- What is the FTSE 100 index?

- FTSE 100 constituents

- How to trade the FTSE 100

- FTSE 100 market hours

- How is the FTSE 100 calculated?

- What moves the FTSE's price?

- Average returns of the FTSE 100

- FTSE 100 companies ranked by market capitalisation

- FTSE FAQ

What is the FTSE 100 index?

The FTSE 100 is a stock index that tracks the 100 largest publicly-traded companies listed on the London Stock Exchange (LSE). The combined value of the FTSE 100 comprises more than 80% of the entire LSE's market cap.

On the City Index platform, the FTSE 100 is called the UK 100.

The FTSE 100 is used as a benchmark for the economic health of the UK. If the price of the index rises, it means the FTSE constituents' share prices are rising, which generally indicates a positive economic situation. Whereas a falling FTSE is a sign that the companies (and the wider economy) are experiencing a period of contraction.

FTSE's name is a combination of the two companies that founded the index: The Financial Times and the London Stock Exchange. It is now completely owned by the LSE.

FTSE 100 constituents

Constituents of the FTSE 100 are considered 'blue chip' firms in the UK, in that they have the highest value. While these companies are often used to measure the UK's economy, a lot of FTSE 100 constituents are now multinational firms.

Want to see the full list of companies? Click here.

To be included on the FTSE 100, a company must be listed on the LSE, its shares must be denominated in pounds and it must meet the index's minimum float and liquidity requirements. FTSE 100 constituents are reviewed every quarter - usually in March, June, September, and December. If a company is no longer in the top 100 companies by market cap, it will be removed from the index and replaced with a new stock. It's important to keep an eye on any changes to the FTSE 100's constituents, as they will impact your exposure to different sectors of the economy.

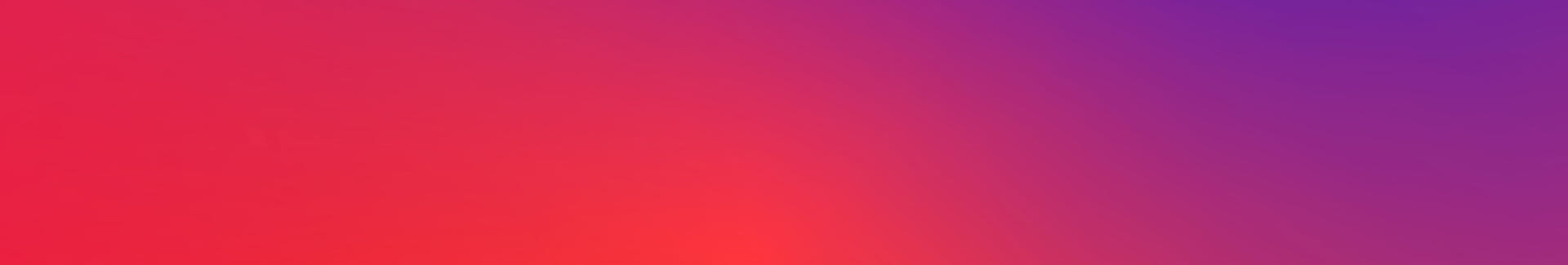

Here's how the top ten sectors of FTSE 100 companies looked after the adjustment in March 2021:

How to trade the FTSE 100

Let's cover five popular methods to trade the FTSE: CFDs, spread betting, FTSE futures, options and ETFs.

FTSE cash CFDs

Contracts for difference (CFDs) are derivatives that take their price from an underlying market. In this case, the FTSE 100.

When you trade a FTSE CFD, you're agreeing to exchange the difference in the index's price from when you open your position to when you close it. The more the FTSE moves in your chosen direction, the more you profit. The more the FTSE moves against you, the more you lose.

You can buy CFDs to open a long position or sell them to go short.

Cash CFDs have some of the tightest spreads on offer, which makes them popular among day traders who open and close positions quickly. However, holding a position overnight will result in additional charges.

Learn more about CFDs.

FTSE spread betting

With FTSE spread betting, you buy or sell a set number of pounds per point on the FTSE's future price movements. As with CFDs, you'll make profit as the index moves in your chosen direction, and a loss if it moves against you.

Say you buy £5 per point when the FTSE's at 7000, for example. If the FTSE moves up 20 points to 7020, you'll make (£5 * 20 points) £100. If it falls 20 points, you'll lose £100.

Find out more about spread betting.

FTSE futures

Futures contracts are agreements to exchange an asset a set price on a set expiry date. Unlike most futures, FTSE contracts don't have an underlying physical asset to exchange, as an index is nothing more than a number representing a group of stocks.

FTSE futures are purely speculative - you're be estimating whether the FTSE will rise or fall by a certain amount by a set date.

The value of FTSE futures can be somewhat difficult to predict, as there's a reciprocal relationship between futures and the underlying index.

While the value of FTSE futures is naturally influenced by the underlying 100 companies themselves, the FTSE 100 is also influenced by futures pricing - because the futures market opens before the London Stock Exchange. So, if the prices of futures increase, the value of FTSE 100 is likely to open higher, and vice versa.

When you trade FTSE futures with City Index, you'll be using CFDs to speculate on the futures market. Usually, you'd use futures for longer-term positions, as the costs of maintaining a position overnight are included in the initial spread.

FTSE 100 options

FTSE 100 options are contracts that give you the right, but not the obligation, to buy or sell the index at a set price on a set date.

Like futures contracts, index options are different from other types of option has there are no underlying assets involved. But unlike futures, when you buy an options contract, you get the right to let your contract expire worthless if you want to.

There are two types of options you'd use to speculate on the price of the FTSE 100. If you're bullish on the FTSE 100, you'd use a call option - this would earn you a profit if the index increased in value. If you were bearish on the FTSE 100, you'd use a put option, which would earn a profit if the index fell in value.

When you trade FTSE options with us, you'd be doing so via CFDs. Learn more about options trading.

FTSE 100 stocks and ETFs

Another way to trade the FTSE is through exchange traded funds (ETFs), which are investment instruments that hold a group of stocks - in this case, the shares of constituents on the index.

The majority of FTSE ETFs will be weighted in exactly the same way that the index is, giving you identical exposure. Examples include the Vanguard FTSE 100 UCTIS ETF and iShares Core FTSE 100 UCITS ETF. Other types of FTSE 100 ETFs will give each company an equal weighting, give you a short exposure or leverage your position, so your returns would look different than the underlying.

Alternatively, you could trade the individual constituents' shares. This would give you exposure to just one part of the index, but you could choose just the stocks and sectors you're interested in.

Find out more about share trading.

FTSE 100 market hours

The FTSE 100 opens at 8am and closes at 4:30 (GMT), which are the hours of the London Stock Exchange. When you trade the FTSE 100 with City Index, you’ll be able to get exposure to the index for much longer.

With your City Index account, you can trade the UK 100 23 hours a day five days a week, with a break from 22:00 to 23:00 (GMT).

You can see the trading hours for every single City Index market within the web trading platform, with a free City Index demo.

Learn more about stock market hours.

How is the FTSE 100 calculated?

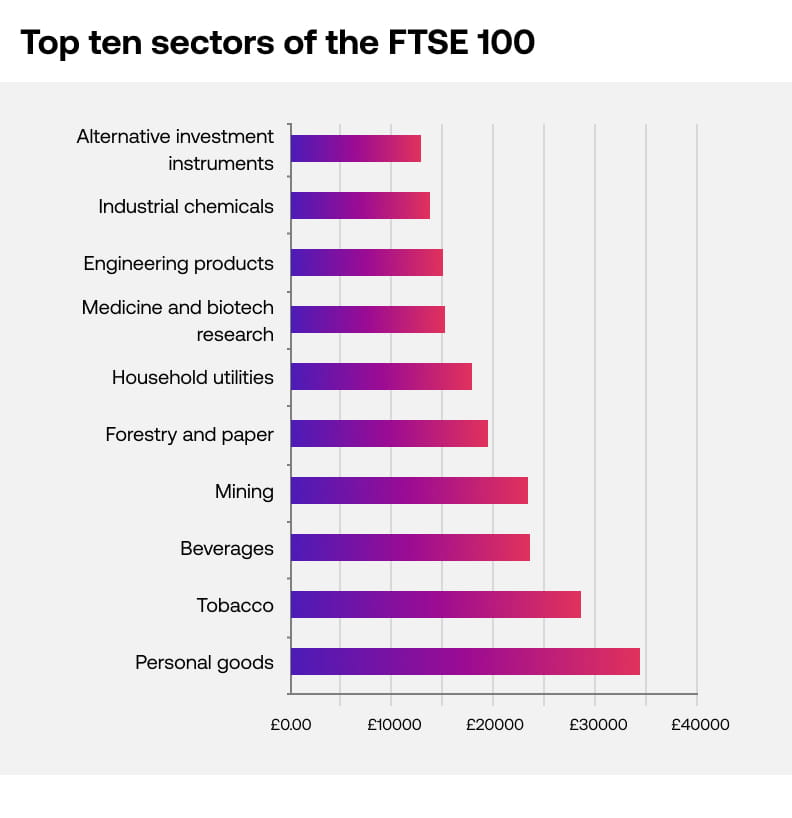

The FTSE 100 is calculated using the total market capitalisation of all 100 constituents. As the index is market-capitalisation weighted, companies with higher values will have more influence over the index's final value.

The calculation starts by multiplying each company's current share price by the total number of shares it has issued. This gives you its market cap.

Each market cap is then multiplied by the company's 'free-float factor', which indicates how many shares are still available on the market. The free-float adjustment factor essentially helps to account for differences between the number of shares available - usually rounded to the nearest 5%. A company with a larger portion of floating shares will have a larger influence on the index's value.

Finally, the market caps of all the companies are combined and divided by the index divisor - this is a figure that is applied to the index to make its value more manageable. The FTSE 100's divisor started at 1000 points in 1984, but as the composition of the index has changed, so has the divisor. This is to make sure the index's value today can be compared to historic data.

At the end of this calculation, you have a figure that tells you how the UK's top 100 public companies are performing, with more emphasis on larger corporations.

What moves the FTSE's price?

The FTSE's price is constantly moving over the course of a trading day, as the companies it represents rise and fall. With 100 constituents to follow, identifying the reason for any single move can be difficult - but some broad trends will usually cause the FTSE to move.

1. GBP

The FTSE includes the biggest blue chips in the UK. These companies tend not to be domestic facing, which gives the index a negative correlation with pound sterling.

Why does this happen? Because a weak pound helps exporting companies make more margin on their profits. If, say, you're selling to the US, then a weak GBP/USD rate will mean you make more pounds by selling your product for the same amount of dollars.

This effect saw the FTSE rally to new highs after the Brexit vote in 2016. The pound tumbled on the back of the result, which helped FTSE 100 companies grow their bottom lines.

2. Fundamental data

Institutional investors will often tweak their portfolios based on the latest economic releases.

Rising inflation, for instance, can be problematic for businesses. It can eat into profit margins and is often followed by rising interest rates, which discourage spending. So, when UK inflation is going up, investors might sell their British stocks and look to put their money elsewhere. This causes stocks to fall, and the FTSE to follow.

However, since the FTSE constituents are international facing (around 70% of their profits come from outside the UK), they are often move sensitive to global events and releases than domestic ones.

If you want a better gauge of the UK's domestic economy, you might want to consider the FTSE 250. With more UK-focused firms, it is commonly used instead of the FTSE 100 now.

3. Individual companies

The FTSE 100 is capitalisation weighted, which means companies with higher market caps will move its price more than smaller constituents.

Major moves from the likes of Unilever, Rio Tinto or GlaxoSmithKline will have a larger impact on the overall index than smaller cap firms like Burberry, Taylor Wimpey or Sainsbury's. Watch out for earnings releases from these global giants, and you can see how they play out across the wider index.

Average returns of the FTSE 100

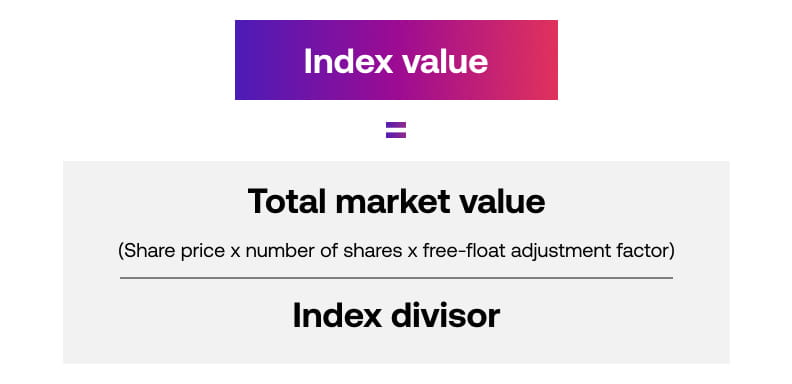

Over the last ten years, the FTSE 100 has had an average annual return of 5.4%. The FTSE 100's average returns are essentially what FTSE-tracking funds will have earned in profit for investors over the course of a year. Naturally, the returns of the FTSE will vary depending on whether dividends paid are reinvested or not.

You can see the yearly returns from 2011-2020 below.1 Remember, past returns are no guarantee of future performance.

FTSE 100 companies ranked by market capitalisation

Here are the FTSE 100 companies by market capitalisation as of May 2022.2

Rank |

Ticker |

Company name |

|---|---|---|

| 1 | SHEL | Shell Plc |

| 2 | AZN | Astrazeneca Plc |

| 3 | HSBA | Hsbc Hldgs Plc |

| 4 | ULVR | Unilever Plc |

| 5 | GSK | Glaxosmithkline Plc |

| 6 | DGE | Diageo Plc |

| 7 | BP. | Bp Plc |

| 8 | BATS | British American Tobacco Plc |

| 9 | RIO | Rio Tinto Plc |

| 10 | GLEN | Glencore Plc |

| 11 | RKT | Reckitt Benckiser Group Plc |

| 12 | AAL | Anglo American Plc |

| 13 | REL | Relx Plc |

| 14 | NG. | National Grid Plc |

| 15 | LSEG | London Stock Exchange Group Plc |

| 16 | VOD | Vodafone Group Plc |

| 17 | CPG | Compass Group Plc |

| 18 | LLOY | Lloyds Banking Group Plc |

| 19 | PRU | Prudential Plc |

| 20 | BARC | Barclays Plc |

| 21 | EXPN | Experian Plc |

| 22 | CRH | Crh Plc Ord |

| 23 | BA. | Bae Systems Plc |

| 24 | NWG | Natwest Group Plc |

| 25 | TSCO | Tesco Plc |

| 26 | SSE | Sse Plc |

| 27 | BT.A | Bt Group Plc |

| 28 | STAN | Standard Chartered Plc |

| 29 | AHT | Ashtead Group Plc |

| 30 | IMB | Imperial Brands Plc |

| 31 | AV. | Aviva Plc |

| 32 | FLTR | Flutter Entertainment Plc |

| 33 | LGEN | Legal & General Group Plc |

| 34 | ANTO | Antofagasta Plc |

| 35 | SGRO | Segro Plc |

| 36 | ABF | Associated British Foods Plc |

| 37 | III | 3I Group Plc |

| 38 | SMT | Scottish Mortgage Inv Tst Plc |

| 39 | SN. | Smith & Nephew Plc |

| 40 | WPP | Wpp Plc |

| 41 | BNZL | Bunzl Plc |

| 42 | CRDA | Croda International Plc |

| 43 | RTO | Rentokil Initial Plc |

| 44 | IHG | Intercontinental Hotels Group Plc |

| 45 | SKG | Smurfit Kappa Group Plc |

| 46 | HLMA | Halma Plc |

| 47 | NXT | Next Plc |

| 48 | SPX | Spirax-Sarco Engineering Plc |

| 49 | INF | Informa Plc |

| 50 | ITRK | Intertek Group Plc |

| 51 | SVT | Severn Trent Plc |

| 52 | MNDI | Mondi Plc |

| 53 | ENT | Entain Plc |

| 54 | UU. | United Utilities Group Plc |

| 55 | SGE | Sage Group Plc |

| 56 | RR. | Rolls-Royce Holdings Plc |

| 57 | ADM | Admiral Group Plc |

| 58 | PSN | Persimmon Plc |

| 59 | STJ | St.James'S Place Plc |

| 60 | SDR | Schroders Plc |

| 61 | AVV | Aveva Group Plc |

| 62 | IAG | Intl Consolidated Airlines Group Sa |

| 63 | BRBY | Burberry Group Plc |

| 64 | JD. | Jd Sports Fashion Plc |

| 65 | MGGT | Meggitt Plc |

| 66 | DCC | Dcc Plc |

| 67 | PHNX | Phoenix Group Holdings Plc |

| 68 | CCH | Coca-Cola Hbc Ag |

| 69 | OCDO | Ocado Group Plc |

| 70 | FRES | Fresnillo Plc |

| 71 | PSON | Pearson Plc |

| 72 | SMIN | Smiths Group Plc |

| 73 | MNG | M&G Plc |

| 74 | SBRY | Sainsbury(J) Plc |

| 75 | LAND | Land Securities Group Plc |

| 76 | WTB | Whitbread Plc |

| 77 | AUTO | Auto Trader Group Plc |

| 78 | AVST | Avast Plc |

| 79 | PSH | Pershing Square Holdings Ltd |

| 80 | AAF | Airtel Africa Plc |

| 81 | KGF | Kingfisher Plc |

| 82 | MRO | Melrose Industries Plc |

| 83 | BDEV | Barratt Developments Plc |

| 84 | EDV | Endeavour Mining Plc |

| 85 | RMV | Rightmove Plc |

| 86 | BME | B&M European Value Retail S.A. |

| 87 | BLND | British Land Co Plc |

| 88 | TW. | Taylor Wimpey Plc |

| 89 | BKG | Berkeley Group Holdings (The) Plc |

| 90 | SMDS | Smith (Ds) Plc |

| 91 | RS1 | Rs Group Plc |

| 92 | HL. | Hargreaves Lansdown |

| 93 | ABDN | Abrdn Plc |

| 94 | ICP | Intermediate Capital Group Plc |

| 95 | HWDN | Howden Joinery Group Plc |

| 96 | HIK | Hikma Pharmaceuticals Plc |

| 97 | DPH | Dechra Pharmaceuticals Plc |

| 98 | RMG | Royal Mail |

| 99 | ITV | Itv Plc |

| 100 | FERG | Ferguson Plc |

1 FTSE Russell, 2021

2 London Stock Exchange, 2021