Asian Indices:

- Australia's ASX 200 index fell by -3.9 points (-0.05%) and currently trades at 7,232.10

- Japan's Nikkei 225 index has fallen by -475.17 points (-1.68%) and currently trades at 27,812.25

- Hong Kong's Hang Seng index has fallen by -134.59 points (-0.66%) and currently trades at 20,274.59

- China's A50 Index has risen by 25.56 points (0.19%) and currently trades at 13,240.48

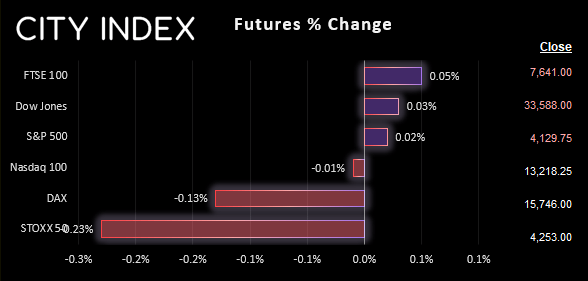

UK and Europe:

- UK's FTSE 100 futures are currently up 4 points (0.05%), the cash market is currently estimated to open at 7,638.52

- Euro STOXX 50 futures are currently down -11 points (-0.26%), the cash market is currently estimated to open at 4,304.32

- Germany's DAX futures are currently down -20 points (-0.13%), the cash market is currently estimated to open at 15,583.47

US Futures:

- DJI futures are currently up 11 points (0.03%)

- S&P 500 futures are currently up 0.75 points (0.02%)

- Nasdaq 100 futures are currently down -0.75 points (-0.01%)

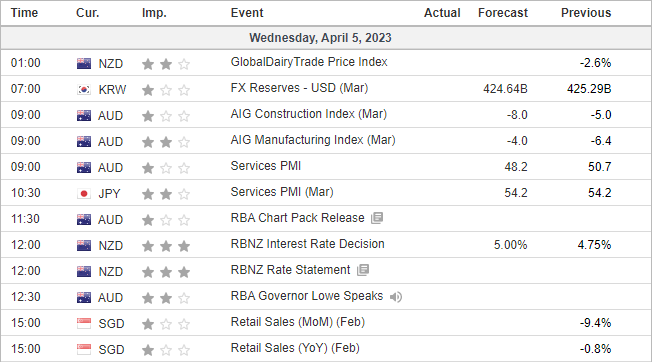

- The RBNZ raised their overnight cash rate by 50bp to 5.25%, surpassing the consensus of a 25bp hike

- The statement leans towards a hawkish hike, although there are several key data points over the next seven weeks for the RBNZ to mull over to shape policy, ahead of their next meeting in May

- NZD was the strongest currency major and rose against all its FX peers, whilst volatility outside the Kiwi was on the miniscule scale

- RBA Governor Lowe said that yesterday’s decision to pause does not signal that interest rate increases are over, adding that the board will look at the coming data on inflation, retail sales and employment before deciding what to do in May

- Japan’s final read of their services PMI was upgraded to a fresh decade high of 55 (above 50 denotes industry expansion)

- German factory orders are released at 07:00 BST, PMI data for Spain, France, Germany and the eurozone between 8 and 9am

- UK PMI data is at 09:30, ahead of a speech from the BOE’s Tenreyro at 10:15

- Key data points today are the ADP employment at 13:15, US services PMI and ISM services report at 14:45 and 15:00

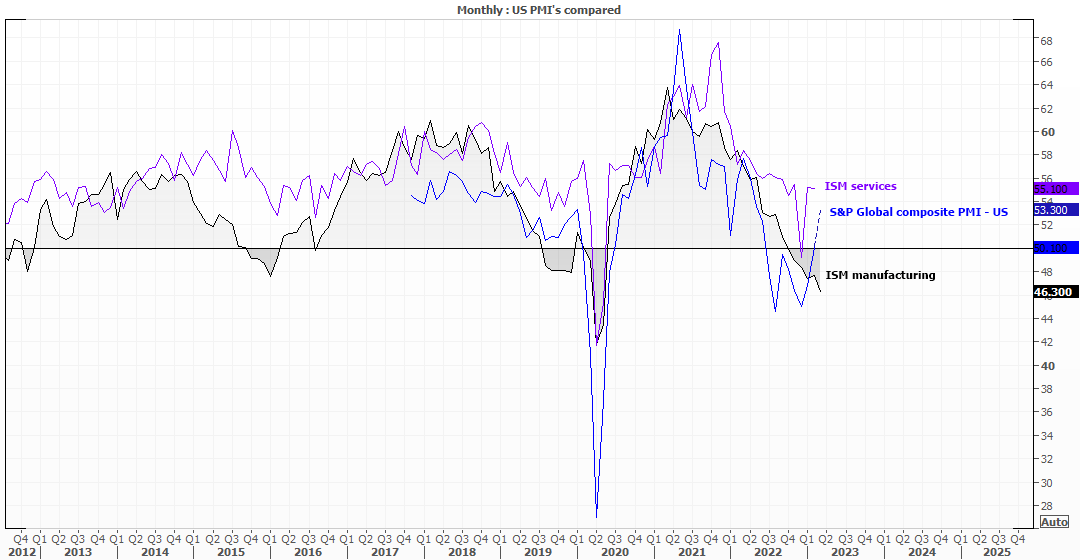

Fears of a US recession continue to weigh on sentiment

It seems that concerns of a financial meltdown are old hat, as we’ve since reverted back to the ‘US recession’ theme. Soft PMI data and a dire ISM manufacturing report on Monday weighed on the US dollar, Wall Street and yields, before yesterday’s weak JOLTS job openings report, factory orders and durable goods orders exacerbated those concerns. The US 10-year / 3-month yield spread continued south to multi-decade lows as investors continued to price in a recession.

With sentiment in the grips of US data and rate expectations (and bond traders trying to goad the Fed into cuts), it makes today’s ADP employment and ISM services reports the more exciting – as weak data could be pounced upon by dollar bears. An the same can be said for the ISM services report if we are delt a weak report, although it has remained a lot more resilient to bumps in the economic road compared with the manufacturing sector.

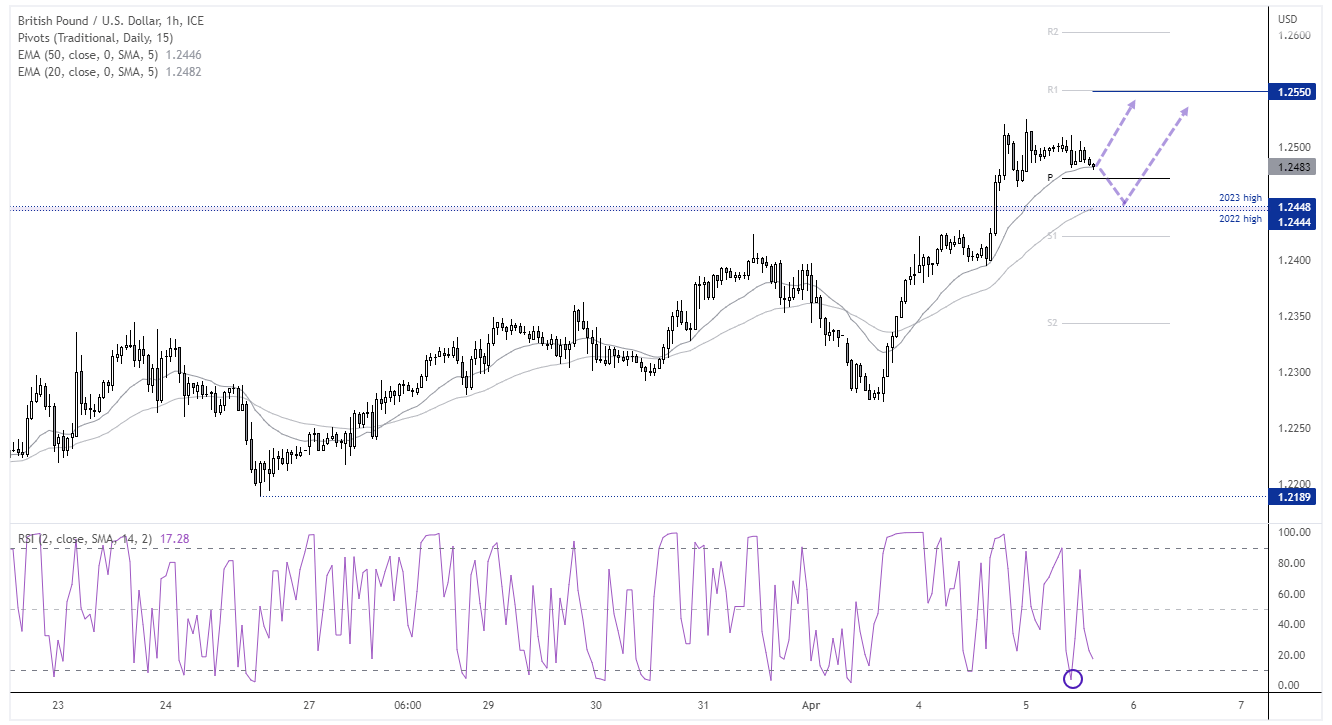

With Nonfarm payrolls in focus on Friday it makes today’s ADP employment report the more exciting, as a weak print here could see markets react as though a weaker NFP report is due. It could also help GBP/USD extend its 10-mont high and USD/CHF break to a fresh YTD low.

GBP/USD 1-hour chart:

GBP/USD broke to a 10-month high yesterday, and prices are now consolidating within a bullish continuation pattern on the 1-hour chart. The bullish trend has accelerated and, even if prices break initially lower, bulls could seek bullish setup above or around the 2022 and 2023 highs. Otherwise perhaps prices can hold above the daily pivot point and head for the daily R1 pivot around 1.2550.

Economic events up next (Times in GMT+1)

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade