- USD/CAD technical analysis

- How to trade the USD/CAD

- US CPI: What are analysts expecting?

All eyes are on the US inflation report, due for release on Thursday, which could trigger a much-needed sharp move in FX markets following a very dull last few days. Among the major FX pairs, the USD/CAD is one that is gearing up for a sharp move. In this brief article, I will discuss what levels to watch and how to trade the Loonie. But first, let’s remind ourselves what to look out for in Thursday’s CPI report.

US CPI: What are analysts expecting?

Analysts expect the US CPI data to show inflation had risen to an annual pace of 3.2% in December on a headline basis, from 3.1% in November. On a monthly basis, CPI is seen rising 0.2% following a 0.1% increased previously. The “Core” (ex-food and energy) reading is anticipated at 3.8% y/y or 0.3% m/m.

For more details, read our CPI preview article, written by my colleague Matt Weller.

USD/CAD technical analysis

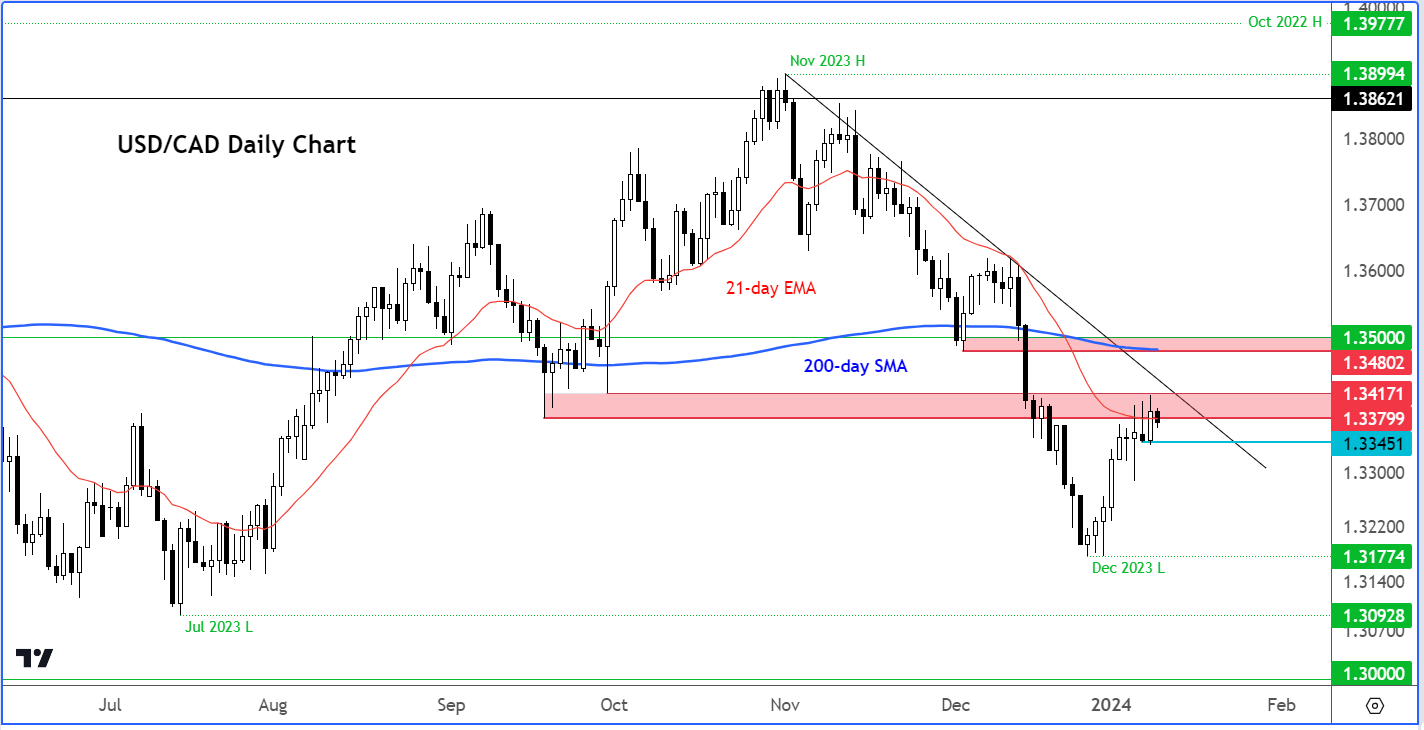

Source: TradinView.com

The overall trend of the USD/CAD remains bearish, although this is subject to change should we see a strong CPI report on Thursday. The slope of the 200-day is negative and there is a bearish trend line in place, and not to mention the fact that the Loonie has been making lower highs ever since peaking in November.

At the time of writing, the USD/CAD was testing a key area of potential resistance around 1.3380 to 1.3420 area. This is where the North American currency pair had previously found strong support on a few occasions back in September, before giving way in the middle of December, when the Fed signalled 3 rate cuts are forthcoming in 2024. The selling gathered pace as the market priced in even more rate cuts for 2024. But after making a low late in December at around 1.3177, the USD/CAD has managed to bounce by a good 200+ pips to get here with investors reducing expectations of a major dovish policy shift. So far, the bulls have held their ground as they attempt to establish a base here.

How to trade the USD/CAD

Heading into the FOMC day, it is essential to watch what the USD/CAD decides first rather than pre-empting the move, unless done so with a very small position.

A clean break above this 1.3380-13420 area could pave the way for a run towards the next key resistance area around 1.3480 to 1.3500, where the 200-day average meets the point of the origin of the last breakdown in December.

However, if support at 1.3345 gives way instead, then this could pave the way for a run towards the December low at 1.3177.

Remember, if you miss the original move, the market does tend to give multiple opportunities to trade in your desired direction. So, you don’t need to pre-empt the move or chase it aggressively when it starts to move. You will get retracements on the lower time frames.

FX technical analysis video

For technical analysis on major FX pairs indices and gold, I have discussed those in this video:

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade