US futures

Dow futures +0.94% at 29010

S&P futures +0.9% at 3615

Nasdaq futures +0.5% at 11030

In Europe

FTSE -0.31% at 6897

Dax +0.1% at 12120

Learn more about trading indices

US ISM manufacturing data due

US stocks heading are set to start the first day of the new quarter on the front foot, after steep losses across August and September.

Futures are on the rose after another steep day of declines on Friday, which saw the Dow Jones close below 29000 for the first time since November 2020.

Equities have fallen on stubbornly high inflation, rising interest rates, and recession fears. Three themes which are expected to continue into the fourth quarter.

There are several data points due later today, with the ISM manufacturing PMI being the main release today, which is expected to show that activity in the sector remains solid.

However, this week, all eyes are on the non-farm payroll, which could cement the likelihood of another aggressive rate hike from the Fed at the November policy meeting.

Several Federal Reserve officials are due to speak today and could shed more light on how hawkish the Federal Reserve is after the hotter-than-expected core PCE data.

Corporate news:

Tesla falls pre-market after reporting 343,830 deliveries in Q3, below forecasts, as shipping struggles prevent the EV maker from reaching its target.

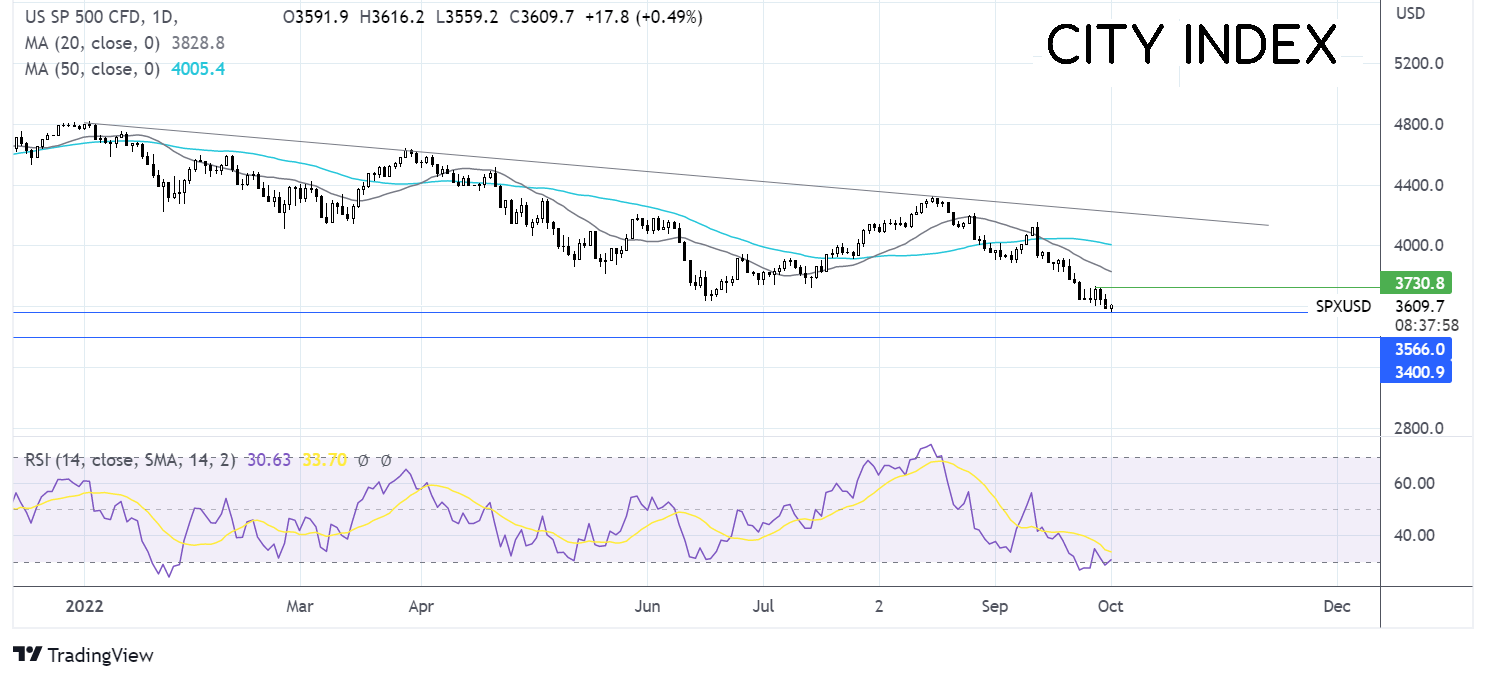

Where next for S&P 500?

The S&P500 fell to a new 2-year low of 3560 in overnight trade. The price continues to form lower highs and lower lows. The RSI has tipped into oversold territory so some consolidation or a move higher could be on the cards. Sellers will look to break below 3560 to extend the selloff to 3500 round number ahead of 3400 the pre-COVID high. Buyers will look for a move over 3730 last week’s high, to expose the 20 sma at 3850.

FX markets – USD rises, GBP rises

The USD has resumed its rally after pausing for breath last week. The USD fell despite hotter than expected copre PCE and personal spending data, boosting hawkish Fed bets. The US non-farm payroll at the end of the week is the key focus, although there ids plenty of data prior to that.

EUR/USD is falling as the energy crisis in Europe mounts. Russia cut off gas supply to Italy raising fears over supply heading into the winter months. Furthermore, manufacturing PMIs were also downwardly revised for the eurozone showing a deeper contraction at 48.4 in September from 49.6 in August.

GBPUSD is rising after the UK government performed a U-turn, ditching the top rate tax cut announced by the Chancellor as part of his min-budget. The U-turn comes after the government’s fiscal plans unleashed turmoil in the financial markets, to the extent that the BoE had to intervene to shore up the gilt market. Today’s move reverses £2 billion from a £45 billion of planned spending cuts.

GBP/USD +0.35% at 1.12

EUR/USD -0.28% at 0.9776

Oil jumps ass OPEC+ comes into view

Oil prices are on the rise, gaining over 4% at the start of the week as investors look ahead to Wednesday’s OPEC+ meeting. The oil cartel will meet to discuss output levels for November. The group is widely expected to consider slashing production by up to 1 million barrels per day. This would mark its largest oil production reduction since before the pandemic.

The meeting comes as oil prices have tumbled across the third quarter as recession fears and China COVID lockdowns hit the demand outlook. The stronger US Dollar has also pulled on the oil price.

Should OPEC+ agree to the production cut, it will be the second straight month of output declines after the group voted to reduce output by 100k barrels last month. US crude oil has risen above $81 per barrel in the hope of reduced supply.

WTI crude trades +4.1% at $82.70

Brent trades +3.7% at $88.50

Learn more about trading oil here.

Looking ahead

14:40 Fed Bostic speaks

14:40 CAD manufacturing PMI

15:00 US ISM manufacturing PMI