Market Brief: Trump’s Tariffs Shock Markets

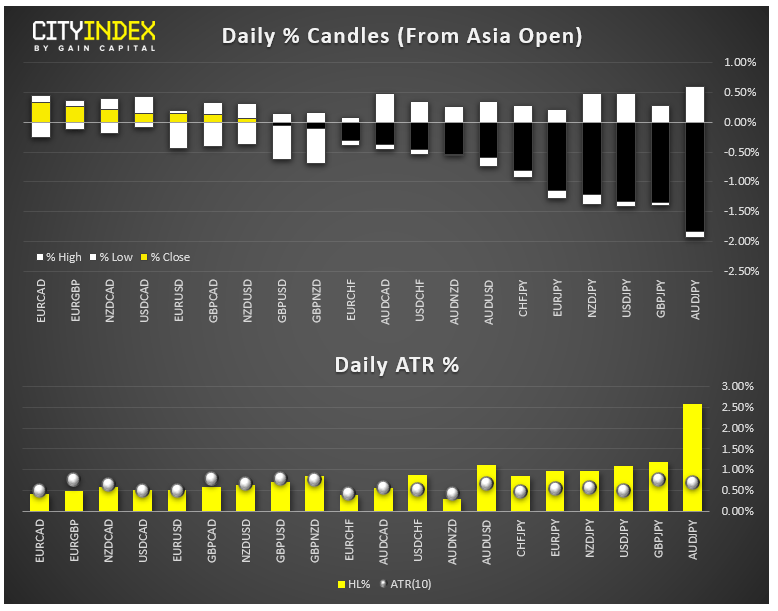

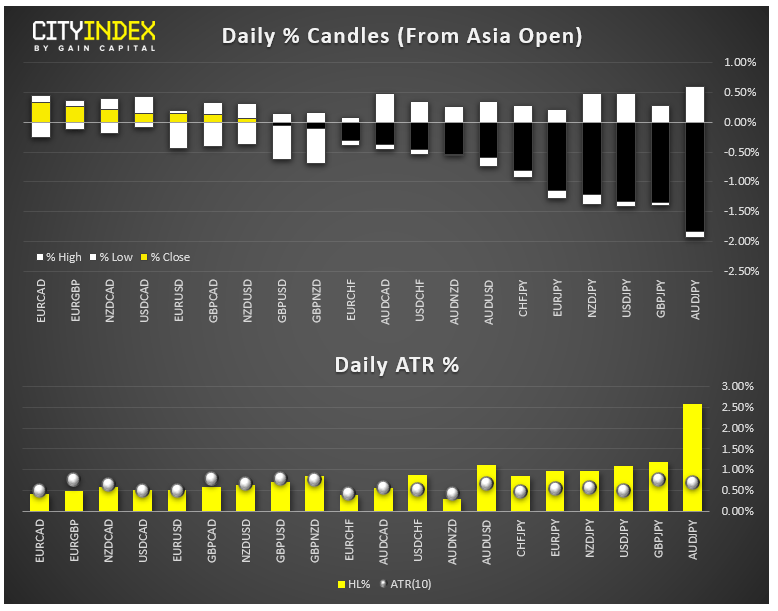

- FX: President Trump triggered a rush for safety midway through today’s US session when he tweeted that the US would impose 10% tariffs on $300B of Chinese goods that are not currently taxed. As a result, the safe haven yen was the strongest major currency on the day and the risk-sensitive Aussie was the weakest.

- AUD/JPY fell 2% on the day and is on track for its lowest close since 2010.

- See our preview for tomorrow’s NFP report.

- Commodities: Oil cratered on the surprise announcement, falling by more than 7% on the day. Gold shined, rising 1% as risk assets fell.

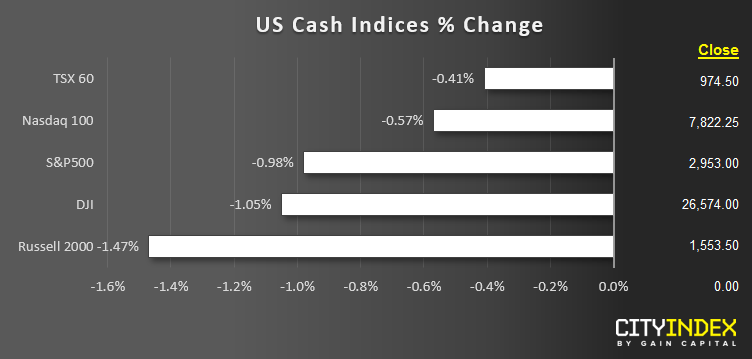

- US indices collapsed on the tariff headlines, dumping from +1% on the day to trade down by more than 0.5% across the board.

- Utilities (XLU) were the strongest sector, with their generally high dividends in demand as bond yields tanked. Energy stocks (XLE) were the weakest major sector, dragged down by the big drop in oil prices.

- Stocks on the Move:

- Verizon (VZ) managed to buck the broader weakness and gain about 0.5% after reporting strong Q2 earnings.

- Yum Brands (YUM, +4%) reported better-than-expected declines in earnings and revenue.

- General Electric’s (GE) CFO is stepping down after less than 2 years, prompting the stock to fall 4% on the day.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM

April 24, 2024 03:30 PM