As of Tuesday 25th January 2022:

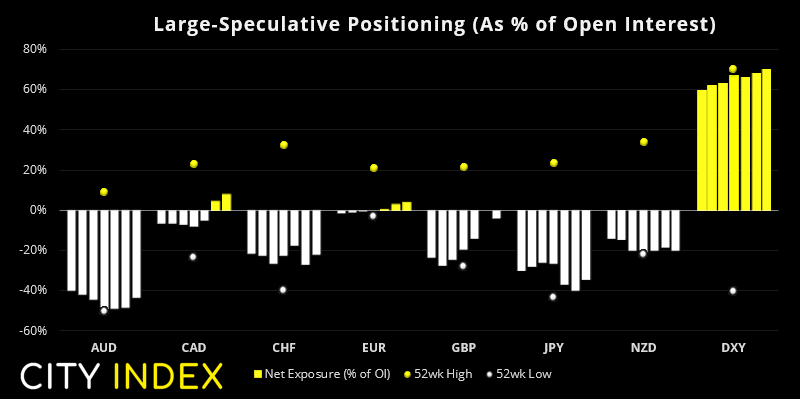

- Net-long exposure to the US dollar fell for a second week, down -$2.3 billion to $10.7, according to data compiled by IMM

- Traders were their most bullish on euro futures in 23-weeks

- Net-long exposure to CAD futures rose to their highest level in 8-months

- Net-short exposure to NZD future rose to its most bearish level since June 2020

Read our guide on how to interpret the weekly COT report

Read our guide on how to interpret the weekly COT report

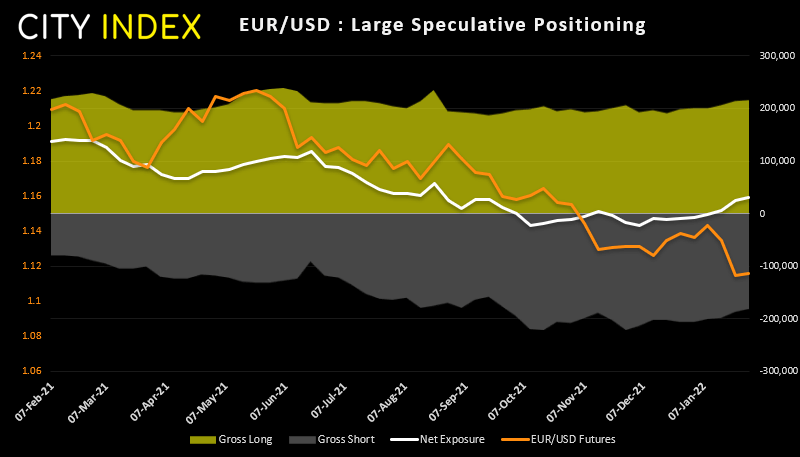

Euro futures:

Net-long exposure to euro futures rose to a 23-week high as of last Tuesday. And the move has been powered by a fast rise in gross longs with a sharp reduction of net-shorts. Yet since this report was compiled, EUR/USD has fallen to a 19-month low thanks for the hawkish press conference after the FOMC meeting. So, which one is correct? Yield differentials favour a lower euro and we have likely seen some of those longs closed out and new shorts initiated. We therefore think EUR/USD is more likely to test 1.10 before it reclaims 1.13.

Euro explained – a guide to the euro

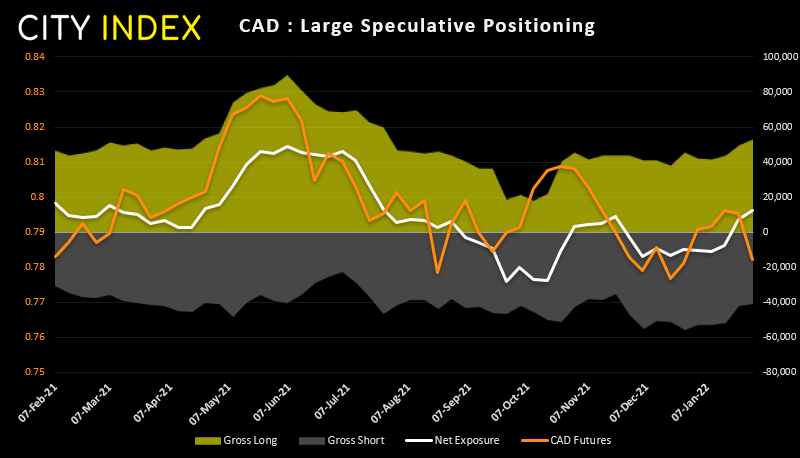

CAD futures:

The Canadian dollar is another currency which is trading in the opposite way that speculative positioning suggests. Net-long exposure sits at a 27-week high with rising longs and diminishing short. Yet like the euro we have also had a hawkish FOMC meeting to contend with which weighed on all currencies except the US dollar. And that could see a reversal in net-long exposure over the coming weeks as it potentially flips back to net-short positioning.

Read our guide on the A guide to CAD

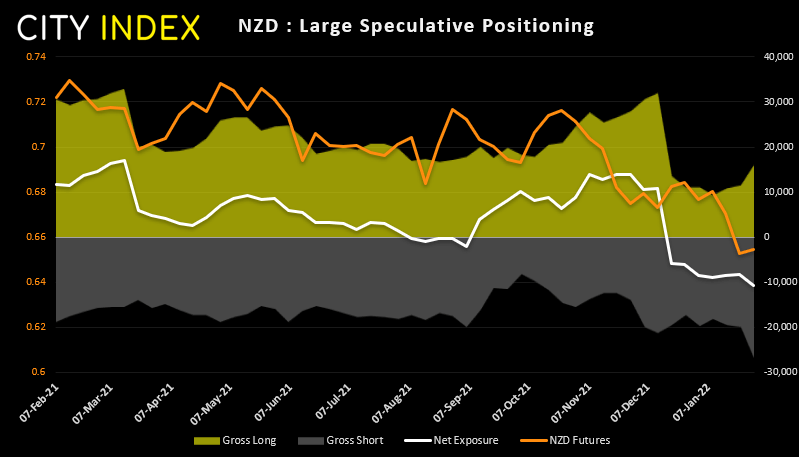

NZD futures:

The New Zealand dollar remains very much unloved with net-short exposure rising to its most bearish level since June 2020. However, whilst gross shorts have also risen to their highest level if the same period, gross longs have also increased. It seems some investors are either hedging their bets or stepping in to pick up a bargain at these lows. And we lean towards the latter given that RBNZ remain hawkish and inflation continues to surge well above RBNZ’s target.

As of Tuesday 25th January 2022:

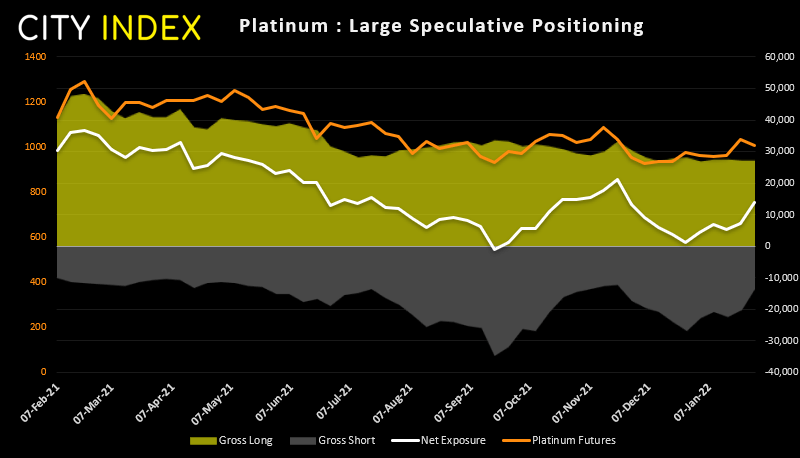

- Net-long exposure to platinum futures nearly doubled, and rose to its most bullish level in 10-weeks

- Traders increased net-long exposure to copper futures for a second week, and to a 3-month high

- Traders increased their net-long exposure to gold to a 7-week high

Platinum futures:

Net-long exposure rose to a 10-week high, from 7.3k to 13.8k contracts. However, this is mostly a function of short-covering as -6.4k short contracts were closed whilst longs added a mere 125 contract. Still, price action does suggest the market is trying to bottom and every trend change must start somewhere. Going forward rising prices alongside increase of gross longs is desirable for the bull-case.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade