Gold is holding its own rather well as we head towards the start of a busy few days with the Fed rate decision today, ECB tomorrow and US non-farm payrolls report at the end of the week. Our bullish gold outlook remains intact heading into these events.

Why is gold rising?

Supported by renewed weakness in bond yields, the precious metal has closed in on the record high of $1975 hit at the height of the pandemic in August 2020. As before, I think it is only a matter of time before it breaks through this level. For one thing, central banks are on the verge of ending their tightening cycles soon; the Fed, for example, looks set to hike by another 25 basis points today and then signal a pause to assess the impact of the past hikes on the economy. For another, financial stability risks, recession fears, the still-high inflation and ongoing concerns over US debt ceiling, all point to growing demand for haven assets. Indeed, these risks have been highlighted this week by weakening manufacturing PMI data from China and Europe, as well as a sell-off in regional bank stocks on Wall Street.

Gold outlook: How will it react to Fed’s decision?

Expectations are for the Fed to hike interest rates by 25 basis points at the conclusion of the FOMC meeting today. If Powel signals that the Fed will now pause and may consider cutting rates before the end of the year, then this should give gold another shot in the arm. However, if the Fed says more rate hikes might be needed, then expect to see a sell-of across all risk assets, including gold. So, the outcome of this meeting does indeed present a key risk to our bullish gold outlook.

Regional banks sell-off boost gold outlook

Tuesday’s session was meant to be the proverbial quiet before the storm, but it proved to be the actual storm as financial markets plunged as regional bank stocks dropped in excess of 20%, raising some doubts over the Fed’s willingness to raise interest rates on Wednesday. The Russell index, comprised of 2000 small cap stocks, led the sell-off as the likes of PacWest Bancorp, Western Alliance Bank and Metropolitan Bank all fell in excess of 20%. Meanwhile, there was more evidence of a colling jobs market as JOLTS jobs opening figures fell for a third month to their lowest in nearly two years. Concerns over the US debt ceiling are also adding to the wall of worry and reinforcing expectations that the Fed will turn more dovish soon. Safe haven gold rallied as bond yields fell, keeping bullish hopes alive that we might see a new record high soon with the metal continuing to consolidate around the $2K hurdle.

Gold technical outlook

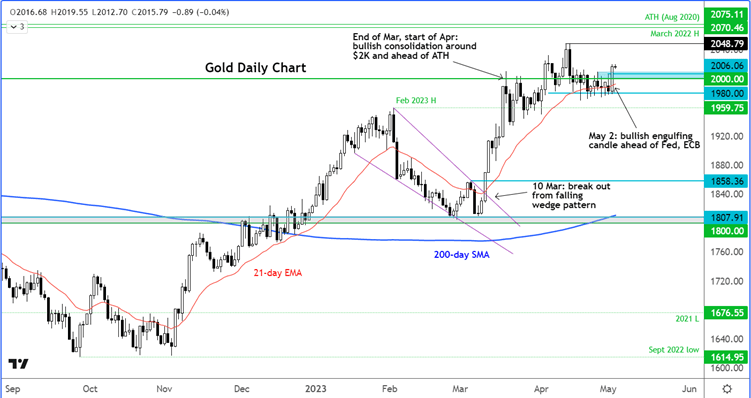

Following Tuesday’s rally, gold ended at a two-week high above Monday’s range. It therefore maintained its bullish bias as it climbed above the 21-day exponential moving average and the key $2,000 level. A run towards the all-time high of $2075 still looks favourable than a sharp sell-off. We will maintain a bullish view on the metal until the chart tells us otherwise.

Right now, $1980 seems to be a very important support level. Thus, a potential break below $1980 would be a bearish development in the short-term outlook.

But for as long as we remain above this level, any short-term weakness we may see today or on Thursday as a result of the rate decisions by the Fed and ECB could be viewed as just market noise.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade