US futures

Dow futures -0.65% at 31140

S&P futures -0.15% at 3870

Nasdaq futures -0.94% at 12052

In Europe

FTSE -0.5% at 7160

Dax -0.85% at 12997

Euro Stoxx -0.78% at 3483

Learn more about trading indices

Stocks fall at the start of the week

US stocks are pointing to a weaker start on Monday as investors look cautiously ahead to the beginning of earnings season and inflation data due on Wednesday.

The inflation report comes hot on the heels of a strong US non-farm payroll report which showed 372k jobs were added in June, defying recession fears. Any slowdown being felt elsewhere in the US economy has yet to show up in the employment report.

The solid report and strong wage growth give the green light to the Fed to keep hiking interest rates. Expectations for a 75 bp rate hike remain strong, and now investors aren’t discounting a 100bp hike.

The banks will kick off earnings season on Thursday. There are growing fears that earning season could spark a selloff with profits forecasts seemingly far too upbeat for the mounting recession risks.

Adding to the downbeat mood are rising COVID cases in China. Mass testing started again in Shanghai after the new Omicron sub-variant, which is more contagious, was found. Cases are growing quickly, raising fears that another lockdown could be on its way.

In corporate news:

Twitter trades 5% lower premarket after Musk walks away from the deal and the social media platform threatens to sue him. This is likely to be a long-drawn-out process in the courts, and Musk will be looking to get a much-reduced price for his purchase, given the massive share price drop since the offer was made.

Read more about Twitter’s fall.

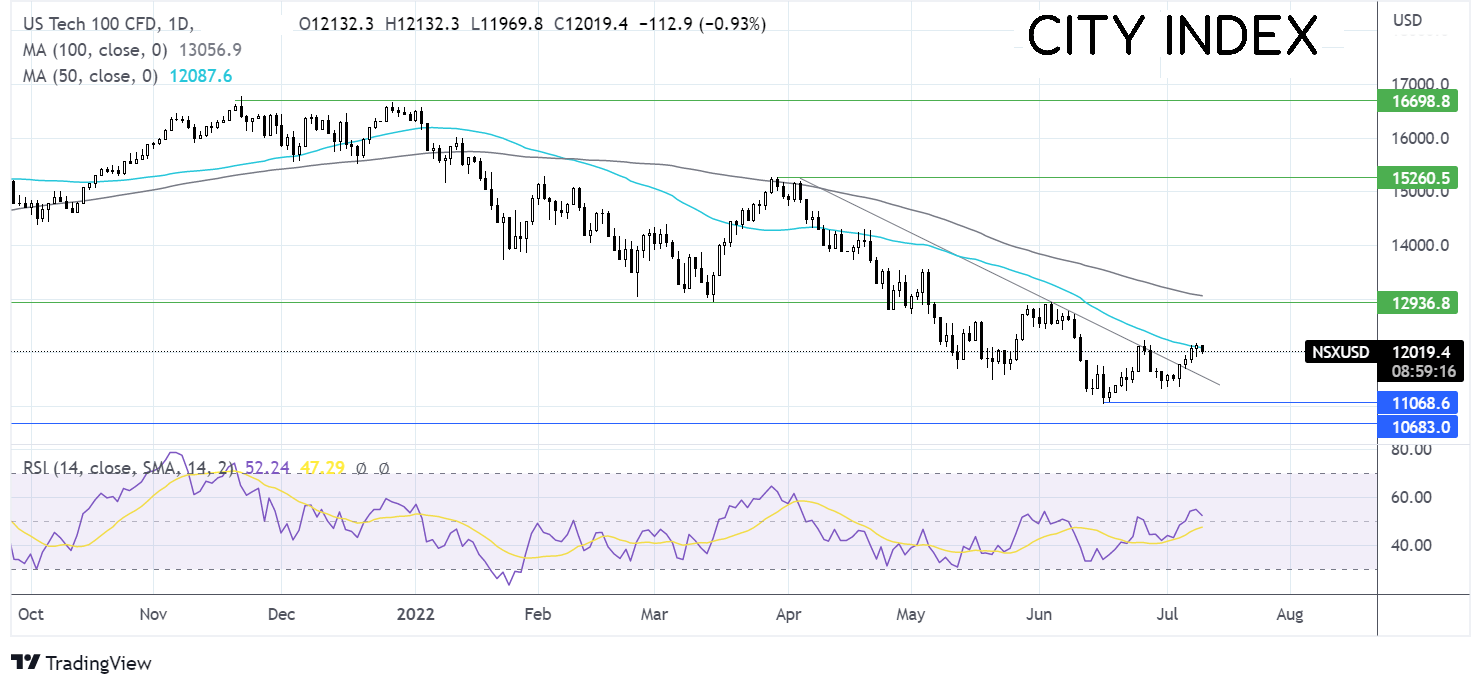

Where next for the Nasdaq?

The Nasdaq has rebounded off the 2022 low of 11740, rising above its multi-month falling trendline, but has run into resistance at the 50 sma at 12090. Buyers would need a move over this level to create a higher high and aim towards 12935, the June high. Sellers would look for a move below 11525, the falling trendline support, and 11300, last week’s low ahead of 11360.

FX markets – USD rises, EUR drops towards parity.

USD is rising, extending gains after the strong US NFP on Friday and amid increasing expectations that the Fed will hike rates, if not by 75 bp, then by 100bp!

EURUSD is heading lower over fears for energy security as the Nord Stream 1 is closed for scheduled maintenance, but fears are rising that Russia may not switch the gas supply back on in 10 days when the works are over. This could cause a recession in Europe.

GBP/USD is falling as the dust settles on Boris Johnson’s resignation. The stepping down of the PM leaves the UK in limbo while a leadership contest takes place, which could take weeks or months. This is when the economic outlook deteriorates, and Brexit remains a mess.

GBP/USD -0.3% at 1.1923

EUR/USD -0.2% at 1.0078

Oil falls as China COVID cases rise.

Oil prices are falling, adding to last week’s decline as demand concerns continue to drive the price lower. While recession fears sent commodity stocks lower last week, concerns over a resurgence of COVID in China and more lockdown restrictions are hurting the demand outlook this week.

The new Omicron sub-variant in Shanghai is rattling the markets outweighing supply concerns. Cases are back at the highest level since May, with more mass testing and growing fears of another extended lockdown.

Concerns over a potential cap on Russian oil prices and ongoing recession fears are also being weighed up by the market. Furthermore, worries overflow along the Caspian Pipeline Consortium remain. While oil is still flowing, following the Russian court’s decision to cut supply, this could soon dry up.

The risks in the market are becoming much more two-sided than they have been for a while

WTI crude trades +2.2% at $100.16

Brent trades -1.94% at $103.70

Learn more about trading oil here.

Looking ahead

19:00 Fed Williams speech