The RBA held their cash rate at 4.35% as widely expected at their last meeting, and removed their slightly hawkish bias from the statement. This initially led to a weakening of the Australian dollar on renewed bets that the RBA may cut sooner than later, yet the Fed surprised by maintaining three 25bp cuts this year in their dot plot, which sent the US dollar broadly lower and AUD/USD above 66c.

Australian employment figures for February were also strong, and simply do not allow any wriggle room for the RBA to cut in my opinion. Unemployment fell back to 3.7% (4% prior), 116.5k jobs were added (78.2k of which were full-time jobs).

And whilst the Fed surprised by continuing to favour three cuts, I just do not see how the RBA can justify a lower cash rate with such strong employment figures. I said it at the time, and I’ll say it again; a 4.35% cash rate is likely to stay for some time. And by that, I mean most of the year.

- AUD/USD recouped all of the prior week’s losses and closed firmly above 66c

- AUD/JPY rose to a 9-year high above 99

- A potential basing pattern is forming on AUD/USD weekly chart

- AUD/NZD rose to a 16-week high and has 1.09 within easy reach

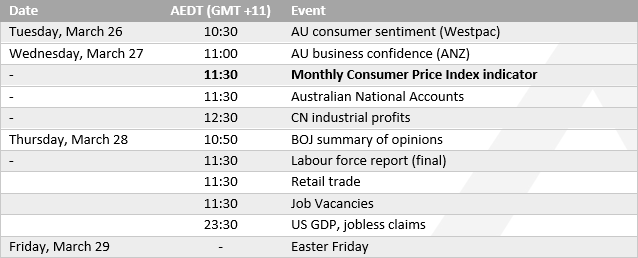

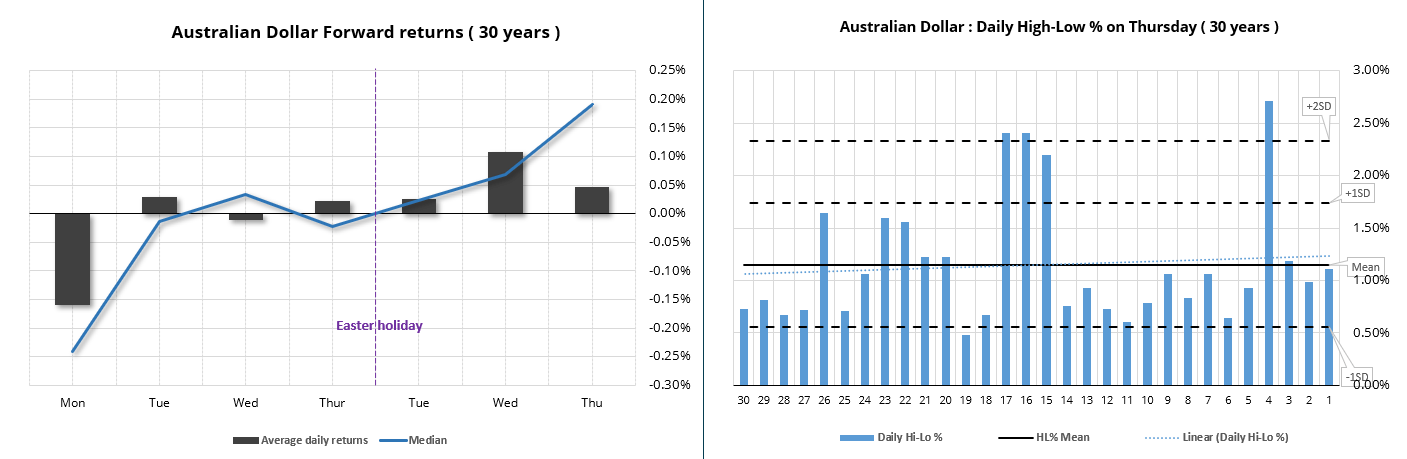

AU inflation is the biggest domestic event for a small week:

There’s not a huge amount of top-tier data this week, which will also be cut short to four days due to the long Easter weekend. Of course, the standout event domestically is the monthly CPI report. The RBA still deem inflation as “too high” so softer figures will be welcomed, but we really need to see falling inflation alongside a notably weaker jobs market before we can get too excited about RBA cuts, I my opinion.

The fact is that inflation remains above the RBA’s 2-3% target, and the rate that is slows is also declining. If it is too high now, what if it ticks higher like we saw in the US? It is certainly not impossible. And that would surely further support the Australian dollar.

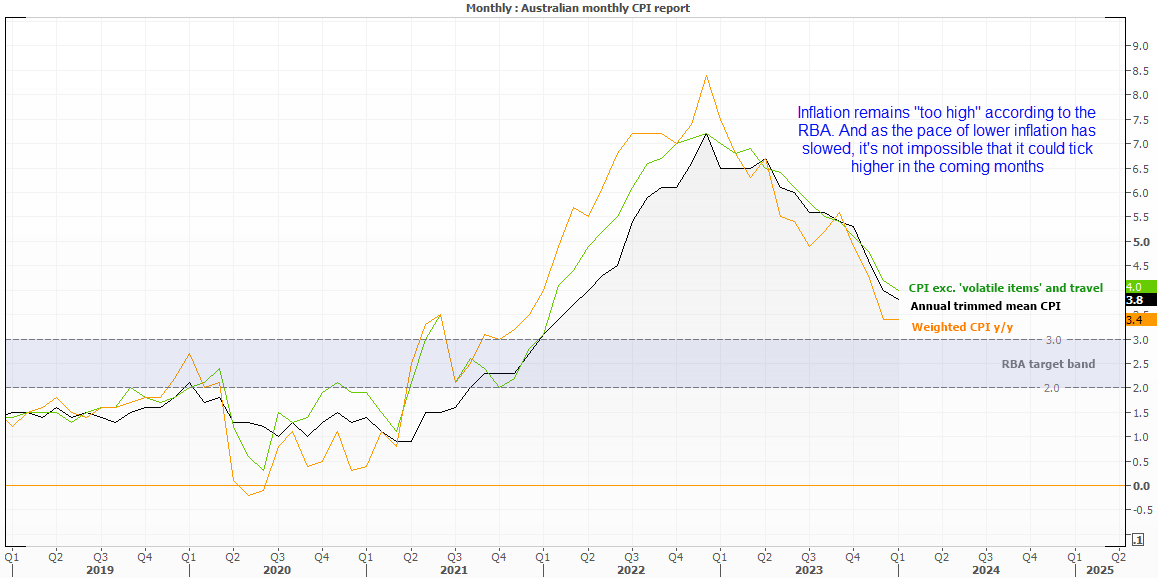

AUD/USD forward returns around Easter:

Due to the shorter trading week, let’s take a look at how AUD/USD has performed around Easter over the past 30 years.

- The Monday before Easter has generated the strongest negative returns, with an average of -0.16% and median of -0.24%

- Returns between Tuesday and Thursday ahead of Easter appear to be negligible (random)

- The Wednesday following Easter has averaged the strongest returns of 0.11%, whereas the strongest median returns are on the following Thursday at 0.19%

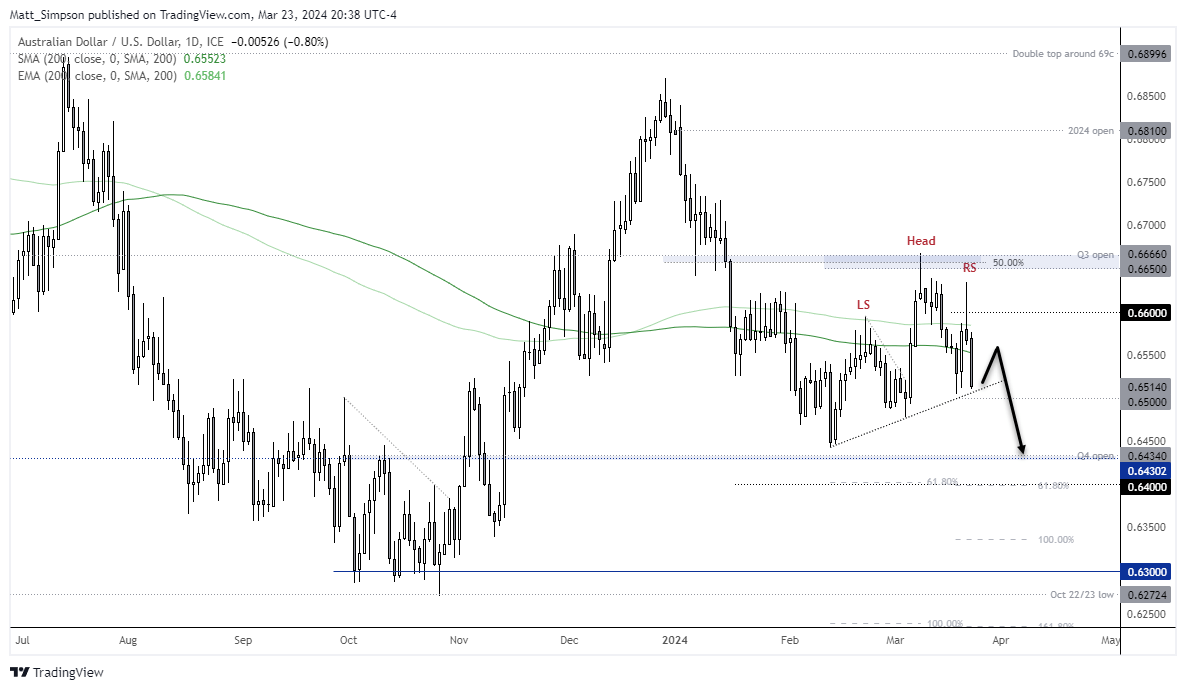

AUD/USD technical analysis

A head and shoulders patterns is forming on the AUD/USD daily chart, which if successful projects a bearish target just below 0.6350. The ‘right shoulder’ (RS) was a shooting star candle which failed to close above the 200-day EMA, and the following day’s trade saw a clear break of the 200-day MA. Prices closed above the ‘neckline’ of the H&S pattern, and I suspect a reasonable chance of it holding above the neckline – at least at the beginning of the week – due to a quiet economic calendar.

But as I doubt the Fed’s ability to cut three times this year as the dot plot suggests, I am open guard for a break lower towards 64c, even though further the downside for AUD/USD could be limited due to its ability to hold up over the past year despite extremely negative sentiment. Ultimately, the wheels likely need to fall off of the global economy to see AUD/USD fall substantially from current levels. And for now, that seems to be an outlier scenario.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade