- GBP/USD outlook supported as UK wages print 5.8% vs. 5.6% expected

- Focus shifts to inflation data from both US and UK

- US CPI expected to print 2.9% vs. 3.4% previously

The GBP/USD saw a slight uptick following robust wage and employment data from the UK earlier today, with more significant data releases expected from both sides of the Atlantic. The upcoming inflation reports from the UK and the US are likely to dictate the trajectory of both the pound and US dollar. As markets await the highly anticipated US CPI release later today, the GBP/USD was showing a modest gain for the week, hovering around 1.2650. Consolidation dominated trading as investors awaited clarity from the inflation front, but the pair may begin trending more cleanly once this week's inflation figures are released.

GBP/USD outlook: UK wages come in stronger

This morning saw the release of stronger-than-expected wages and jobs data from the UK, which gave the GBP/USD and other GBP crosses a lift.

The Average Earnings Index, which includes bonuses, came in at 5.8% in the three months to December, compared to a year-ago period. This was stronger than 5.6% expected and the previous month’s data was revised up to 6.7% from 6.5%, suggesting that wage inflation is still going strong. On top of this, the annual rate of unemployment fell more than expected to just 3.8% in the three months to December, down from 4.2% in November. In fact, the employment sector remained quite strong at the start of the year as jobless claims rose less than expected at 14.1K in January.

The stronger data helps to push back further against bets of a sooner-than-expected Bank of England rate cut, which is why the pound is finding support today.

GBP/USD outlook: Focus Shifts to US Consumer Price Index

During much of last week and at the onset of this week, the FX markets exhibited a predominant preference for the US dollar, with the greenback retaining its strength despite the absence of significant news developments. The preceding week saw a robust US jobs report and several other economic indicators exceeding expectations, coupled with statements from Fed Chair Powell and the FOMC signalling against an early rate cut.

Today, a potentially stronger inflation report could further bolster the dollar's position against currencies with lower yields, while a softer reading would be welcomed by traders favouring foreign currencies over the USD, including those invested in GBP/USD.

So, the focal point on today's US economic calendar is the Consumer Price Index (CPI), which is expected to fall to a 2.9% annual pace in January from 3.4% in December, with a month-over-month print of +0.2% compared to +0.3% in the previous month. Core CPI is anticipated to print at +3.7% year-on-year, down from +3.9%, or +0.3% month-on-month.

More US data later in the week

This week’s other key US data include retail sales, industrial production, jobless claims and Manufacturing indices from Philadelphia and New York, all on Thursday, ahead of PPI, building permits and UoM Consumer Sentiment on Friday.

Recent retail sales figures have consistently surpassed forecasts for six consecutive months, highlighting the resilience of the US consumer. December witnessed a 0.6% increase in retail sales, coupled with a 0.4% uptick in core sales. These positive retail indicators have coincided with a surge in consumer sentiment over recent months. As a result, unemployment remains low, wages continue to rise, and inflation is gradually moderating. Given these factors, the Federal Reserve has found no compelling reason to hasten its policy loosening. If this week's data releases, particularly retail sales, indicate further economic resilience in the US, expect continued gains for the US dollar.

However, retail sales are anticipated to decline by 0.2% on a month-over-month basis this time around, though core sales are projected to increase by +0.1%.

GBP/USD outlook will be influenced by even more important UK data this week

The GBP/USD outlook will be impacted by the upcoming US data releases, as will other major currency pairs. However, the GBP is poised for added volatility due to a packed schedule of data releases in the UK this week. Notable among the UK data releases are CPI, GDP, and retail sales figures, all set to be unveiled starting Wednesday.

Earlier today, we had stronger data from the UK as wages beat and the unemployment rate fell more than expected.

Among key macro events to watch for the remainder of this week from the UK, we have UK CPI on Wednesday, followed by a speech by the BoE Governor Bailey later in the day. Both monthly and quarterly estimates of UK GDP will come in on Thursday, before the focus turns to retail sales on Friday.

The pound, stronger today, could become under pressure if UK inflation turns out to be surprisingly weak, although economists think prices have risen further to 4.1% y/y in January from 4.0% in December.

Nevertheless, the volatility of the GBP/USD will also be contingent upon the US data. Thus, if you aim to gauge the pound's response solely to the forthcoming UK data, focusing on a pound cross like the EUR/GBP or GBP/CHF would be more prudent than the GBP/USD itself, which will be swayed by the imminent CPI data from the US.

However, if you prefer the GBP/USD pair, then waiting for the the release of inflation figures is important for potentially lucrative trading opportunities.

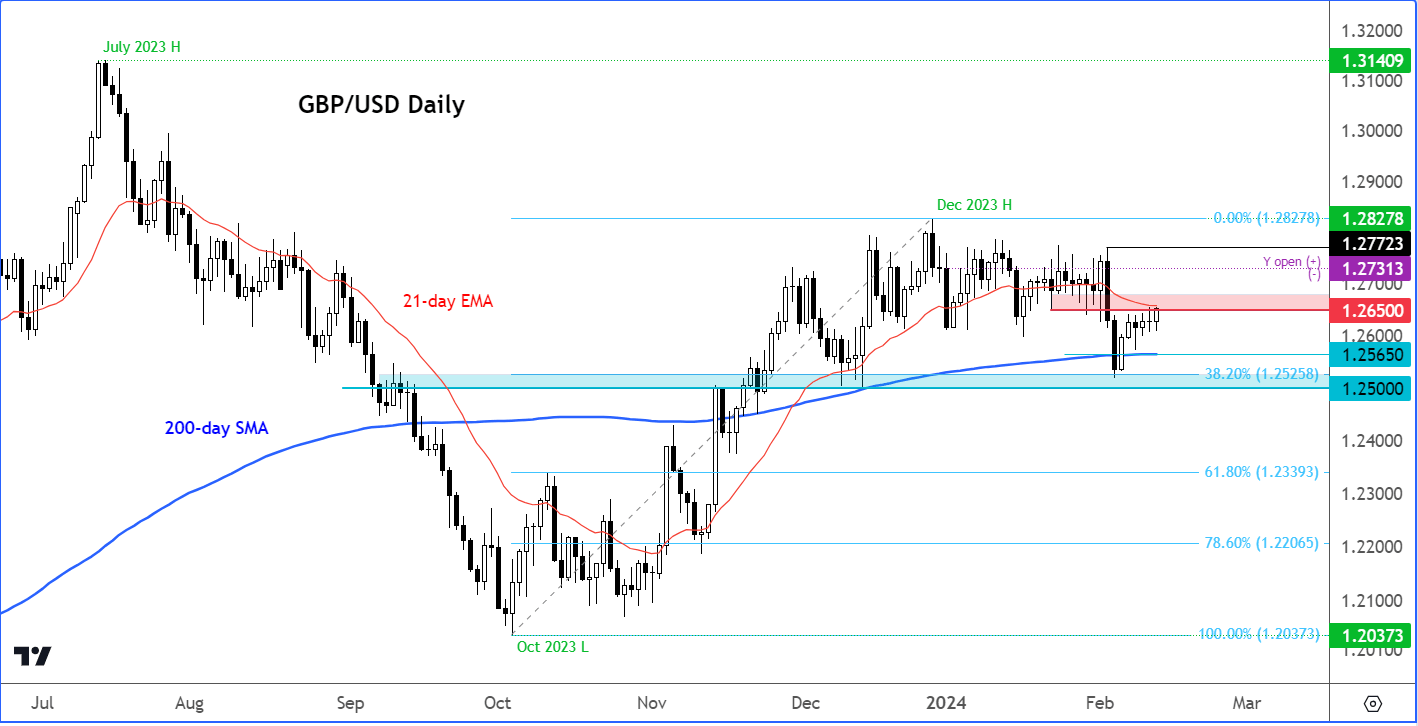

GBP/USD technical analysis

Source: TradingView.com

The key short-term pivotal level to monitor on the GBP/USD stands at around 1.2650, which has started to give way in response to the stronger UK data this morning but remains to be seen whether the breakout will hold later when US CPI is released. This level previously served as support, with the 21-day exponential moving average adding significance to its relevance.

Beyond this level, the range between 1.2730 to 1.2770 presents an additional resistance zone, where recent rally attempts, including those from last week, have faltered. Therefore, a decisive move above last week’s high of 1.2772, sustained over time, would signal a significant bullish reversal.

On the downside, interim support comes in around the 200-day average, circa the 1.2560 region. Below this, the area spanning from the psychologically significant level of 1.2500 to the long-term 38.2% Fibonacci level at 1.2525 holds importance. A potential daily close below the 1.25 mark would mark a significant bearish reversal.

Currently, the GBP/USD finds itself within a trading range with a modest bullish inclination but lacks a clear longer-term directional bias. This week's impending inflation data could alter this scenario and establish the tone for potentially weeks to come. Thus, it's imperative to include the GBP/USD in your watchlist of tradable markets, particularly if a surprisingly weak US inflation report comes in later today.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade