Market Summary:

I noted in Friday’s Week Ahead report that, for whatever reason, January 15th had averaged the strongest daily returns for the US dollar index alongside the high win rate of 78.9%. So, it is interesting to see that the US dollar index did indeed turn higher yesterday and was nearly the strongest major (a close second place behind the euro).

The US dollar index remains within its tight range flagged in Friday’s report, although now in the top half of that range. Traders remain heavily net-short the US dollar on bets on multiple rate cuts, so a key event for traders to watch is FOMC member Waller’s speech titled “Economic Outlook” at 11:00 EST on Tuesday (16:00 GMT, 03:00 AETD). Ultimately, traders will want to see Waller’s outlook align with their pricing of multiple rate cuts, as failure to do so could end up supporting the US dollar due to short-covering and weigh on appetite for risk.

Trading volumes are expected to pick up in the European and US session with US traders returning to their desks after a 3-day weekend.

Australian inflation rose 1% in December according to the Melbourne Institute’s CPI gauge, up from 0.3% the month prior. It doesn’t generally carry the same weigh as official CPI data as it is considered to be less reliable, but it is something to take in mind ahead of employment data on Thursday and the quarterly CPI report on January 31.

Events in focus (AEDT):

- 10:30 – Australian consumer sentiment (Westpac)

- 10:50 – Japan’s producer price index

- 11:30 – Australian building permits, private housing approvals

- 18:00 – German CPI

- 18:00 – UK employment, average earnings, claiming count

- 20:00 – ZEW economic sentiment for Germany and Eurozone, consumer CPI expectations

- 12:30 – Canadian inflation report

- 02:00 – BOE governor Bailey speaks

- 03:00 – Fed Waller speech: Economic Outlook

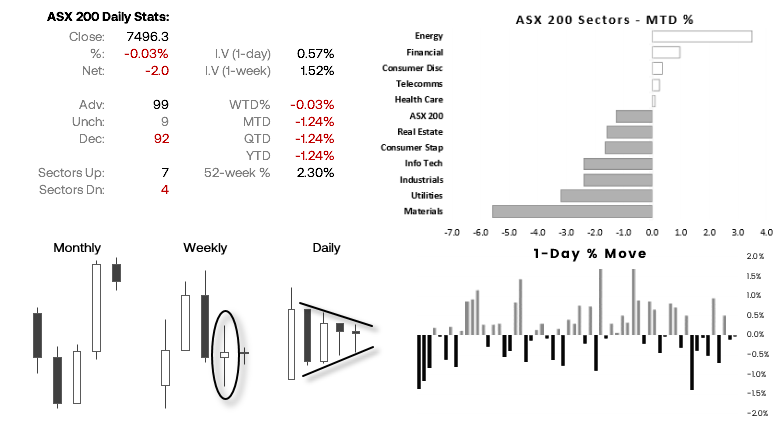

ASX 200 at a glance:

- The ASX 200 is coiling up on the daily chart and formed an indecision candle last week to show overall indecision (and low volatility)

- This could suggest volatility is to return, but as for when it remains to be seen

- But given we’re trading within a tight range near the 2023 highs, bulls may want to question how much more upside potential there is – as a sustained bullish breakout likely requires a dovish Fed and RBA

- Energy and financial stocks are the strongest ASX sectors this year so far, with materials and utilities lagging

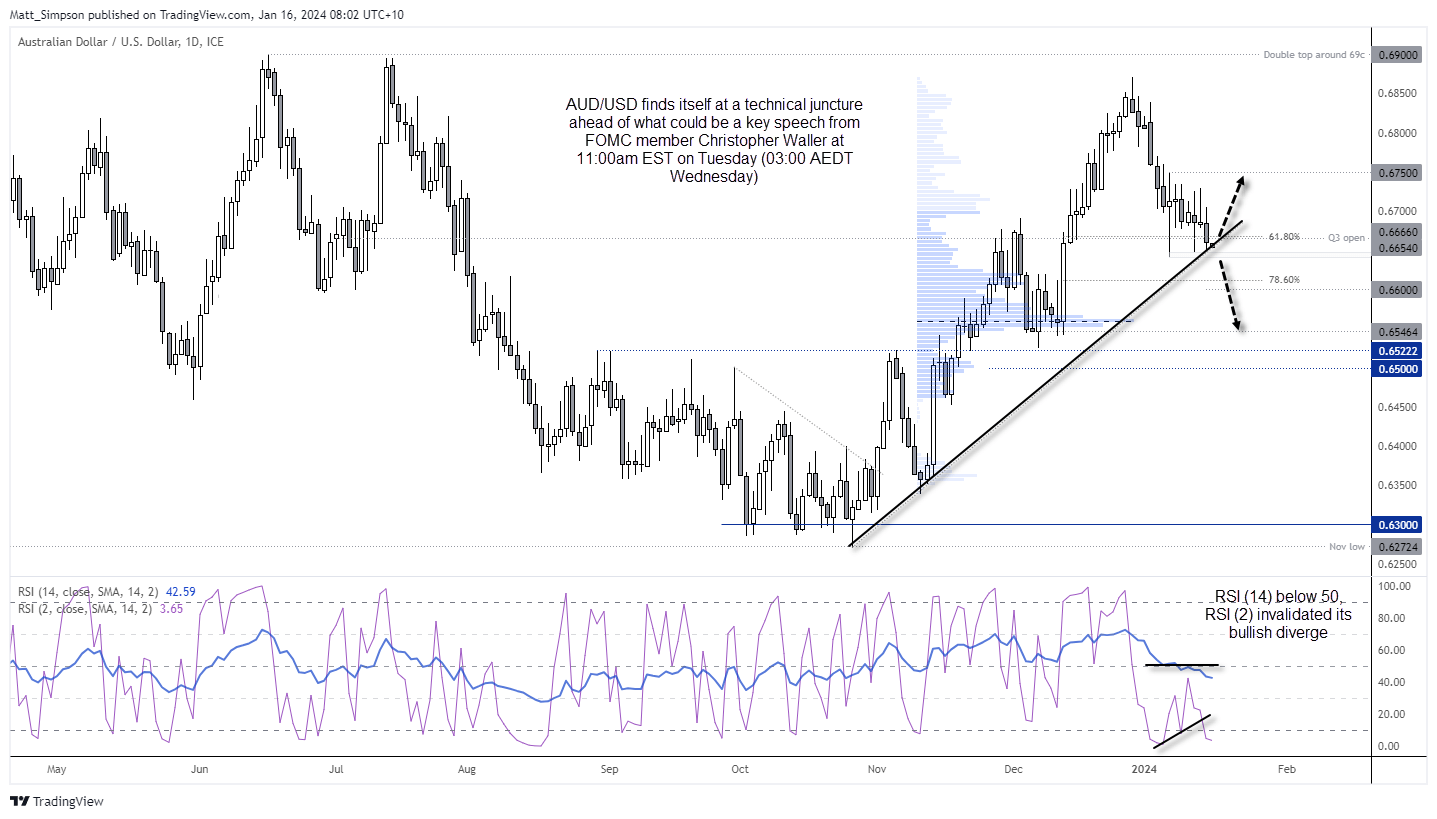

AUD/USD technical analysis (daily chart):

Last week I highlighted a potential long swing trade opportunity for AUD/USD, and whilst it remains valid with prices holding above th0.6640 low – it is trading a bit too close for comfort for my liking. Besides, we may have a binary outcome from Fed Waller’s speech which could just as easily see it break to new lows as it could rally higher form current levels.

AUD/USD has closed beneath the Q3 open for the first time since December 13th, which has dragged the RSI (2) back into oversold and invalidated its small bullish divergence. Should Waller deliver a hawkish speech it could weigh on risk and send AUD/USD towards 0.66 initially, a break beneath which beings the volume cluster around 0.6546 onto focus.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade