US futures

Dow futures +0.42% at 33393

S&P futures -0.15% at 4100

Nasdaq futures -0.8% at 13075

In Europe

FTSE +0.08% at 7660

Dax -0.20% at 15604

OPEC+ cuts output by 1.1M BPD

Oil stocks rise, Tesla falls despite record deliveries

USD falls, EUR rises after upward revision to manufacturing PMI

Oil jumps 6%

Learn more about trading indices

OPEC+ cuts output by 1.1M BPD

US futures are falling, with the tech-heavy Nasdaq leading the declines after OPEC+ surprised the market by cutting oil output, in a move which hurts Fed pivot bets.

With oil prices up 6% so far, Goldman Sachs forecast Brent will be $95 pb by the end of the year, as the momentum for global oil is positive amid a strong recovery in China.

As a result, it could mean that inflation will take longer to bring back to the target level and will require more rate hikes from the Fed to cool. The markets are now reassessing the chances of a 25-basis point rate hike in May, with a 58% probability of the hike being priced in, up from 48% on Friday.

As higher oil prices feed through into the inflation data, this will mean that interest rates will need to stay higher for longer.

A dovish pivot, which the market was optimistically pricing in before the OPEC+ decision, with two rate cuts by the end of the year, is now looking even more unlikely.

Attention will now turn to US ISM manufacturing PMI data, which is expected to fall to 47.5 in March, down from 47.7. Weak growth data could help off set some of the renewed inflation fears.

Corporate news

Energy stocks are rising firmly, tracking oil prices higher. Exxon Mobil, Chevron, BP are among the gainers pre-market.

Tesla falls over 3% pre-market after announcing that it delivered 422,875 vehicles in Q1. This was up 4% from the previous quarter and up 36% from the same period in 2022. This is still short of the target that Elon Musk had set for the company and raised concerns that the recent price cuts had failed to boost demand sufficiently.

Micron Technologies is falling, extending Friday’s losses sparked by a decision from China to launch a review of imports from the US memory chip maker.

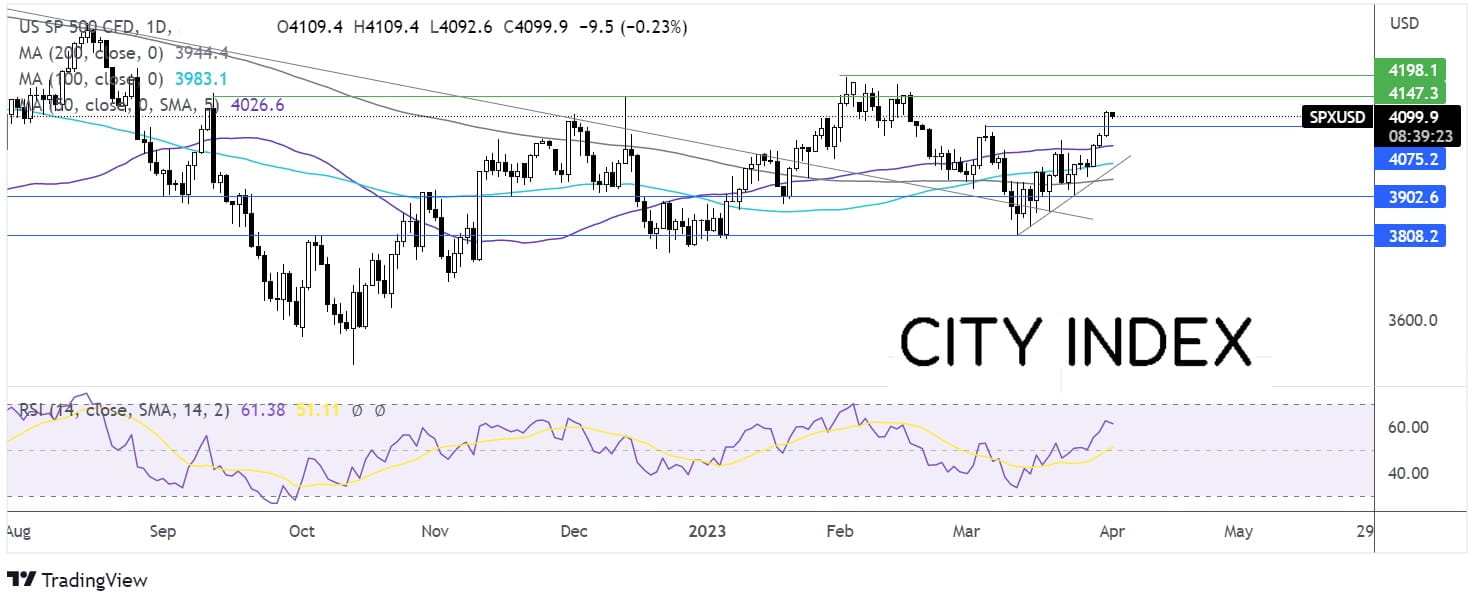

Where next for the S&P500?

After rebounding from 3935 the S&P 500 has risen above the 200, 100 & 50 sma, in addition to the 4078 resistance. This, along with the RSI over 50 keeps buyers hopeful of further upside. Bulls will look to rise above 4110, last week’s high to extend the bullish trend, bringing 4144, the December 13 high into target ahead of 4195, the 2023 high. Meanwhile, a break below the 50 sma at 4026 open the door to 3980, the 100 sma and the rising trendline resistance. A break below here negates the near term uptrend.

FX markets – USD falls, GBP rises

The USD is falling, extending losses from the previous session. While the greenback had initially risen amid fears that high oil prices would slow the pace that inflation cools and see the Feed raise rates again in May.

EUR/USD is rising after the eurozone manufacturing PMI was upwardly revised to 47.3, from the preliminary reading of 47.1. This is still down from 48.5 in February and marks a 4 month low. There was significant divergence within the block with Spsin and Italy seeing manufacturing growth while Germany’s contraction was deep at 44.7.

GBP/USD is rising, adding to gains from last week, which markers the third straight week of gains. The pound has shrugged off the downward revision to the March manufacturing PMI to 47.9 from 48 in the preliminary reading and 49.3 in February.

EUR/USD +0.28% at 1.0870

GBP/USD +0.45% at 1.2372

Oil jumps 6%

Oil prices have jumped on the open after OPEC+ unexpectedly cut oil output by 1.1 million barrels to stabilise the oil price.

The cut is in addition to a 2 million bpd cut that the group had previously agreed, taking total cuts to over 3 million bpd, and over 3% of global demand.

The move comes after oil fell to a 15-month low last month amid demand uncertainty as the banking crisis hit and the US said that it would not replenish Its strategic stockpile.

Goldman Sachs has upwardly revised its Brent year-end forecast for Brent to $95.

WTI crude trades +6% at $80.45

Brent trades at +5.8% at $84.16

Learn more about trading oil here.

Looking ahead

15:00 US ISM manufacturing PMI