AUD/USD Key Points

- Traders are increasing bets on RBA rate cuts after a softer-than-expected inflation report in today’s Asian session.

- Copper has shown a close correlation with AUD/USD of late, and the metal’s big drop off it’s holiday highs could hint at more weakness to come in AUD/USD.

- A break below 0.6675 in AUD/USD could set the stage for it to “catch down” to Copper prices and fall toward 0.6600 or 0.6520 next.

AUD/USD Fundamental Analysis

Overnight, Australia released its November CPI report, showing that prices rose by 4.3% over the prior year, a tick below the 4.4% reading expected. Matching the disinflationary trend across the globe, Australia’s inflation has been cut nearly in half from a peak of 8.4% in December 2022 to the current 4.3% reading. According to RBA forecasts, inflation extend its drop toward 3.3% by the end of the year.

Not surprisingly, traders increased their bets on RBA rate cuts in the wake of the report, with the market now favoring an interest rate cut in the first half of the year and two 25bps reductions fully discounted this year. Interest rate differentials are generally the most important factor to watch when trading the forex market, but in the case of AUD/USD, traders should also keep a close eye on the price of industrial metal broadly and copper in particular. According to the AusIMM, the mining industry accounts for “…75% of the country’s exports, contributes significantly to Australia’s workforce and is a leading influence on Australia’s standard of living, rising incomes and flourishing economy”, so its not surprising that metals prices are closely correlated with the currency’s value.

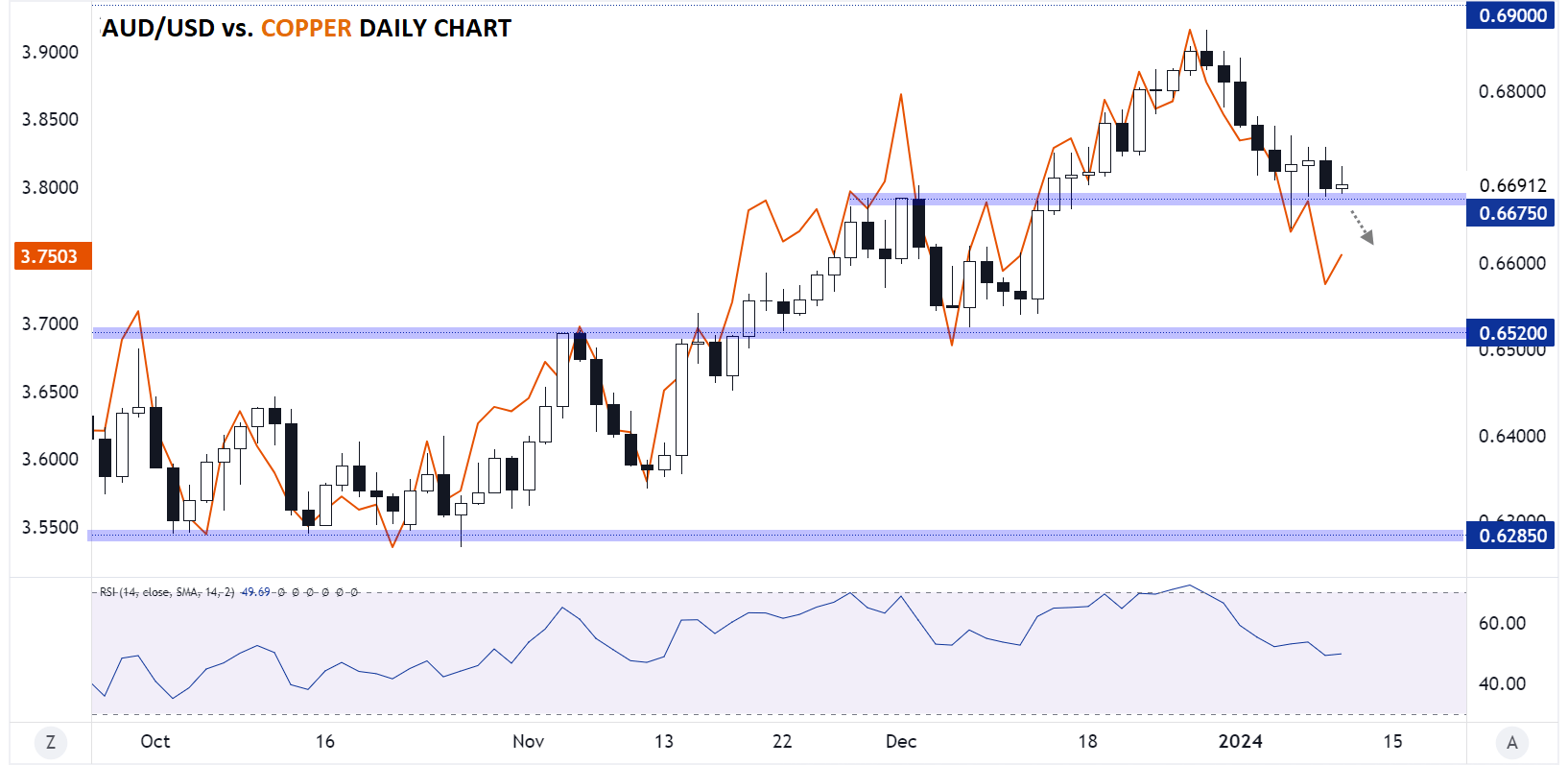

Australian Dollar Technical Analysis – AUD/USD Daily Chart

Source: TradingView, StoneX

The chart above shows the close relationship between the price of Copper and AUD/USD. After bottoming near $3.55/lb in early Q4, Copper rallied as high as 3.90 by the end of the year, pulling AUD/USD up 600 pips in the process.

As we flip the calendars to 2024, Copper appears to have lost its momentum, retracing nearly half of its Q4 rally back toward $3.75. Meanwhile, AUD/USD has seen a more limited 200 pip drop, hinting at the potential for more downside in AUD/USD if Copper remains weak. From a purely technical perspective, AUD/USD is holding previous-resistance-turned-support at 0.6675 so far, but a break below that support level could set the stage for Aussie to “catch down” to Copper prices and fall toward 0.6600 or previous support at 0.6520 next.

Make no mistake, there are plenty of other factors beyond the price of copper that influence AUD/USD, but given the close correlation of late, it’s worth keeping a wary eye on the metal if you’re trading AUD/USD.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX