US futures

Dow futures +0.32% at 33025

S&P futures +0.22% at 4160

Nasdaq futures +0.3% at 12999

In Europe

FTSE +0.2% at 7480

Dax +0.4% at 13256

Euro Stoxx +0.09% at 3670

Learn more about trading indices

PCE slows by more than forecast

US stocks set to open the session higher ahead of Federal Reserve Chair Powell’s speech and after softer than expected inflation.

US PCE fell -0.1% MoM in July, down from 0.6% in June, suggesting that prices are heading in the right direction. Core PCE also fell more than expected to 4.6%. However, it is not all good news, because personal spending also fell sharply to just 0.1% down from 1% in June, indicating that consumers are tightening their belts.

Following the data, the USD slipped and stocks pared earlier losses and pushed higher.

Looking ahead all eyes are on Federal Reserve Chair Jerome Powell as he speaks at Jackson Hole. The Fed Chair is expected to adopt a hawkish tone despite the cooling in inflation.

No matter which way you look at is inflation is significantly above the Fed’s target. Fed speakers have said that the bigger risk is underestimating elevated price pressures. That said there is still room for stocks to extend gains post speech.

If Fed Powell sticks to the same hawkish tone that we’ve seen from Fed speakers all week the USD and stocks may remain supported at current levels. Should the market interpret a more hawkish stance, despite the PCE data, stocks are likely to fall.

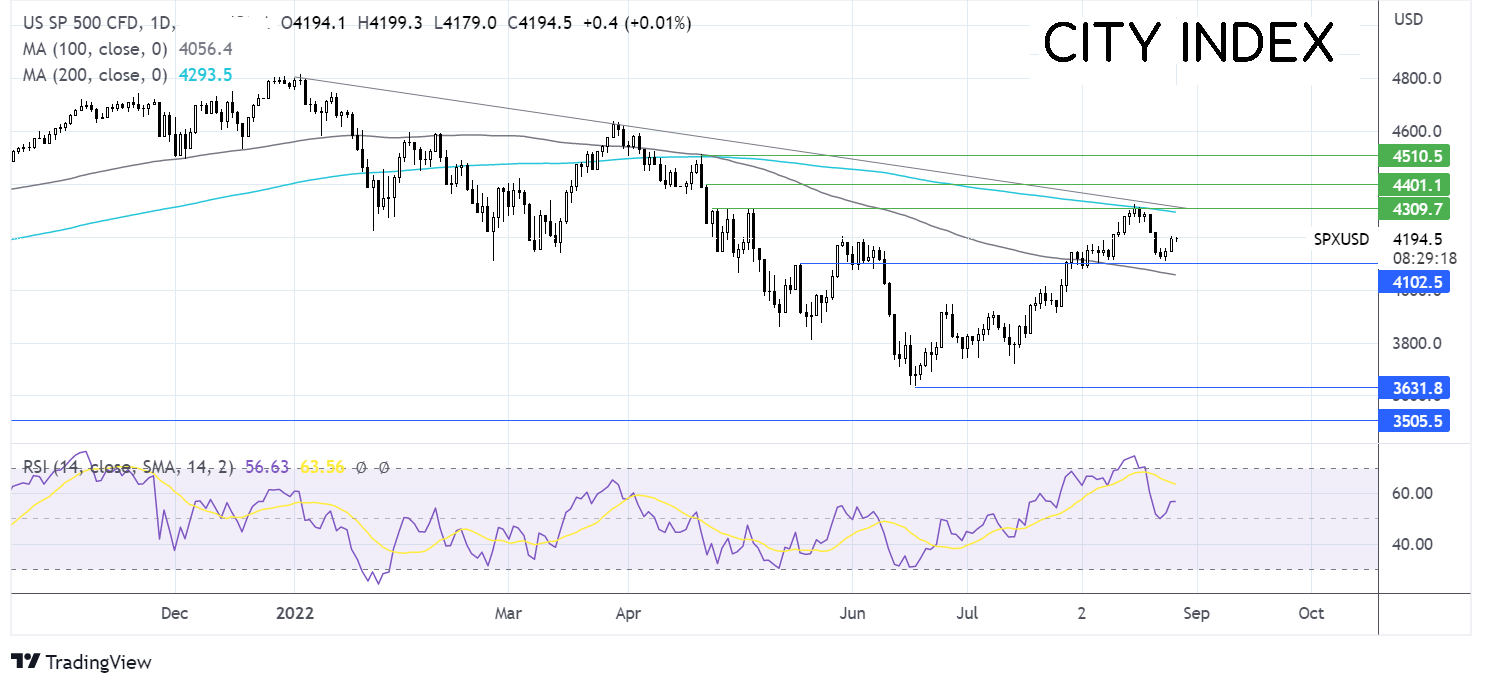

Where next for the S&P?

The S&P500 ran into resistance at 4300 the 200 sma before rebounding lower and finding support at 4100. The price trades caught between the 100 and 200 sma and the RSI is relatively neutral. Sellers will be looking for a move southwards of 4100 horizontal support and 4070 the 100 sma. Buyers will look for a move over 4300 to extend the upside recovery and create a higher high.

FX markets – USD falls, EUR rises

The USD is heading lower after US PCE fell by more than forecast cooling aggressive Fed bets ahead of Fed Chair Powell’s speech.

EUR/USD is rising despite weaker than expected German consumer morale. Data showed that consumer confidence plunged to a record low in September as energy bills rise and recession fears grow.

GBP/USD is falling after Ofgem the UK energy regulator increased the energy price cap by 80%, which will come into effect in October. The move will squeeze household incomes further deepening the cost of living crisis.

GBP/USD -0.1% at 1.1825

EUR/USD +0.23% at 1.00

Oil set for weekly gains

Oil prices are rising and are set to book gains of around 3% across the week after upbeat data from the US yesterday calms recession fears.

The US contracted at a slower pace than expected in Q2 owing to higher than forecast consumer spending. The figures helped the demand outlook.

The price has been underpinned across the week by comments from Saudi Arabia floating the possibility of cutting oil output.

WTI crude trades +0.75% at $93.78

Brent trades +0.7% at $99.40

Learn more about trading oil here.

Looking ahead

15:00 Powell speaks at the Jackson Hole Symposium