- USD/CAD outlook undermined by rising Fed rate cut expectations

- USD/CAD technical outlook: key levels to watch

- First week of 2024 could be a busy one for USD/CAD

The USD/CAD has fallen below the 1.33 handle for first time since August. The move has been supported by a weakening US dollar, which has remained largely out of favour ever since the Fed signalled that interest rate hikes were done and dusted. Today, we had an unexpected downward revision in US GDP and a weak print on the lates Philly Fed Manufacturing Index, both further boosting expectations of rate cuts in 2024. The Canadian dollar, meanwhile, has been supported by mixed data this week, with CPI coming hotter on Tuesday and retail sales more or less matching expectations.

The USD/CAD will remain in focus with Canadian GDP and US core PCE Price Index and a few other US data releases to come on Friday. If core PCE comes in softer than 0.2% m/m or 3.3% y/y expected, then this could further weigh on the US dollar, heading to the festive period and start of 2024.

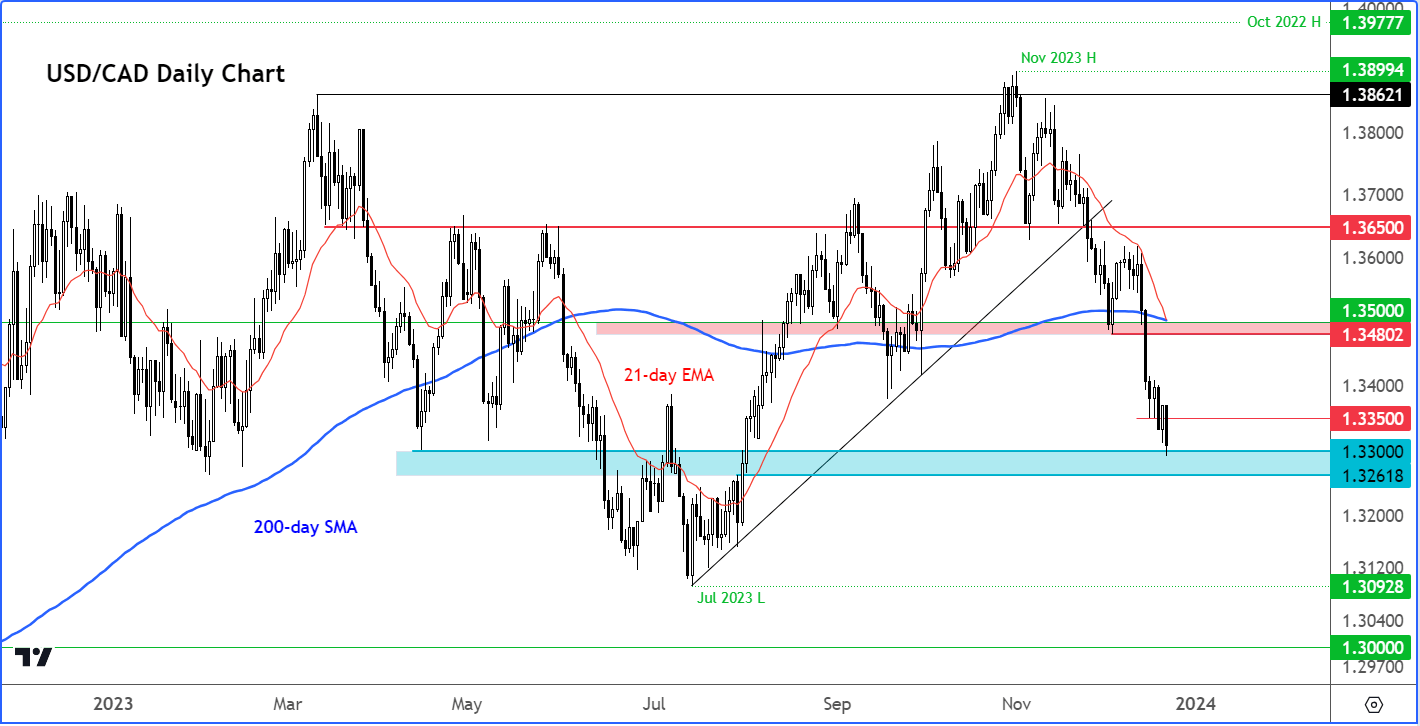

Before we discuss the key data releases coming up in the first week of 2024, let’s have a quick look at the chart of the USD/CAD first…

USD/CAD outlook: technical levels to watch

Source: TradingView.com

The trend is bearish on the USD/CAD with price being below the 200-day average and with several support levels having been broken. Any short-term bounces here should therefore be taken with a pinch of salt.

Among those broken levels, 1.3350 is the nearest old support, which is now going to be the first line of defence for the bears. A more significant resistance area is seen around the 1.3480 to 1.3500 area, which was previously support and where the 21- and 200-day moving averages also converge.

In terms of support, the area between 1.3260 to 1.3300 is where the USD/CAD last staged a rally from back at the end of July and start of August. This area needs to hold, else a continuation towards the July low of 1.3092 could get underway soon.

USD/CAD outlook: Looking ahead to first week of 2024

The economic calendar is void of any major news in a shortened last week of the year, with the exception of some second-tier US data such as jobless claims and pending home sales. In the first week of January, however, we will start the new year with a bang for US data. We will have the ISM manufacturing and services PMIs, the FOMC’s meeting minutes and the monthly nonfarm payrolls report, along with a few other data releases.

Let’s briefly review the top 3 of those data releases…

ISM Manufacturing PMI

Wednesday, January 3

15:00 GMT

We will have a handful of pre-NFP leading indicators in the first few days of the year, starting with the ADP private payrolls and ISM manufacturing PMI on Wednesday. The headline PMI has remained below the boom/bust level of 50.0 more than a year ago. Is that trend going to continue as we start the first week of trading in 2024?

FOMC meeting minutes

Wednesday, January 3

19:00 GMT

The FOMC signalled 3 rate cuts in 2024 at their last meeting in December, sending some of the US stock indices to fresh record highs and causing a sharp drop in bond yields and the dollar. Since that meeting, some Fed officials have tried to scale back market pricing of several rate cuts, but this has proven to be futile, even with US data remaining surprisingly resilient in some sectors of the economy. The minutes of the December meeting should provide more clarity about the Fed’s next move.

US non-farm payrolls report

Friday, January 5

13:30 GMT

It is all about when the Fed will start cutting rates in 2024, and the December jobs report could have significant implications on those expectations. Last time, the jobs report was quite strong with both the headline jobs growing more than expected at nearly 200K and average hourly earnings printing 0.4% m/m. If employment continues to remain strong, then the Fed may have to delay its rate cuts in an effort to prevent inflation from accelerating again. The market will be looking for evidence of a soft landing.

Happy holidays!

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade