Asia Morning: U.S. Stocks Higher, Nasdaq 100 Marks Fresh Record

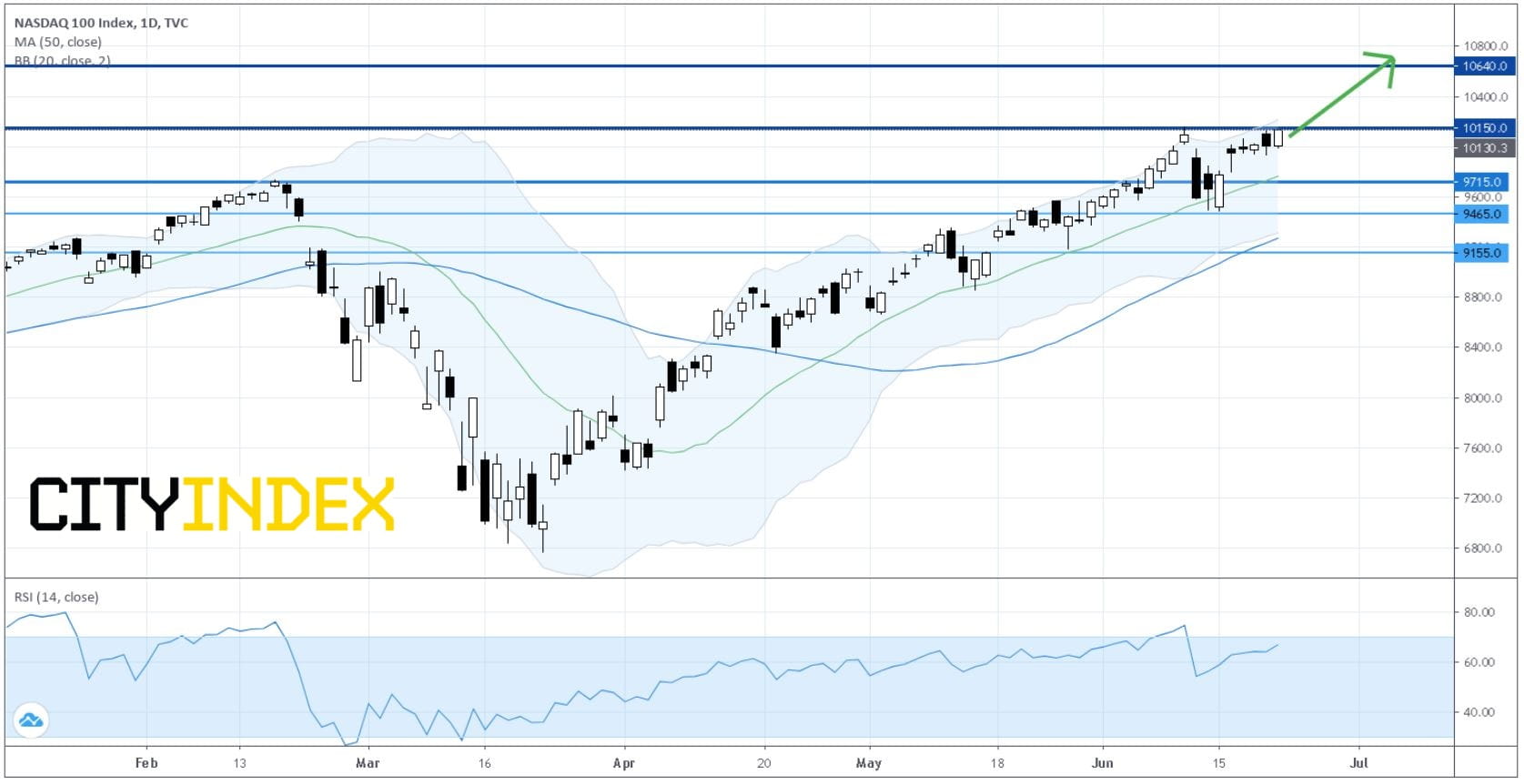

On Monday, U.S. stocks closed higher, as New York City entered its reopening plan Phase 2 boosting investors' confidence of a continued economic recovery. The Dow Jones Industrial Average rebounded 153 points (+0.6%) to 26025, the S&P 500 rose 20 points (+0.7%) to 3117, and the Nasdaq 100 jumped 121 points (1.2%) to 10130, a fresh record close.

Nasdaq 100 Index: Daily Chart

Source: GAIN Capital, TradingView

Software & related Services (+2.17%), Technology Hardware & Equipment (+1.92%) and Consumer Durables & Apparel (+1.88%) sectors performed the best.

Amazon.com (AMZN +1.45% to $2,713.82) and Apple (AAPL +2.62% to $358.87) closed at record highs. Cruise-ship stocks Royal Caribbean (RCL -6.17%), Norwegian Cruise Line (NCLH -6.2%) and Carnival (CCL -3.37%) sank further.

On the technical side, about 42.1% (43.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 37.5% (52.0% in the prior session) were trading above their 20-day moving average.

U.S. official data showed that Existing Homes Sales declined to an annualized rate of 3.91 million units in May (4.15 million units expected), the lowest level since 2010.

Due later today are reports on Markit's U.S. Manufacturing Purchasing Mangers' Index (June preliminary reading, a rise to 51.5 expected) and New Home Sales (to rise to an annualized rate of 640,000 units in May expected).

European stocks closed in negative territory, with the Stoxx Europe 600 Index falling 0.8%. Both Germany's DAX and France's CAC lost 0.6%, and the U.K.'s FTSE 100 was down 0.8%.

U.S. government bond prices eased, as the benchmark 10-year Treasury yield firmed up to 0.704%.

Spot gold price advanced a further $11.00 dollar (+0.6%) to $1,755 an ounce, the highest level since November 2012.

Oil prices remained buoyed, as U.S. WTI crude oil futures (July) settled 1.8% higher at $40.46 a barrel, a 15-week high.

On the forex front, the ICE U.S. Dollar Index retreated 0.6% on day to 97.01, halting a four-day rally.

EUR/USD rebounded 0.8% to 1.1270. Official data showed that the eurozone's Consumer Confidence Index improved to -14.7 in June (-15.0 expected) from -18.8 in May. Later today, research firm Markit will report the eurozone's June Manufacturing PMI (45.0 expected) and Services PMI (41.5 expected).

GBP/USD jumped 1.1% to 1.2486, snapping a four-day losing streak. The Markit Manufacturing PMI (45.0 expected) and Services PMI (40.0 expected) will be released later in the day.

USD/JPY was broadly flat at 106.91.

AUD/USD surged 1.3% to 0.6923. The Reserve Bank of Australia governor Philip Lowe said it is "hard to argue that the Australian dollar is overvalued", even it could be pushed higher if other central banks ease their policies further.

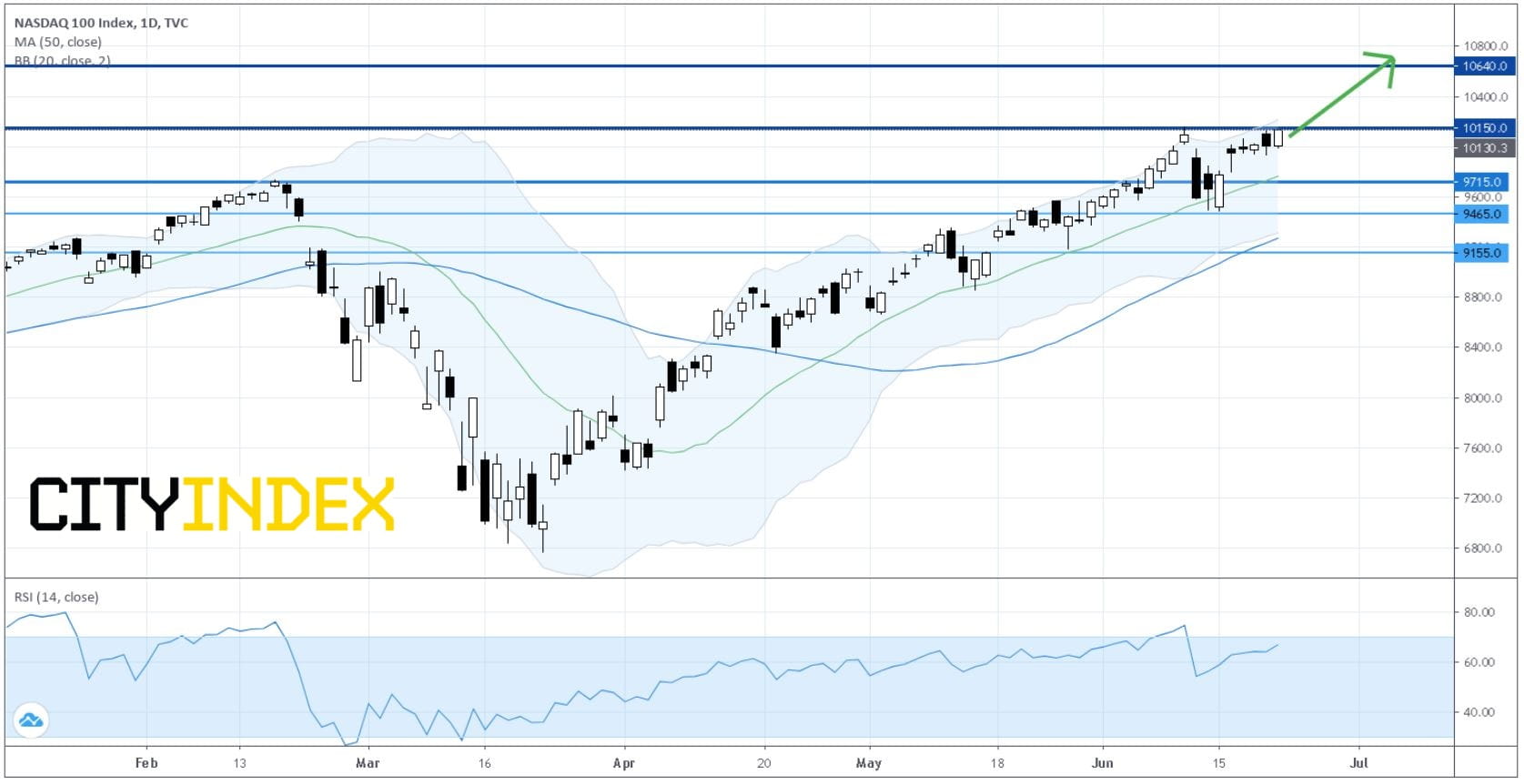

Nasdaq 100 Index: Daily Chart

Source: GAIN Capital, TradingView

Software & related Services (+2.17%), Technology Hardware & Equipment (+1.92%) and Consumer Durables & Apparel (+1.88%) sectors performed the best.

Amazon.com (AMZN +1.45% to $2,713.82) and Apple (AAPL +2.62% to $358.87) closed at record highs. Cruise-ship stocks Royal Caribbean (RCL -6.17%), Norwegian Cruise Line (NCLH -6.2%) and Carnival (CCL -3.37%) sank further.

On the technical side, about 42.1% (43.3% in the prior session) of stocks in the S&P 500 Index were trading above their 200-day moving average, and 37.5% (52.0% in the prior session) were trading above their 20-day moving average.

U.S. official data showed that Existing Homes Sales declined to an annualized rate of 3.91 million units in May (4.15 million units expected), the lowest level since 2010.

Due later today are reports on Markit's U.S. Manufacturing Purchasing Mangers' Index (June preliminary reading, a rise to 51.5 expected) and New Home Sales (to rise to an annualized rate of 640,000 units in May expected).

European stocks closed in negative territory, with the Stoxx Europe 600 Index falling 0.8%. Both Germany's DAX and France's CAC lost 0.6%, and the U.K.'s FTSE 100 was down 0.8%.

U.S. government bond prices eased, as the benchmark 10-year Treasury yield firmed up to 0.704%.

Spot gold price advanced a further $11.00 dollar (+0.6%) to $1,755 an ounce, the highest level since November 2012.

Oil prices remained buoyed, as U.S. WTI crude oil futures (July) settled 1.8% higher at $40.46 a barrel, a 15-week high.

On the forex front, the ICE U.S. Dollar Index retreated 0.6% on day to 97.01, halting a four-day rally.

EUR/USD rebounded 0.8% to 1.1270. Official data showed that the eurozone's Consumer Confidence Index improved to -14.7 in June (-15.0 expected) from -18.8 in May. Later today, research firm Markit will report the eurozone's June Manufacturing PMI (45.0 expected) and Services PMI (41.5 expected).

GBP/USD jumped 1.1% to 1.2486, snapping a four-day losing streak. The Markit Manufacturing PMI (45.0 expected) and Services PMI (40.0 expected) will be released later in the day.

USD/JPY was broadly flat at 106.91.

AUD/USD surged 1.3% to 0.6923. The Reserve Bank of Australia governor Philip Lowe said it is "hard to argue that the Australian dollar is overvalued", even it could be pushed higher if other central banks ease their policies further.

Latest market news

Yesterday 01:32 PM

Yesterday 09:35 AM

Yesterday 07:23 AM

Yesterday 04:48 AM

Yesterday 12:17 AM

July 25, 2024 10:39 PM