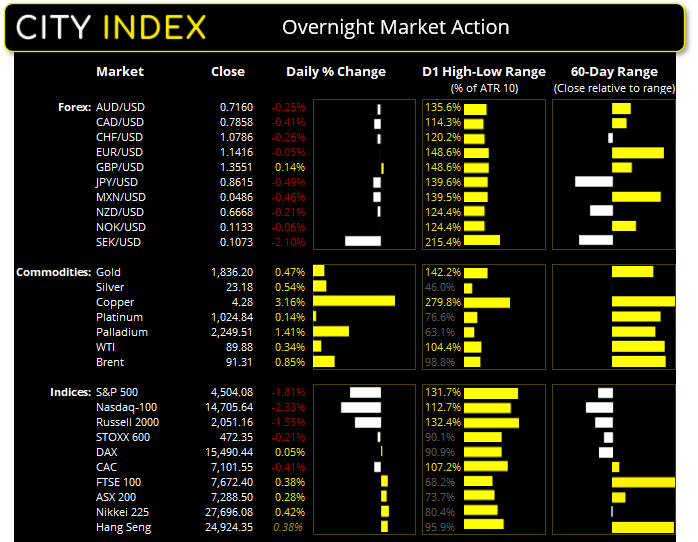

Thursday US cash market close:

- The Dow Jones Industrial fell -83.1 points (-1.47%) to close at 35,241.59

- The S&P 500 index fell -83.1 points (-1.82%) to close at 4,504.08

- The Nasdaq 100 index fell -351.323 points (-2.33%) to close at 14,705.64

Asian futures:

- Australia's ASX 200 futures are down -55 points (-0.77%), the cash market is currently estimated to open at 7,233.50

- Japan's Nikkei 225 futures are down -320 points (-1.16%), the cash market is currently estimated to open at 27,376.08

- Hong Kong's Hang Seng futures are down -34 points (-0.14%), the cash market is currently estimated to open at 24,890.35

- China's A50 Index futures are up 29 points (0.19%), the cash market is currently estimated to open at 15,160.53

Wall Street was broadly lower overnight after the stronger than expected inflation print spooked investors. And momentum only accelerated further when calls for an emergency rate from the Fed surfaced. The Fed funds have collapsed with markets pricing in a 96% chance of a 50-bps hike at their March meeting. But with the Fed funds falling at an alarming rate some investors think the Fed may have to step in as soon as tomorrow (Friday US) to restore order to the money markets. It seems we were right to be cautious of the Dow Jones breakout on Wednesday (which had not been confirmed by breakouts on the S&P and Nasdaq) with all three firmly in the red.

The US 2-year yield surged +26 bps by its high of the day, and that reaction is quite significant when you consider traders were supposedly expecting a 40-year high read on CPI. But with inflation adding a full 2.1 percentage points over the past four months alone, it’s a good job the Fed have ditched the term transitory!

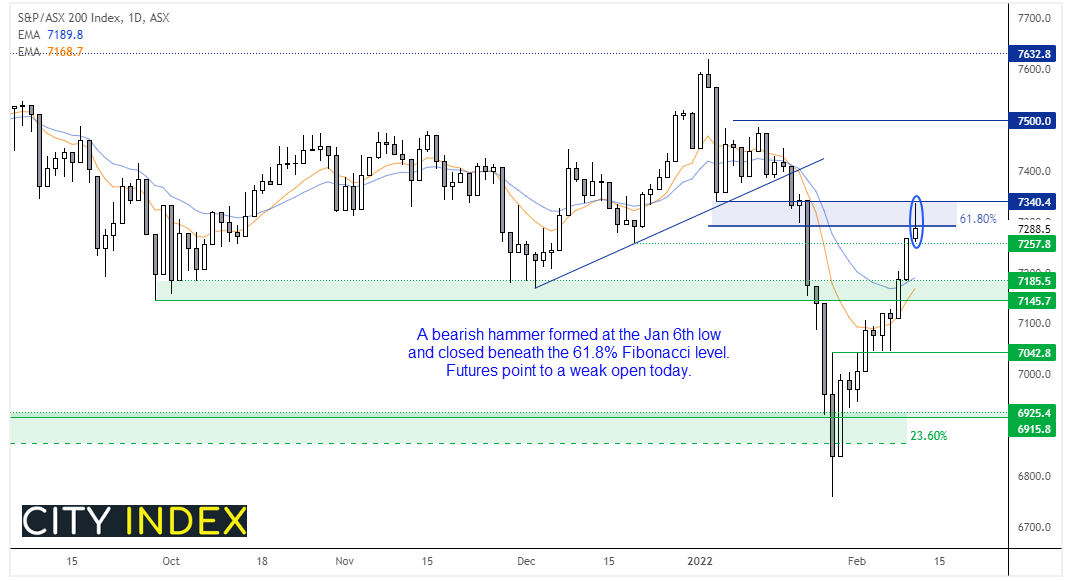

Futures point to a weak open for the ASX 200

We think it’s (relatively) safe to say the ASX 200 has seen its high for the week. It met resistance at the January 6th low yesterday and formed a 1-day reversal pattern (bearish hammer) which closed below the 61.8% Fibonacci level. And with a weak lead from Wall Street, we’d expect some selling pressure today. A break below 7257 confirms the 1-bar reversal and may even (dare we say) mark the corrective high of its rally from the January low. We hope you like red.

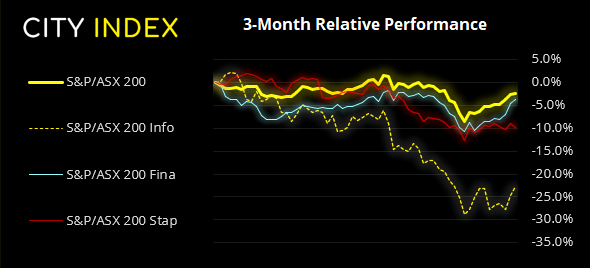

ASX 200: Market internals

ASX 200: 7288.5 (0.28%), 10 February 2022

- Information Technology (2.61%) was the strongest sector and Materials (0.52%) was the weakest

- 3 out of the 11 sectors closed higher

- 7 out of the 11 sectors closed lower

- 3 out of the 11 sectors outperformed the index

- 99 (47.60%) stocks advanced, 99 (47.60%) stocks declined

Outperformers:

- +10% - Bapcor Ltd (BAP.AX)

- +7.64% - Megaport Ltd (MP1.AX)

- +6.76% - Paladin Energy Ltd (PDN.AX)

Underperformers:

- -7.13% - CIMIC Group Ltd (CIM.AX)

- -3.81% - ASX Ltd (ASX.AX)

- -3.78% - PEXA Group Ltd (PXA.AX)

Volatile trade for currencies

By the New York close, JPY and CAD were the weakest major currencies, whilst the GBP and USD were the strongest. We could be in for a lively session in Asia today as traders digest these developments. USD/JPY is above 116 and looks set to challenge YTD high. And, with Japan on public holiday, it means we have a lower liquidity environment with the potential for knee-jerk reaction.

Gold snaps 4-day winning streak

The yellow metal faltered at 1840 amid the carnage and printed its first down day in five. As the baulk of the trading activity took place between 1828 – 1834 – an area which produced a low-liquidity gap in January - that gap has now been filled and we see the potential for gold to top out from here. A break below 1820 would be constructive for that bias.

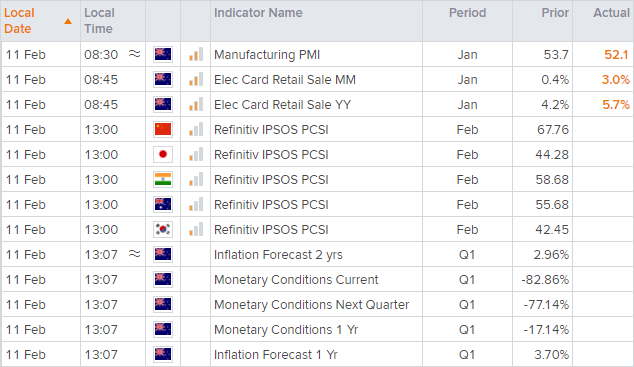

Up Next (Times in AEDT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade