The US dollar rose for a sixth consecutive day as Fed chair Jerome Powell hinted that inflation was not slowing fast enough. Describing the economy as “quite strong”, Powell said that inflation data showed a “lack of further progress” and that the Fed could retain the current rates for as long as needed “if higher inflation persists”.

US yields continued to climb for a second day across the curve, with the 10-year closing above 4.6% for the first time this year and the 2-year within a couple of basis points below 5%.

Sentiment remained fragile which saw European indices extend their losses and Wall Street trade slightly lower. This meant AUD/USD was the weakest forex major as it was caught within the mild risk off session, falling for a third day and touching 64c for the first time since mid November.

BOC governor Macklem said that inflation was moving in the right direction after another set of softer CPI figures on Tuesday. This further fed hopes of the BOC to begin easing first with a June rate cut, as Macklem said a couple of weeks ago that such as move was “possible”. Core CPI landed right on the BOC’s 2% target, median CPI slowed to 2.8% y/y and trimmed mean was 3.1%. I suspect that should trimmed mean CPI fall within the BOC’s 1-3% target band at next month’s inflation report, a rate cut in June could be al but confirmed.

UK wage data was mixed on Tuesday, with warnings excluding bonus ‘slowing’ to 6% to 6.1%, and earnings with bonus rising 5.6% compared with 5.5% forecast and 5.6% prior. Job claims were also lower than expected at 10.9k versus 17.2k forecast. These figures aren’t exactly deflationary, which helped GBP/USD withstand most of the US dollar strength and hold above 1.24. All eyes will now be on UK data released later today.

Economic events (times in AEST)

- 08:45 – New Zealand quarterly CPI (could decide the timing of any RBNZ cut)

- 09:00 – Japan’s monthly Tankan survey (Reuters)

- 09:50 – Japan’s trade balance

- 16:00 – UK CPI (key report for BOE policy)

- 19:00 – Euro area CPI

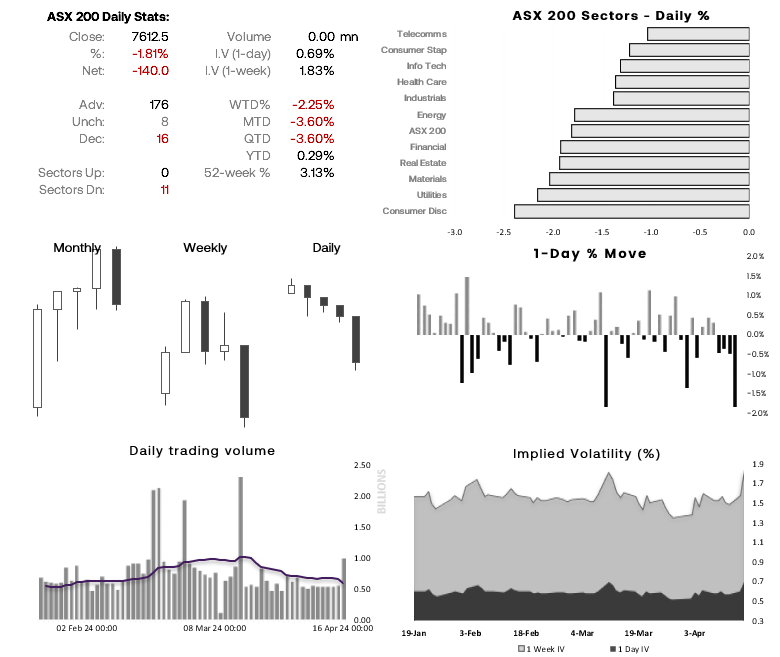

ASX 200 at a glance:

- At -1.8%, the ASX 200 cash index suffered its second worst day of the year

- Daily trading volumes were the highest in a month, to show conviction in the bearish day

- All 11 sectors were lower, led by consumer discretionary and utilities

- 176 ASX200 stocks declined (88%), 16 advanced (8%), 4 were unchanged

- 1-week implied volatility

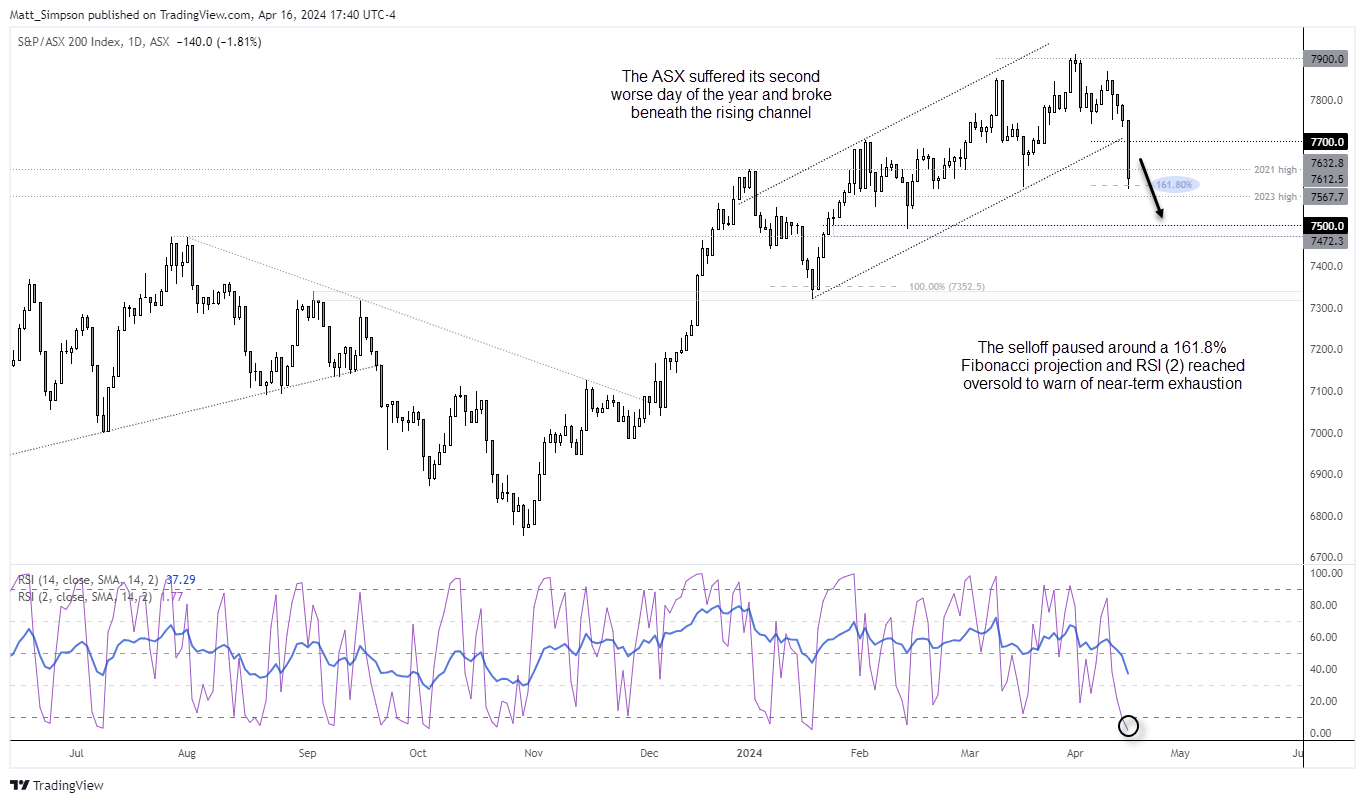

ASX 200 technical analysis:

The ASX 200 saw a clear break of the daily channel and the 7700 handle, during its second worst day of the year. A move to 7500 at a minimum could now be on the cards, although channel breaks can also lead prices back to the base which would be around 7300 in this instance if successful. However, Tuesday’s low stalled around a 161.8% Fibonacci projection and RSI (2) reached oversold on the daily chart to warn of overextension to the downside. Bears could seek to fade into minor rallies if sentiment remains sour, but if we’re treated to a turn in sentiment then bears could seek evidence of a swing high closer to 7700, in anticipation of a swing lower to at least 7500.

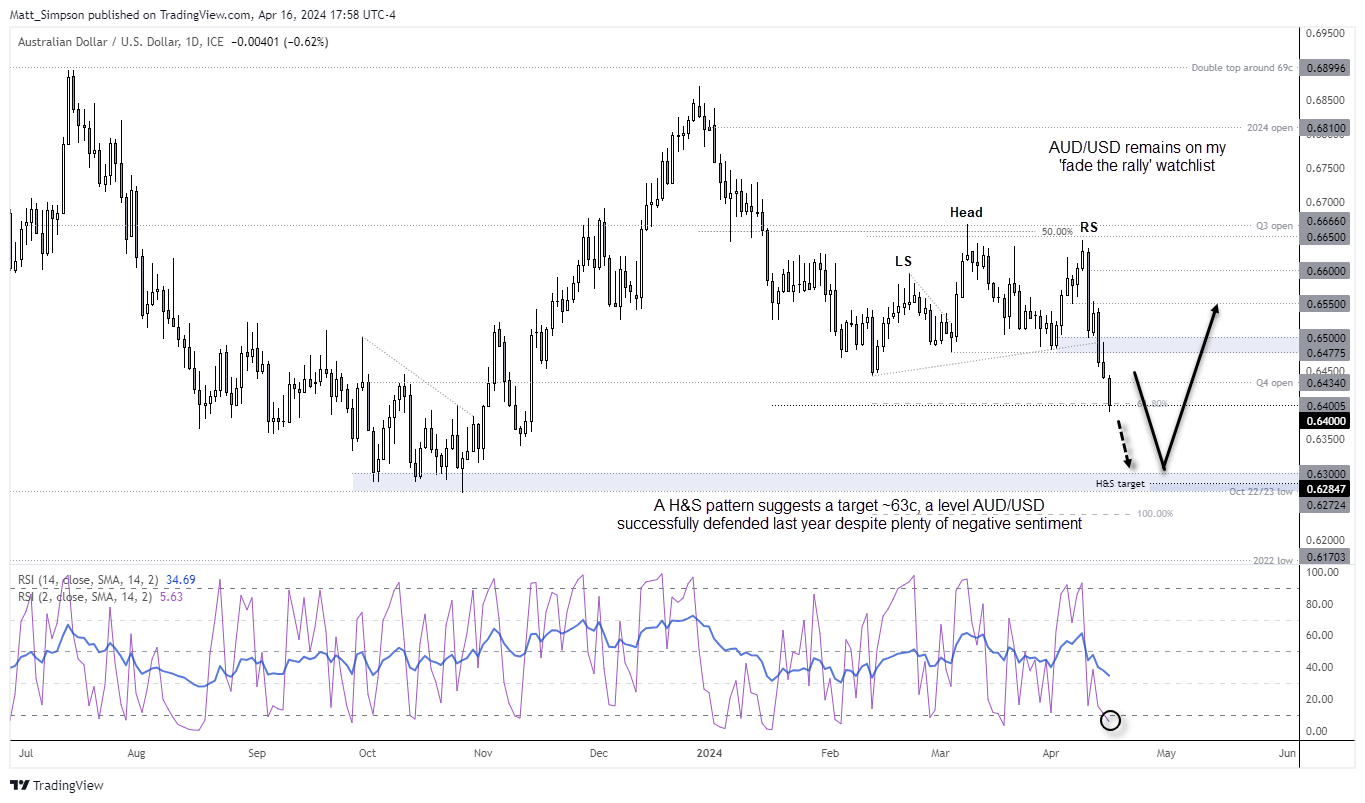

AUD/USD technical analysis:

AUD/USD fell to 64c on Tuesday to take the Aussie to a 5-month low. The fall from 0.6650 has come in a relatively straight line, although support was found around 64c which is also near a 61.8% Fibonacci projection. Interestingly, we may also have a head and shoulder pattern playing out which projects a downside target just below 63c.

I saw in the 2024 outlook that I doubt we’ll see AUD/USD fall below 63c unless the wheels fall off the global or domestic economy. I’ll remain optimistic and assume that to be the case for now, given AUD/USD successfully held 63c last year despite a slew of negative sentiment and a relatively dovish RBA.

For now, AUD/USD remains on my ‘sell the rally’ watchlist, however minor it may be. Traders may also want to keep an eye on how global indices perform alongside AUD/USD to better asses sentiment. As AUD/USD is moving in lockstep step with them for now.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade