Asian Indices:

- Australia's ASX 200 index fell by -115.9 points (-1.53%) and currently trades at 7,476.90

- Japan's Nikkei 225 index has fallen by -474.8 points (-1.72%) and currently trades at 27,078.26

- Hong Kong's Hang Seng index has fallen by -43.97 points (-0.21%) and currently trades at 20,638.25

- China's A50 Index has risen by 110.24 points (0.82%) and currently trades at 13,507.86

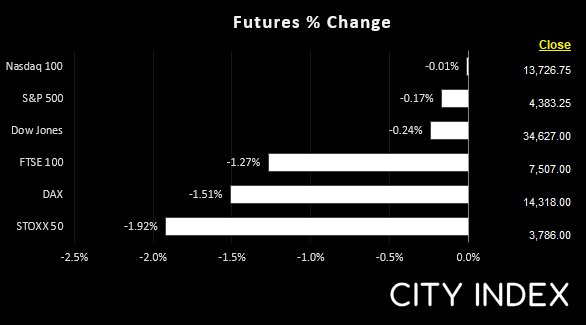

UK and Europe:

- UK's FTSE 100 futures are currently down -95.5 points (-1.26%), the cash market is currently estimated to open at 7,532.45

- Euro STOXX 50 futures are currently down -71 points (-1.84%), the cash market is currently estimated to open at 3,857.03

- Germany's DAX futures are currently down -212 points (-1.46%), the cash market is currently estimated to open at 14,290.41

US Futures:

- DJI futures are currently down -65 points (-0.19%)

- S&P 500 futures are currently up 1.5 points (0.01%)

- Nasdaq 100 futures are currently down -5.5 points (-0.13%)

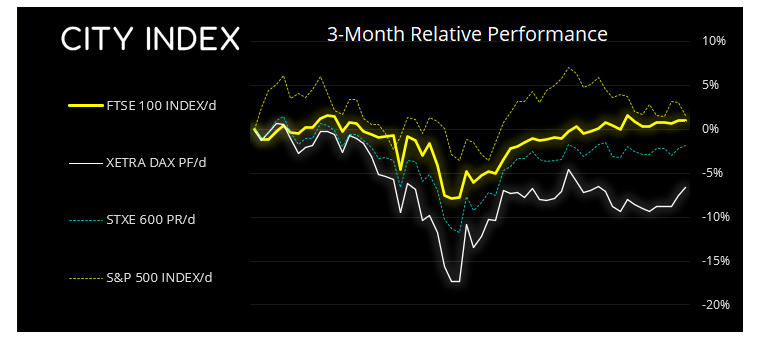

Asian equity markets tracked Wall Street lower after Jerome Powell effectively confirmed that the Fed will hike by 50-bps at their next meeting. The Nikkei led the declines and fell around -0.7%, although China’s equity markets bucked the trend with the China A50 rising around 0.5%.

The DAX reached our 14,600 target yesterday before pulling back to around 14,500. As mentioned in yesterday’s report we suspect an important corrective low formed at 13,887 on April the 12th which assumes an eventual break above 15,000. Yet yesterday’s high wick is an early indication that bullish momentum may be waning, although that still leaves opportunities for intraday bulls on the index until we see a more compelling sign of a market top.

FTSE: Market Internals

FTSE 350: 4270.31 (-0.02%) 21 April 2022

- 231 (65.81%) stocks advanced and 108 (30.77%) declined

- 33.05% of stocks closed above their 200-day average

- 52.42% of stocks closed above their 50-day average

- 15.1% of stocks closed above their 20-day average

Japan’s inflation is unlikely to ‘de-dove’ the BOJ

Consumer prices in Japan rose 0.8% y/y March, which are their fastest pace in over two years. However, when fresh food and energy are stripped out they fell -0.7%. This is unlikely to prompt the BOJ to turn even vaguely hawkish at next week’s BOJ meeting. Besides, the more interesting thing to be tracking right now in regards to the BOJ is whether they’ll be forced to revise (or cancel) their yield curve control with rates on the verge of bursting through their upper band of 0.25%. If they do, it allows them to take back control of their currency again.

Commodity FX under pressure

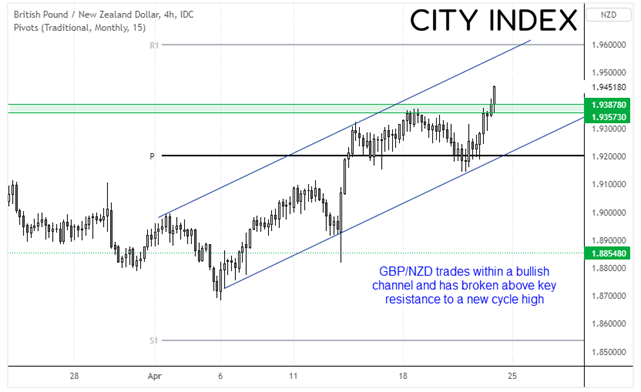

AUD and NZD were the weakest majors overnight as investors reacted to yesterday’s hawkish comments from the Fed and ECB. AUD/USD tested trend support from the January 2022 low and NZD/USD fell to a 2-month low.

And that’s worked out quite well for GBP/NZD which has broken above a key resistance zone overnight. We can see that the four-hour chart trades within a bullish channel and prices have also broken to a new cycle high. From here we’re targeting the monthly R1 pivot, although the upper trendline may also provide resistance along the way.

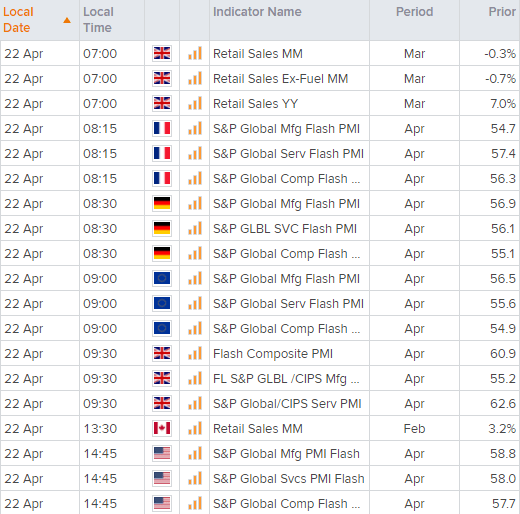

Up Next (Times in GMT)