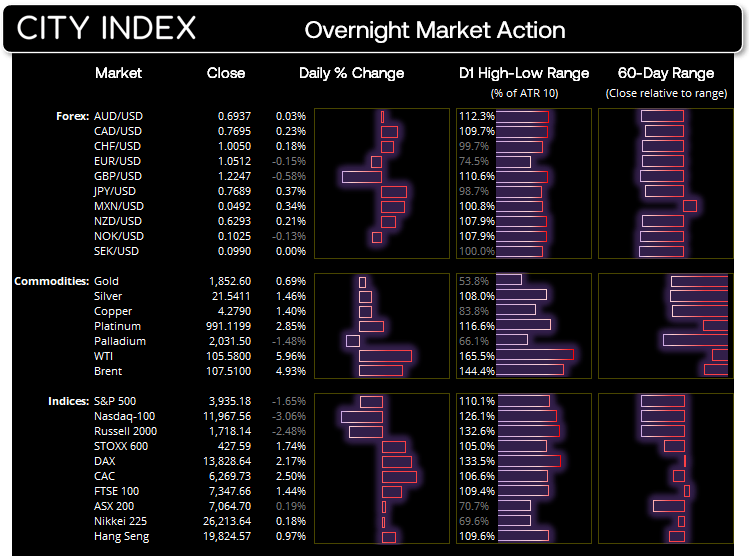

Wednesday US cash market close:

- The Dow Jones Industrial fell -326.63 points (-1.02%) to close at 31,834.11

- The S&P 500 index rose -65.87 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -378.299 points (-3.06%) to close at 11,967.56

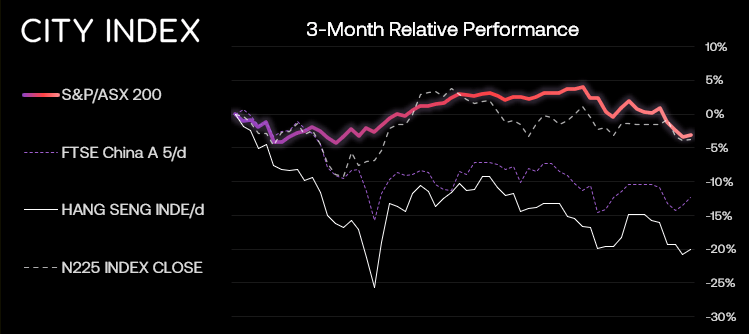

Asian futures:

- Australia's ASX 200 futures are down -15 points (-0.21%), the cash market is currently estimated to open at 7,049.70

- Japan's Nikkei 225 futures are down -350 points (-1.33%), the cash market is currently estimated to open at 25,863.64

- Hong Kong's Hang Seng futures are down -379 points (-1.92%), the cash market is currently estimated to open at 19,445.57

- China's A50 Index futures are down -69 points (-0.52%), the cash market is currently estimated to open at 13,161.77

There was a lot of expectation that CPI would soften enough to provide confidence that inflation had peaked. Those expectations were not fulfilled.

US inflation in April indeed was softer than March, just not as soft as expected. Food rose 0.9% m/m and 9.4% y/y whilst energy fell -2.7% m/m, yet rose 30.3% y/y. This led to some knee-jerk reactions across markets as they tried to decipher whether this was a good or bad print, and what it meant for the Fed’s hiking cycle. Ultimately, we don’t think it changes anything; the Fed are still on track for several 50bps hikes, 75-bps is not the base-case, and this report neither makes it more or less likely 75-bps hikes will be required. But what traders were clearly hoping for was a decisive signal that inflation has peaked, and they didn’t get it.

This led to some knee-jerk reactions on Wall Street index futures initially handing back their pre-emptive gains, rallying to a new intraday high before reversing lower again. We expect equities across Asia to face selling pressure today, although conditions could be choppy as traders face the same conundrum.

The US dollar remains support although currency pairs experienced similar spats of volatility before succumbing to the dollar’s strength. AUD/USD spiked above 70c before erasing the day’s gains, although USD/JPY is now a touch below 130.

Energy higher on geopolitical tensions

Kyiv were forced to reduce gas supplies from Russia via the capital on Wednesday, blaming interference from occupying Russian forces. Ukraine remains an important hub for Russia’s gas route to Europe and it is estimated to have dropped by around 25%. Yesterday. Oil prices rallied with WTI recovering back above $100 and closing above its 50-day eMA. Natural gas rallied for a second day to $7.66.

Gold is showing the promising signs of an important swing low

Gold recovered back above its 200-day average and trend support from the August low and formed a 2-day bullish reversal pattern (bullish piercing line). Furthermore, the 10-year breakevens (inflation expectations) rose +8 bps, and daily gold ETF flows rose at their fastest pace since January. Our bias now remains bullish above $1830, and a break above $1866 brings $1880 and $1892 resistance levels into focus.

ASX 200:

ASX 200: 7064.7 (0.19%), 11 May 2022

- Health Care (1.74%) was the strongest sector and Financial (-1.08%) was the weakest

- 7 out of the 11 sectors closed higher

- 4 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 118 (59.00%) stocks advanced, 67 (33.50%) stocks declined

Outperformers:

- +5.86% - Summerset Group Holdings Ltd (SNZ.AX)

- +5.34% - Johns Lyng Group Ltd (JLG.AX)

- +4.52% - A2 Milk Company Ltd (A2M.AX)

Underperformers:

- -15.09% - Link Administration Holdings Ltd (LNK.AX)

- -6.47% - Meridian Energy Ltd (MEZ.AX)

- -5.21% - Chalice Mining Ltd (CHN.AX)

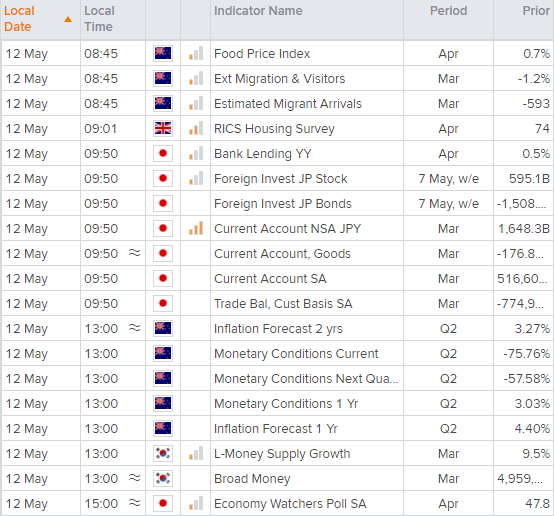

Up Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade