US futures

Dow futures -0.05% at 33055

S&P futures -0.03% at 4133

Nasdaq futures -0.01% at 12895

In Europe

FTSE -0.63% at 7479

Dax -0.12% at 13206

Euro Stoxx -0.19% at 3650

Learn more about trading indices

PMIs expected to be mixed

US stocks are pointed to a muted open after booking steep losses in the previous session and as investors look ahead to the release of PMI data later today.

Stocks sold off sharply yesterday, led lower by the Nasdaq, as the market priced in expectations that the Fed would keep hiking interest rates aggressively. Hopes that the Fed could hint towards a dovish pivot are looking increasingly unlikely at this point. Inflation is still over 4 times higher than the target 2% level and the Fed simply can’t risk it becoming entrenched.

That is not to say that stocks can’t still push higher following Jackson Hole, but the pre-requisite is that Jerome Powell dials back slightly on the hawkish rhetoric, or at least just reiterates the July Fed meeting position.

Looking ahead US PMI data is expected to show that services PMI rose to 49 in August, up from 47 in July. Meanwhile manufacturing PMI is expected to ease to 51.5, down from 52.2. The level 50 separates expansion from contraction.

In corporate news:

Zoom is falling sharply pre-market after reporting EPS of $1.05 on revenue of $1.10 billion, ahead of forecasts of $0.92 on revenue of $1.12 billion. However, guidance for the current quarter was below expectations with EPS forecast at $0.83 down vs. forecasts of $0.93 and revenue is seen at $1.095 billion below the $1.16 billion forecast.

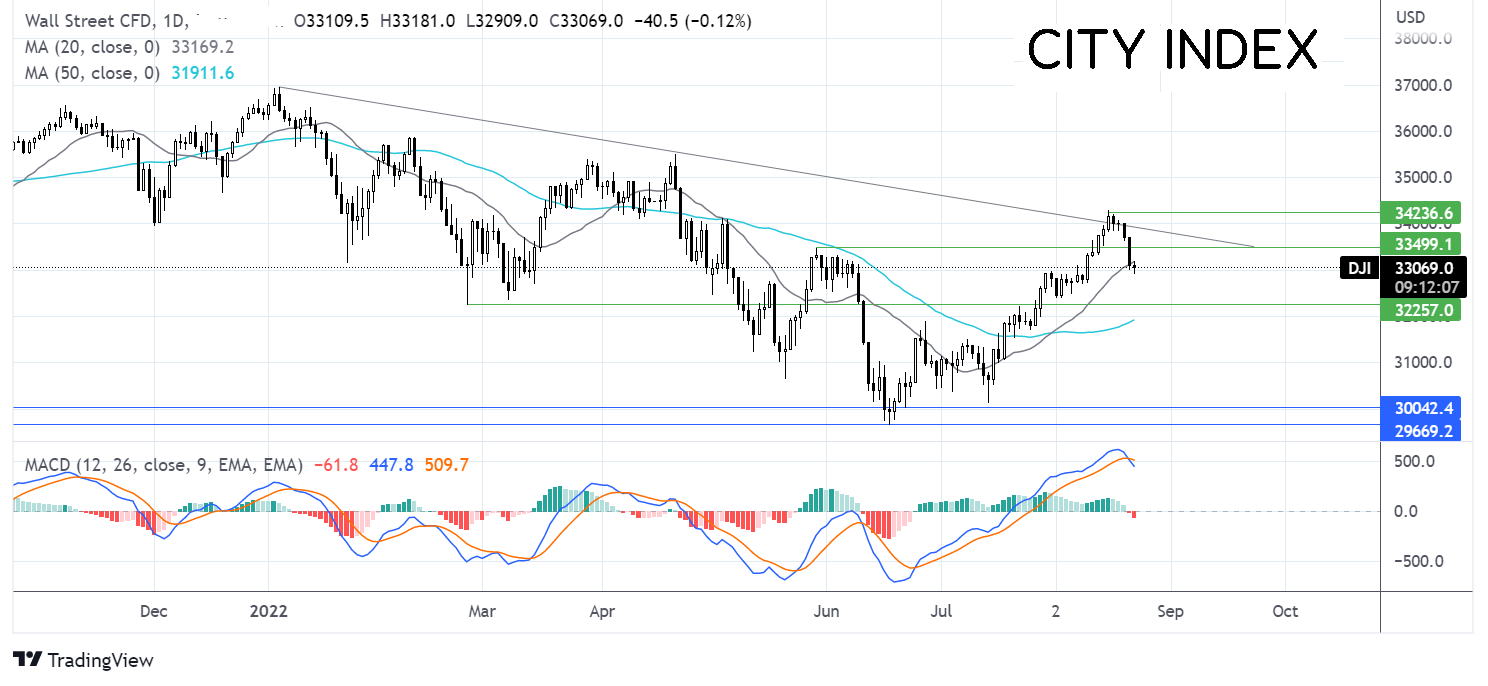

Where next for the Dow Jones?

The Dow Jones rebound from the 2022 low ran into resistance at 34200 and is heading southwards. The price trades below the multi-month falling trendline, which combined with the bearish crossover on the MACD keeps sellers hopeful of further losses. Sellers need to break below 33000 round number to head towards 32260 the February low. On the flip side, buyers would look for a move over 33460 the June high to bring 34200 back into focus.

FX markets – USD steadies, EUR falls

The USD is holding steady after strong gains in the previous session. The USD rallied over 0.75% as investors ramped up hawkish Fed bets ahead of the Jackson Hole Symposium later today.

EUR/USD closed below parity yesterday for the first time in 2 decades and continues to trade at 20-year lows after business activity contracted again in August. The composite PMI fell to 49.2, down from 49.9 in July. The energy crisis and rising inflation mean a recession is more likely than not.

GBP/USD is holding steady at around 2022 lows after PMI data painted a mixed picture. Services PMI came in better than expected at 52.5, down from 52.6. Expectations had been for services to grow at a slower pace of 52. Manufacturing, however, slumped harder than forecast to 46, down from 52.1 in July.

GBP/USD -0.01% at 1.1768

EUR/USD -0.19% at 0.9922

Oil rises from session lows.

Oil prices are rising as tight supply worries overshadow concerns that slowing global growth could hurt the demand outlook for oil.

Oil has risen over 1.5% following remarks from Saudi Arabia that it could cut oil output to support prices which have fallen sharply in recent weeks. Saudi Arabia cited the fall in US inventories as part of the evidence that production may need to be reined in.

Oil prices had surged to $147 per barrel earlier in the year and now trade at $90 per barrel as recession fears pulled the price lower. However, oil prices appear to have found a floor around this level.

Separately the revival of the Iran nuclear deal is reportedly making progress albeit slow. This certainly feels like it’s one step forward two steps back process. I doubt traders are holding their breath on the announcement of a deal.

WTI crude trades +1.85% at $91.95

Brent trades +1.42% at $97.42

Learn more about trading oil here.

Looking ahead

14:45 US composite PMI

15:00 US new home sales

15:00 Eurozone consumer confidence