US futures

Dow futures -0.94% at 30037

S&P futures -0.9% at 37415

Nasdaq futures -0.9% at 11470

In Europe

FTSE -0.71% at 7036

Dax -0.9% at 12550

Learn more about trading indices

US ISM services data due

US stocks are falling after two days of solid gains as investors digest the latest jobs data ahead of Friday’s non-farm payroll.

While weak data earlier in the week fueled expectations that the Fed could consider a less hawkish stance, the market appears to have come to its senses. With inflation still over four times the Fed’s 2% target and the jobs market still strong, any dovish pivot is likely still a long way off.

ADP payrolls rose by a more than expected 208k in September, up from an upwardly revised 185k in August and above the 200k forecast. The stronger than expected report comes ahead of Friday’s closely watched non-farm payroll report.

Looking ahead, US ISM services PMI data is due to be released and is expected to be 56, just a slight decline from 56.9 in August. Should the ISM figure come in much weaker than expected, showing a slowdown in the economy, stocks could rally. However, given the lag time from hiking rates to the impact being felt in the economy, it could be too soon to see a significant slowdown in the service sector.

Corporate news:

The Twitter deal is back on. Elon Musk has backtracked entirely and said that he wants to press ahead with the $44 billion deal. The share price jumped 22% yesterday and is holding those gains today.

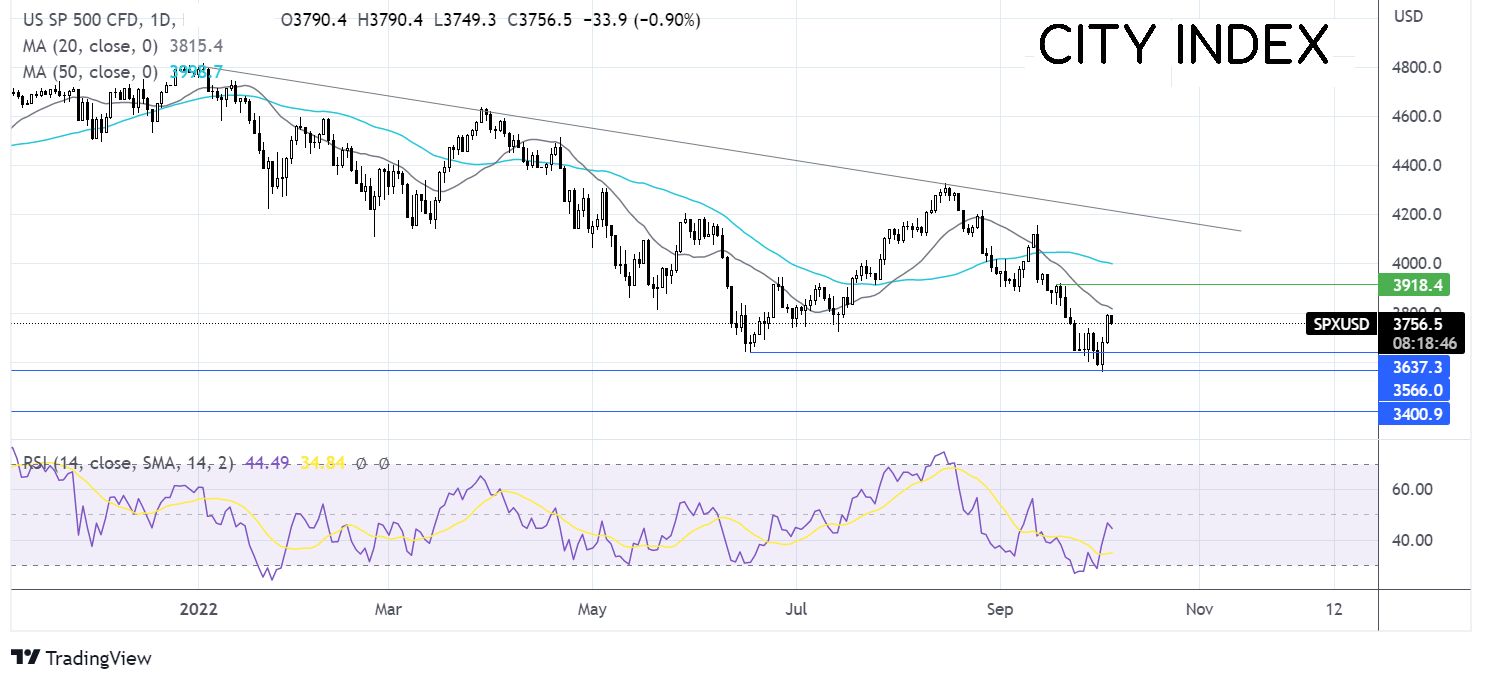

Where next for S&P 500?

The S&P500 rebound from 3560 ran into resistance at 3800 just shy of the 20 sma, which along with the bearish RSI, is keeping sellers optimistic about further downside. Sellers will look to take out support at 3715, the mid-July low, ahead of 3638, the mid-June low, opening the door to 3560, the 2022 low. Buyers will look to break above 3800 and 3815 the 20 sma to target 3915, the mid-September high.

FX markets – USD rises, GBP falls

The USD has resumed its rally after falling steeply in the previous few session. Hawkish comments from Federal Reserve officials reminded investors that the Fed will not likely adopt a dovish pivot anytime soon. The stronger than forecast ADP payroll data supports this view.

EUR/USD is falling after weaker than forecast composite PMI data. This fell to 48.1 in September, marginally below the 48.2 forecast but down firmly from 48.9 in August. The risk-off mood is also weighing on the euro, which has shrugged off comments from the EU energy minister that it has sufficient gas reserves for the winter.

GBPUSD is falling, paring solid gains from the previous few days. Investors are shrugging off a slightly better than expected services PMI, which was 50, better than the 49.2 forecast but still down from 50.9 in August. The UK’s dominant sector is stalling and a recession looks difficult to avoid.

GBP/USD -0.65% at 1.1380

EUR/USD -0.58% at 0.9916

Oil holds steady ahead of OPEC+

Oil prices are holding steady as investors look ahead to the OPEC+ meeting, which is taking place today, in person for the first time since the pandemic, in Vienna.

OPEC+ is expected to slash oil output by 1 million barrels per day, possibly more, as it looks to stabilise the price following a 35% decline since mid-June.

Oil prices have jumped 8% this week in anticipation of the cut, a cut that would mark the largest since the early days of the pandemic.

A large cut may sound surprising. However, the real impact of a large cut would be smaller, given that some of the members are failing to reach their output quotas.

However, an agreement on a large cut would send a strong message that the group is more than determined to support oil prices, even if this means strong criticism from other countries such as the US.

WTI crude trades -0.3% at $86.00

Brent trades -0.3% at $91.50

Learn more about trading oil here.

Looking ahead

14:45 S&P services PMI

15:00 US ISM services PMI