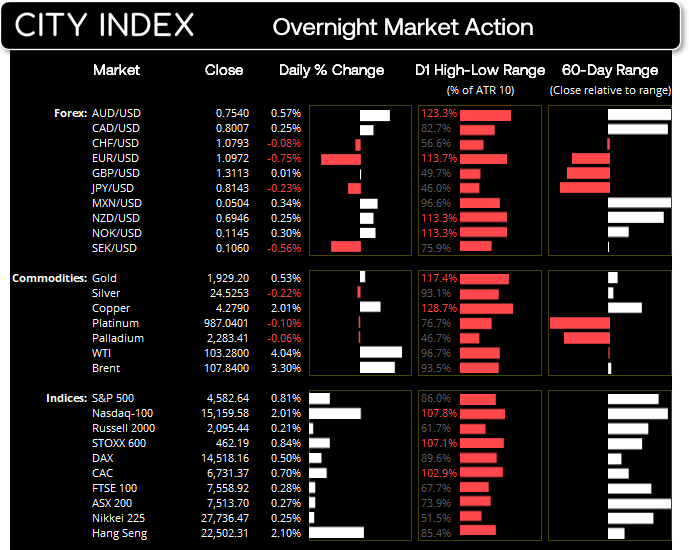

Monday US cash market close:

- The Dow Jones Industrial rose 201 points (0.3%) to close at 34,921.88

- The S&P 500 index rose 36.78 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 298.369 points (2.01%) to close at 15,159.58

Asian futures:

- Australia's ASX 200 futures are up 27 points (0.36%), the cash market is currently estimated to open at 7,540.70

- Japan's Nikkei 225 futures are up 160 points (0.58%), the cash market is currently estimated to open at 27,896.47

- Hong Kong's Hang Seng futures are up 144 points (0.64%), the cash market is currently estimated to open at 22,646.31

- China's A50 Index futures are up 96 points (0.69%), the cash market is currently estimated to open at 14,105.59

Not so long ago, headlines of new sanctions on Russia and accusations of war crimes would have weighed heavily on sentiment (and on technology stocks, in particular). But the fact the Russia is yet to turn off the gas tap to Europe alongside news that Elon Musk has purchased a 9.2% stake in Twitter appears to have triggered a risk-on rally overnight, with indices, commodities and bond yields moving broadly higher.

The Nasdaq rose 2% and closed back above 15,000. Friday’s bullish hammer respected the 200 and 110-day eMA as support which makes it a likely swing low, so we’re now seeking a break above last Tuesday’s high to assume bullish continuation. The S&P 500 rose 0.8% although seven of its 11 sectors declined, led by utilities and healthcare.

ASX 200:

The positive lead from Wall Street is likely to bode well for the ASX 200 today, with technology and energy stocks likely contenders to take the lead. The ASX has rallied for the past three weeks and now stands a better chance of holding above 7500, a level it has meandered around over the past four sessions. The financial sector may come under pressure like its US counterpart, and price action on the sector does appear to be carving out a topping pattern. The consumer discretionary sector appears to have set a swing high last week and momentum is now pointing firmly lower for the sector.

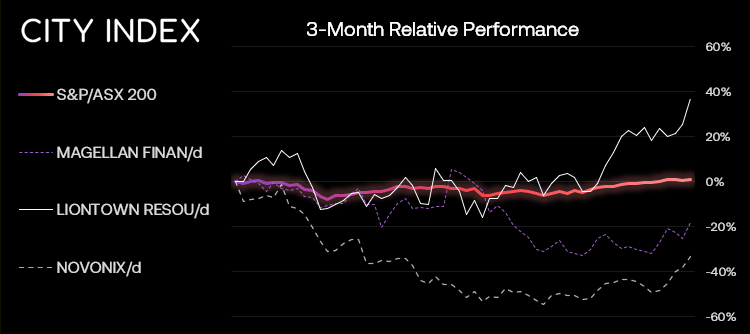

ASX 200: 7513.7 (0.27%), 04 April 2022

- Utilities (1.08%) was the strongest sector and Consumer Disc (-0.86%) was the weakest

- 6 out of the 11 sectors closed higher

- 5 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 130 (65.00%) stocks advanced, 62 (31.00%) stocks declined

Outperformers:

- +9.71% - Magellan Financial Group Ltd (MFG.AX)

- +9.00% - Liontown Resources Ltd (LTR.AX)

- +7.96% - Novonix Ltd (NVX.AX)

Underperformers:

- -3.25% - Fletcher Building Ltd (FBU.AX)

- -3.18% - Bank of Queensland Ltd (BOQ.AX)

- -3.01% - Aristocrat Leisure Ltd (ALL.AX)

Talk of fresh sanctions pushes energy prices higher

Natural gas hit a 9-week high and tracked oil prices on talks of fresh sanctions. WTI futures closed back above $100, reached (and exceeded) our $103 target to reach a high of nearly $104. But as daily trading activity was its lowest in over two weeks, we suspect it may be a mild short-covering rally. So bulls would be wise to tread with caution until volumes improve.

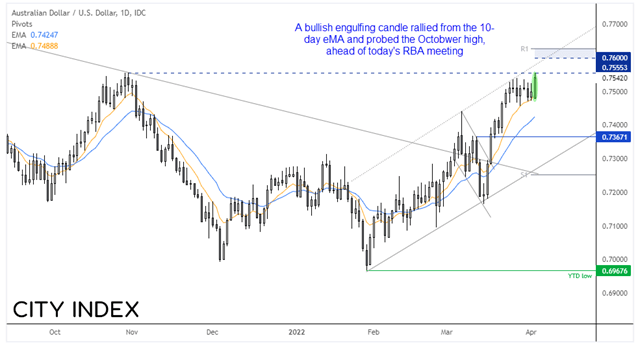

AUD/USD probes resistance ahead of RBA

Commodity currencies were higher overnight, with AUD firmly in the lead and NZD in second place. AUD/JPY broke above the 92.33 high to trigger our bullish bias from yesterday’s report. AUD/USD printed a bullish outside day on the daily chart

The Aussie finds itself at an interest level ahead of today’s meeting. Yesterday’s bullish engulfing candle rallied from the 10-day eMA and probed the October high and trades within a bullish channel. Should the RBA cave and hint ever to slightly of a sooner hike, a move to (and possibly 0.7600) seems more then feasible. But the downside to this argument is that they generally do nothing exciting whatsoever ahead of a general election. So there’s a solid chance that bulls could be disappointed today and the Aussie pulls back from the October. But whatever happens, that AUD is at a pivotal leave ahead of a potentially binary outcome leaves the potential for a bullish and bearish setup around current levels.

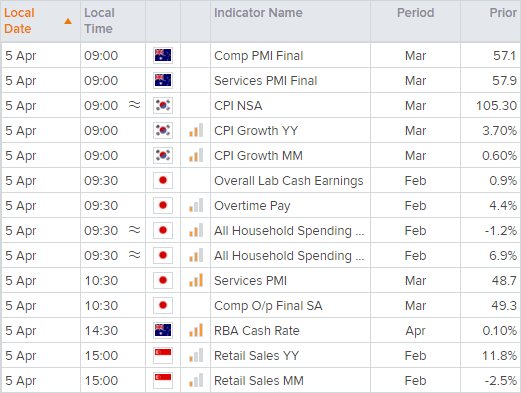

Read our guide on the Australian DollarUp Next (Times in AEST)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade