When is the OPEC+ meeting?

The OPEC+ group are due to meet on Thursday 4th November

What to expect?

The group is set to decide whether to stick with the current supply output increase of 400,000 barrels per day, agreed in July. Or whether to increase supply at a quicker rate a move which would please many leaders, including US President Joe Biden, who have called for more supply to cool prices.

Oil prices have surged across the year and across the past quarter, hitting multi year highs as demand from economies reopening has ramped up. Additionally, surging gas and coal prices have made oil a comparatively cheap alternative for power generation increasing demand for oil further.

Yet as demand ramp up the supply side remains tight.

What OPEC+ members are saying?

The latest commentary from a Kuwait and Iraq suggests that they support sticking to the previously agreed plan, despite demand clearly outstripping demand. These comments come following heavy weight Saudi Arabia already dismissing call for additional oil supply.

In light of recent commentary, the broad expectation is that OPEC+ will stick to the previously agreed output plan. This is also likely following OPEC reducing its oil deficit projections for the fourth quarter to 300,000 bpd. This is much smaller than the 1.1 million bpd initially forecast. This revision is likely to support a more cautious approach.

Struggling to ramp up production

The meeting comes as some countries in OPEC+ have failed to ramp up production to the quotas permitted in October. OPEC undershot the planned rise of 254,000 bpd achieving a rise of just 190,000.

With OPEC+ seeming keen to remain behind the demand curve oil prices could well advance further. Iran is the wildcard. Iran is holding talks with the West regarding its nuclear programme. A deal could see Iranian oil flooding back to the market as US sanctions are removed. Whilst this is a possibility and could weigh on prices, the reality is that this won’t be an overnight occurrence.

Learn more about trading oilWhere next for WTI?

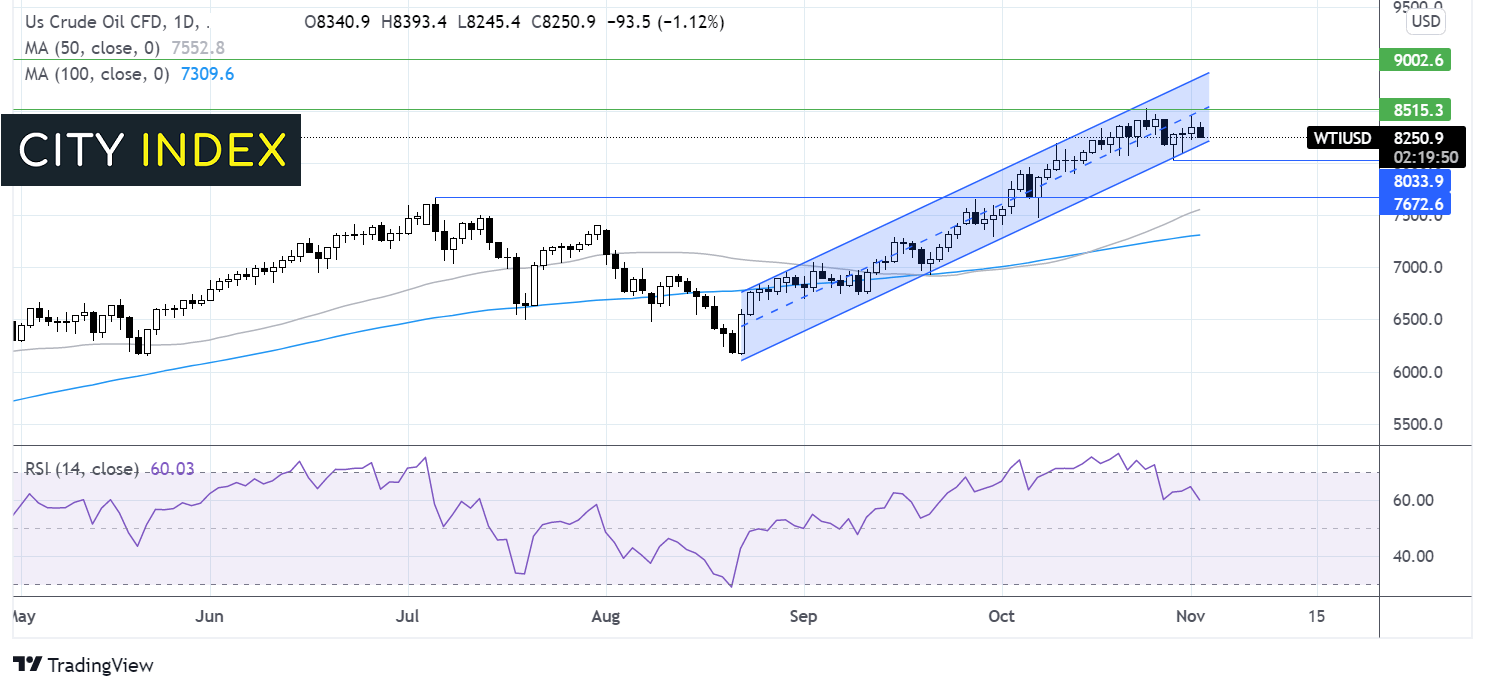

WTI crude oil continues to trade within the ascending channel dating back to mid-August. After running into resistance at 85.10, the 7 year high the price has softened slightly and the RSI has pulled back from overbought territory. It would take a move below 80.30 the low Oct 28 for bullish bias to be replaced with a bearish bias. Meanwhile buyers could look for a move back over 85.26 for fresh multi year highs.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.