US futures

Dow futures -0.7 % at 33850

S&P futures -0.62% at 4276

Nasdaq futures -0.6% at 13440

In Europe

FTSE +0.7% at 7437

Dax +0.7% at 14020

Euro Stoxx +0.8% at 3790

Learn more about trading indices

Twitter headlines dominate

US stocks are set for a weaker start, after a solid finish in the previous session and ahead of the start of big tech earnings. Inflation has been a key theme throughout earnings season so far and investors will continue to look for insights into the impact of inflation and consumer spending as the results roll in.

On the data from US durable goods were weaker than forecast rising 0.8% in March, up from 1.7% in February, but still short of the 1% forecast.

Looking ahead US consumer confidence data is due later this afternoon and is expected to rise to 108.00 from a 10-month low. This would mark the first time that it improves in four months, amid surging inflation. Interestingly despite consumer confidence plunging Americans haven’t stopped spending, with retail sales still holding relatively firm.

In corporate news:

Twitter rises 0.2% premarket as investors continue digesting the news that Elon Musk has bought the social media firm after the board agreed to the $44 billion deal to take the company private. Elon Musk has already hinted that he may not look to make Twitter more monetizable, in fact, his aim is quite different, to make it a more transparent fairer platform for free speech.

Looking ahead, earnings will step up a notch with big tech earnings moving into focus. Broadly speaking, earnings growth is expected to slow. Although, Microsoft, which reports after the close today is set to see record earnings growth. Even so, the share price has underperformed.

Alphabet is also due to report after the close. Expectations are for EPS of $25.63 on revenue of $68.13 billion.

More news on the stocks to watch

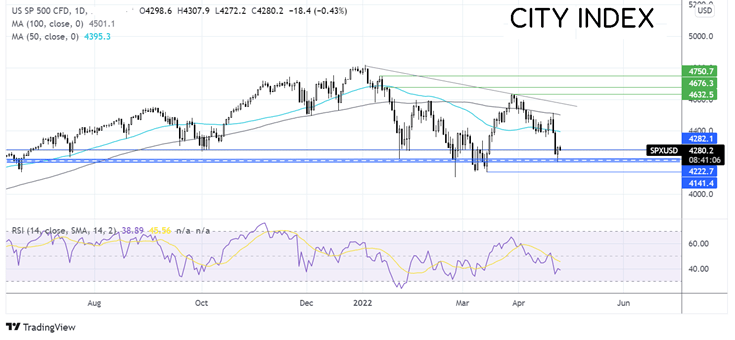

Where next for the S&P500?

The S&P500 ran into resistance at the 100 sma at 4510 and rebounded lower breaking below the 50 sma falling to support at 4200. The RSI is below 50 and supports further downside while it trades out of the oversold territory. The zone 4210/4200 could be strong support for the index with a break below here opening the door to 4140. Meanwhile, buyers could be encouraged by the long lower wick on the candle to 4200, suggesting that the price failed to find much acceptance at these lower levels, helping the price higher. Buyers are currently testing resistance at 4280 with a move above here exposing the 50 sma at 4400.

FX markets USD rises, EUR looks to 2020 low.

USD is extending gains, driven by a combination of safe-haven flows and hawkish Fed expectations. Attention will now turn to US consumer confidence data for further clues over the health of the economy

EUR/USD trades below 1.07 as euro bulls shrug off hawkish ECB chatter and USD strength drags the pair lower. There is no high impacting EZ data so the greenback is likely to be the biggest influence on the pair. Bears will look for a move towards 1.0637 the 2020 low.

GBP/USD -0.4% at 1.2643

EUR/USD -0.35% at 1.0673

Oil steadies as demand concerns remain

Oil prices are holding steady after steep losses in the previous session. Concerns over the demand outlook saw oil prices drop over $7 per barrel at one point yesterday before some losses were clawed back and oil settled $2 lower.

China is the largest importer of oil so mass testing across major cities is understandably unnerving the market. China’s demand is already down some 1 million barrels per day with the Shanghai lockdown. Should more districts impose strict lockdown rules then demand will deteriorate further.

Supply remains tight which is keeping the price elevated. Europe appears to be moving closer to putting plans into place to phase out Russian oil and gas imports. Germany has given the go-ahead to do so as soon as possible.

WTI crude trades +0.3% at $98.60

Brent trades +0.6% at $102.80

Learn more about trading oil here.

Looking ahead

15:00 US consumer confidence

21:30 API crude oil stock piles

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.