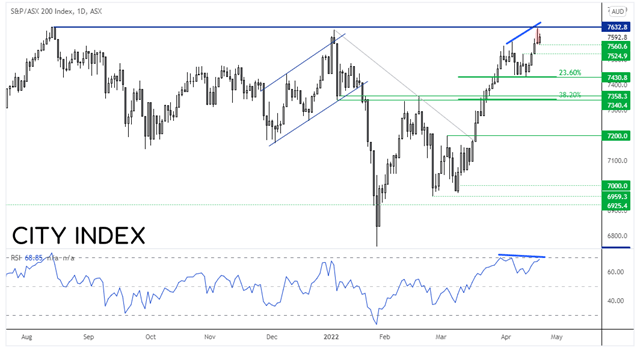

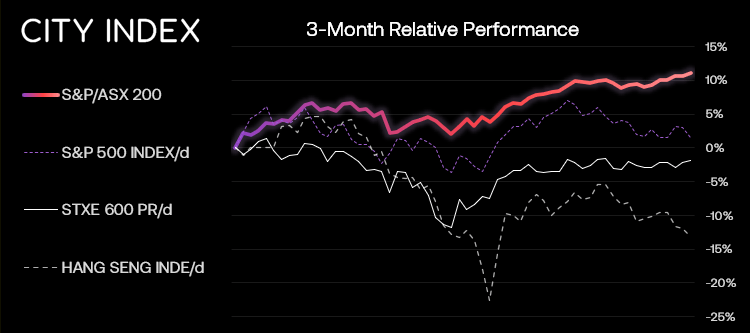

ASX 200:

We may not have seen the mean reversion we anticipated yet, but the case is now stronger given the weak lead from Wall Street. A small bullish candle formed yesterday which lacked the enthusiasm to have another crack at the record high, and a break below 7560.6 confirms Wednesday’s bearish pinbar. Given it formed below the record high then a cheeky pullback seems like the higher probability setup over the near-term.

ASX 200: 7592.8 (0.31%), 21 April 2022

- Industrials (2.23%) was the strongest sector and Info Tech (-2.62%) was the weakest

- 8 out of the 11 sectors closed higher

- 3 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 139 (69.50%) stocks advanced, 52 (26.00%) stocks declined

Outperformers:

- +9.81% - Challenger Ltd (CGF.AX)

- +7.98% - Brambles Ltd (BXB.AX)

- +5.05% - LendLease Group (LLC.AX)

Underperformers:

- -6.94% - Block Inc (SQ2.AX)

- -5.93% - AVZ Minerals Ltd (AVZ.AX)

- -5.78% - Core Lithium Ltd (CXO.AX)

USD index rebounds from 100

Powell’s comments bolstered the US dollar, but only after it reached (and exceeded) our 100 target then rebounding to 100.63. Perhaps we have seen the swing low already. USD/CHF hit a 22-month high, EUR/USD met resistance at 1.0986 and printed a bearish hammer. AUD/USD formed a large bearish outside day and is now less than a day’s ATR away from trend support, making 0.7350 an area to watch heading into the weekend.

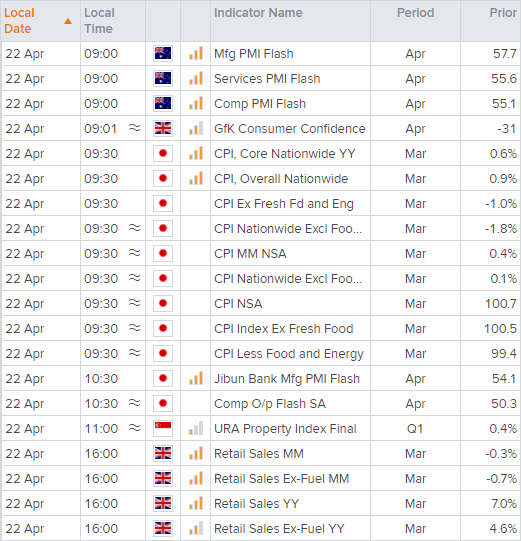

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade