Oil jumps 4.5% on supply fears

Oil prices are rising sharply higher after the West imposed tougher sanctions on Russia, blocking some Russian banks from SWIFT, the international payments system. Fears that these moves could disrupt supply, in an already tight market have pushed oil prices back over $100 per barrel.

Without being part of the international payment systems, the possibility of exporting commodities, including oil is greatly reduced.

Goldman Sachs have upwardly revised their one-month Brent price forecast to $115 a barrel, up from $95.

In order for oil prices to fall a sustained increase in oil supply is needed. The news last week that the US was looking work with other nations to release more reserves into the market helped bring oil prices off fresh 7 year highs. However, the effect has been short lived.

Will OPEC+ raise the output target for April?

The broad expectation is that OPCE+ is likely to stick to its current plan of raising oil output gradually, by adding 400,000 bpd extra a month, even after the latest Russia, Ukraine developments.

According to OPEC delegates, the jump in oil prices over $100 doesn’t actually reflect an imbalance between supply and demand. Although this stance could still change should Russia experience problems exporting its oil owing to some Russian bank being excluded from SWIFT. Let’s not forget that Russian oil accounts for around 10% of global supply so any slowdown in supply would be significant.

Ahead of Wednesday’s meeting, OPEC+ downwardly revised its surplus forecast for 2022 by around 200,000 bpd, highlighting the increased tightness in the market.

It’s worth keeping in mind that OPEC is already struggling to keep up with upwardly revised output targets. According to the International Energy Agency, OPEC+ was pumping around 1 million barrels, below the current quota, which raises questions over how useful another increase in the output target would be.

The situation in with Russia is very fluid and market reactions are still playing out. If OPEC did decide to increase output, it wouldn’t be the first time that they have caught the market off-guard.

Where next for oil prices?

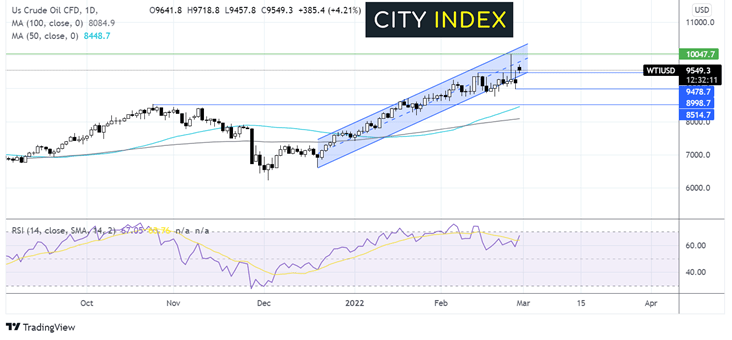

Oil has traded within a rising channel since late December. Whilst the price struggled around the lower band of the channel across the second half of February, the price has rebounded off the $90 low on Friday and re-entered the channel. The RSI is supportive of further upside whilst it remains out of overbought territory.

Buyers will be looking for a move over $97.17 to target $100 and fresh 7 year highs.

Immediate support can be seen at $94.80 a level which has offered resistance on several occasions across February. However, it would take a move below $90 Friday’s low to create a lower low and see sellers gain momentum.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.