GBP/USD holds steady around 1.2150 ahead of the Fed rate decision

- Federal Reserve is expected to keep rates unchanged at 5.25-5.5%

- The door is likely to be left open for further hikes

- US ADP payroll, JOLTS job openings to paint a mixed picture

- GBP/USD trades in a symmetrical triangle

GBP/USD is holding steady after modest losses in the previous session as the market looks ahead to the Federal Reserve interest rate decision later today.

The Fed is widely expected to leave interest rates on hold at the 22-year high of 5.25 to 5.5% but leave the possibility of another rate hike, potentially as soon as next month, on the table.

Recent U.S. data has highlighted the resilience of the economy. Inflation remains over two times the Fed's target, and recent GDP data showed 4.9% annualised growth in Q3.

As a result, policymakers will want to wait and see more data to assess the impact of past increases on the economy as they approach the end of the hiking cycle.

Fed Jerome Powell's press conference will be watched closely and is expected to leave the door open for future hikes. Whether today's pause will turn into the end of the Fed's hiking cycle will largely depend on labour and inflation data over the coming months.

In addition to the Fed, attention will also be on US ISM manufacturing PMI, which is expected to hold steady at 49 in October.

Jobs data will also be in focus with the release of the ADP payroll report, which is expected to see a 150K increase up from 89 K in September. However, JOLTS job openings are expected to decline from 9.61 million to 9.25 million in September, which could indicate that the labour market is cooling. The data comes ahead of Friday's non-farm payroll report.

Meanwhile, the pound will look to UK manufacturing PMI data, which is expected to confirm the preliminary reading of 45.2 up from 44.3 in September. However, this continues to be below the 50 level, which separates expansion from contraction and highlights the gloomy outlook for the UK economy.

The Bank of England will announce its interest rate decision tomorrow, where a weakening economic backdrop could encourage policymakers to keep interest rates on hold at 525%.

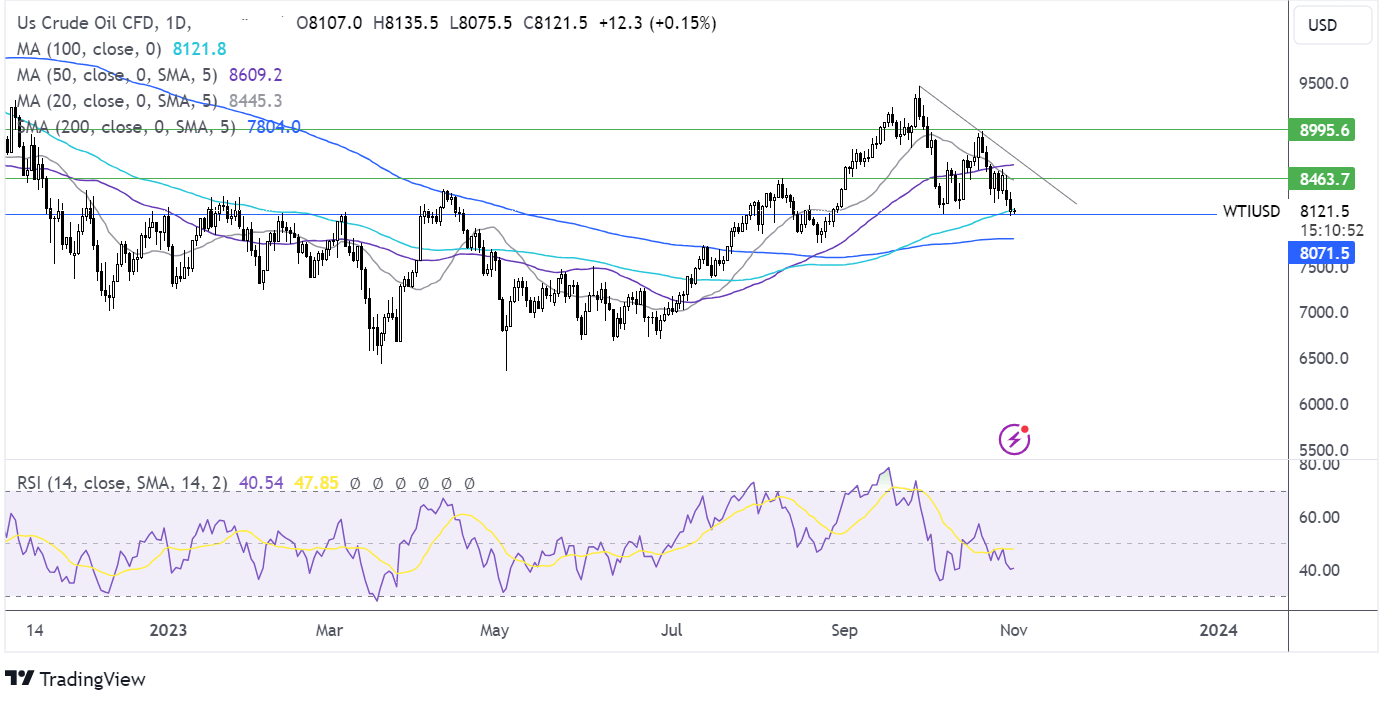

GBP USD forecast -technical analysis

GBP/USD trades in a symmetrical triangle, forming a series of lower highs and higher lows. The price has failed to push above the 20 sma, and the RSI below 50 keeps sellers hopeful of a break out to the downside.

Sellers will look to break below 1.2090, the rising trendline, bringing 1.2070, last week’s low, into focus ahead of 1.2040, the October low.

On the upside, buyers need a rise above 1.2180/1.22, the 20 sma and falling trendline support to test 1.2290, last week’s high ahead of 1.2340 the October high.

Oil inches higher after two days of losses

- US production increases to 13.05 million

- OPEC output rose 180k bpd in October

- Middle East & Fed decision in focus

- Oil tests support around 81.00

Oil prices are heading higher, snapping a two-day losing run which saw the price of oil drop almost 5% as global supply concerns ease.

According to the EIA, crude oil production broke record levels, with output hitting 13.05 million barrels a day in August. This came following an increase of 0.7% in the previous month. The increase in US output also comes as OPEC raised production levels by 180,000 barrels per day in October, mainly due to increased production from Nigeria and Angola.

While supply concerns have eased, the demand outlook is more of a mixed bag. US demand for crude and petroleum products rose to 20.88 million barrels per day in August, marking its highest level in four years. However, weak manufacturing activity data from China, the world's largest oil importer, raises concerns over the country's demand prospects.

Games are proving to be limited on Wednesday in cautious trade ahead of the Federal Reserve's interest rate decision and as investors keep a watchful eye on developments in the Middle East.

Geopolitical risk concerning the Israel-Hamas conflict remains a key influence on oil prices. So far, the conflict has not directly impacted oil supply but remains a variable that could tighten supply conditions.

Looking ahead to the central bank's interest rate decision will be in focus as it indirectly impacts the oil demand outlook.

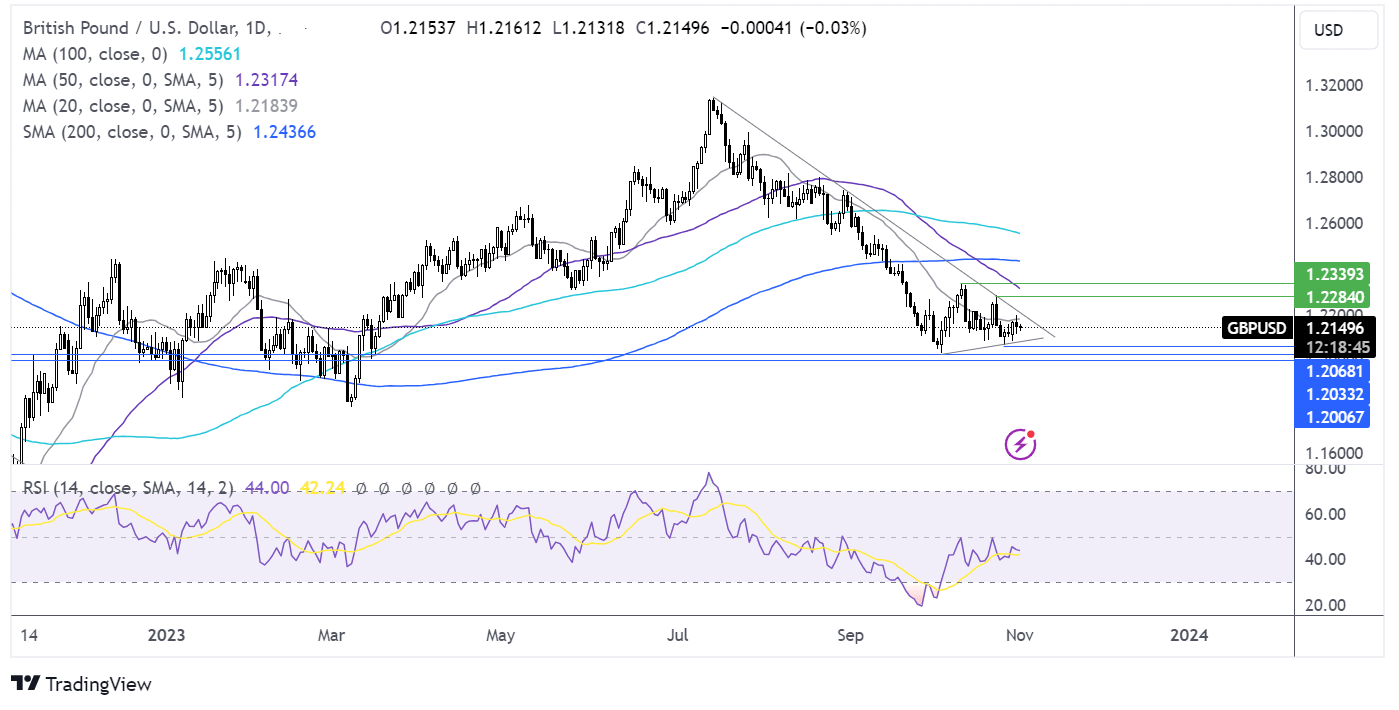

Oil forecast – technical analysis

Oil is testing support around 81.00 the 100 sma and the October low. A breakdown here is needed to extend the bearish trend towards 78.00, the 200 sma and the August low.

Should support hold at 81.00, buyers will look to 85.00 the 20 sma and the August high.