Asian Indices:

- Australia's ASX 200 index fell by -15.9 points (-0.22%) and currently trades at 7,278.50

- Japan's Nikkei 225 index has risen by 274.13 points (0.8%) and currently trades at 34,754.93

- Hong Kong's Hang Seng index has fallen by -18.13 points (-0.08%) and currently trades at 21,394.27

- China's A50 Index has fallen by -42.19 points (-0.31%) and currently trades at 13,750.25

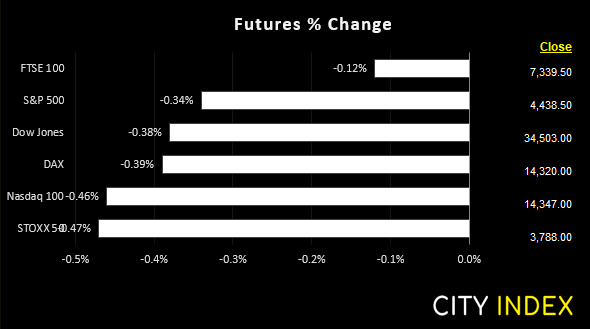

UK and Europe:

- UK's FTSE 100 futures are currently down -3 points (-0.04%), the cash market is currently estimated to open at 7,401.73

- Euro STOXX 50 futures are currently down -18 points (-0.47%), the cash market is currently estimated to open at 3,884.44

- Germany's DAX futures are currently down -60 points (-0.42%), the cash market is currently estimated to open at 14,353.09

US Futures:

- DJI futures are currently down -129 points (-0.37%)

- S&P 500 futures are currently down -59.5 points (-0.41%)

- Nasdaq 100 futures are currently down -14.75 points (-0.33%)

The strong rally on Wall Street heading into the weekend petered out during Asian trade today, with the majority of major benchmarks across the region trading lower for the day.

Ukraine rejected a deadline set by Russia for Mariupol to lay down their weapons and surrender. An ammonia leak from a chemical plant in Ukraine has affected a 2.5km area in the city of Sumy and a shopping centre in Kyiv has been shelled. Ukraine’s Deputy PM said there is “no question of surrender” and that Russia need to open a humanitarian corridor.

Gold prices were marginally higher across the board after receiving safe-haven flow, and platinum (a key export for Russia) rose back above 2500 on supply fears after Ukraine rejected Russia’s deadline. WTI also rose to a 5-day high on rising geopolitical tensions.

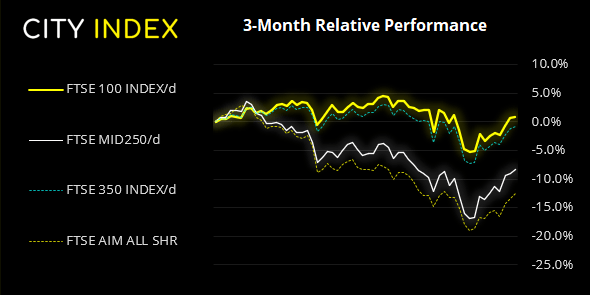

FTSE - Market Internals:

The FTSE 100 closed above 7400 for the first time in two weeks and back above the 50-day eMA on Friday. It was also its heaviest day of trading volume since March 2020, although this may be partly explained by the fact it was a triple witching day (where options, index and stock futures expire on the same day). The monthly pivot point is around 7450 and the 7500 high is within a day’s ATR, as long as prices rally from the open. However, the index has had a strong rally since the March low and with such resistance levels nearby we are also on guard for a reversal day or two.

FTSE 350: 4164.9 (0.26%) 18 March 2022

- 249 (70.94%) stocks advanced and 91 (25.93%) declined

- 2 stocks rose to a new 52-week high, 1 fell to new lows

- 34.76% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 20.8% of stocks closed above their 20-day average

Outperformers:

- + 15.50% - Helios Towers PLC (HTWS.L)

- + 9.82% - Bridgepoint Group PLC (BPTB.L)

- + 7.60% - Ocado Group PLC (OCDO.L)

Underperformers:

- -4.18% - Sirius Real Estate Ltd (SRET.L)

- -3.90% - NCC Group PLC (NCCG.L)

- -3.68% - Centamin PLC (CEY.L)

FTSE 100 trading guide

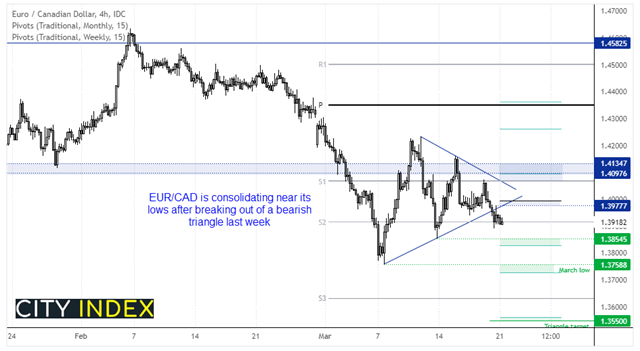

Triangle breakout on EUR/CAD

A strong retail print on boosted the Canadian dollar on Friday and helped EUR/CAD break to the downside of its symmetrical triangle. The pattern projects a target around 1.355, although support zones near the March low and 1.3855 low make suitable interim targets, depending on time horizon of the trader. Prices need to remain below the broken trendline to keep the triangle intact, and ideally any pullback against the breakout will remain below the 1.400 area, near the weekly pivot point.

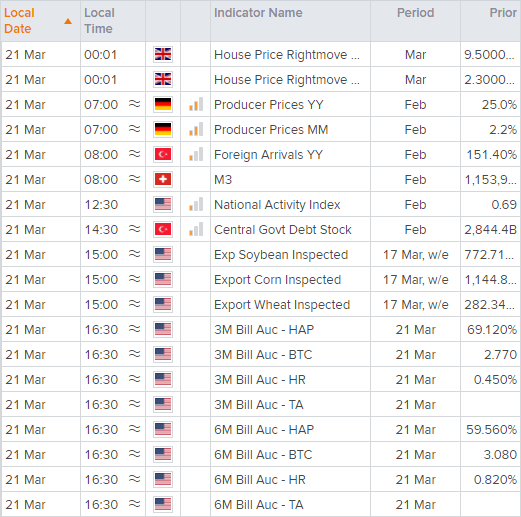

Up Next (Times in GMT)

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade