- AUD/USD analysis: RBA set to hike rates again

- Weaker NFP and ISM PMI point to peak Fed interest rates

- AUD/USD technical analysis: Bullish outside weekly candle

The AUD/USD is our featured currency pair of the week, in what will be a quieter week for economic data compared to the previous week. Still, it could be a busy one for the Aussie given that we have a rate decision from the RBA as well as economic data from China and the US to look forward to.

AUD/USD analysis: RBA and UoM survey among key data highlights

Even before last week’s dollar sell-off, the likes of the Aussie dollar had managed to hold their own better compared to some other major FX pairs. The Aussie outperformed last week in part because of the positive risk tone with global indices rebounding sharply. On top of this, expectations over a further rate hike from the RBA, at the time when the Fed has stopped its hiking, made the AUD/USD attractive from a relative yields perspective.

The Reserve Bank of Australia’s rate decision is on Tuesday at 03:30 GMT. It is widely expected that the RBA may opt for a 25-basis point rate hike after pausing in October. Although inflation in Australia has been falling, in line with the global trend, it remains significantly above the RBA’s target. In fact, CPI accelerated surprisingly sharply to 5.3% y/y in September from 5.2% in the previous month, increasing the probability of a rate increase.

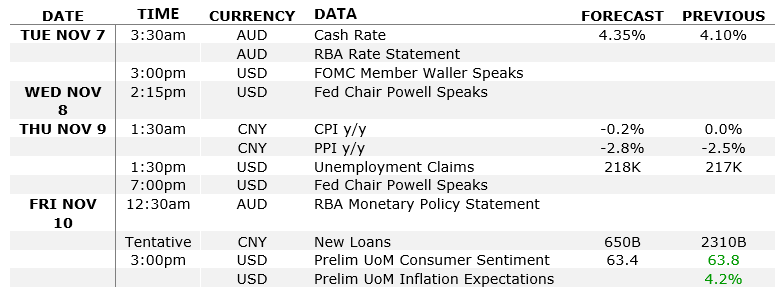

Here are the key data releases to watch this week relevant to the AUD/USD pair:

The developments in risk sentiment and other bearish external factors such as China’s struggling economy, might hold the AUD back until the US data strength fades further. We have a couple of economic pointers from China to look forward to as well this week. But ff the focus moves further away from the “higher-for-longer” US rates narrative, then this could boost the appeal of the Aussie even more compared to currencies where economic data has been poor. But the key question remains…

Has the dollar peaked?

Friday’s publication of a weaker US jobs report and ISM PMI data further cemented expectations that the Fed has reach peaked interest rates. Bond yields and the dollar sold off while indices and gold pushed higher. The headline non-farm payrolls report was weaker compared to expectations, printing 150K and there were downward revisions to the prior month’s reading, underscoring the view that jobs growth is weakening as the impact of the Fed’s tightening works through the economy.

Following last week’s data dump, the week ahead is going to be quieter for US data until Friday when the UoM’s survey is released, although it remains to be seen how much of an impact this will have on the greenback. Other US data highlights this week include the weekly jobs report on Thursday and Powell’s speech on Wednesday. So, if the dollar were to move sharply this week, this will be more likely because of external factors and spill over from last week, than anything new US-related. So far, we have seen modest further losses for the greenback due to momentum selling.

Investors are wondering whether the trend of US data has now decidedly turned. The resilience of the US economy and the potential for inflation to remain high for longer is what drove the dollar to new highs for much of 2023. But in recent weeks have seen some signs of weakness in data. If the weakness turns into a trend, then we may well have seen the peak of the dollar. The NFP and ISM PMI data certainly pointed in that direction last week. The trouble is, though, that it is not just the US where economic data has deteriorated. The rest of the world, most notably China and the Eurozone, have been in an even prolonged period of soft data patch. In the land of the blind, the one-eyed man is king. So, the dollar may yet rebound because of a relatively better performance in data.

Meanwhile, it is possible that the dollar may find support from a possible bearish reversal in the stock markets, say because of weak company earnings or if the situation in the Middle East deteriorates to the point other oil-producing nations get militarily involved in the conflict. So, geopolitics remain a key risk factor to watch.

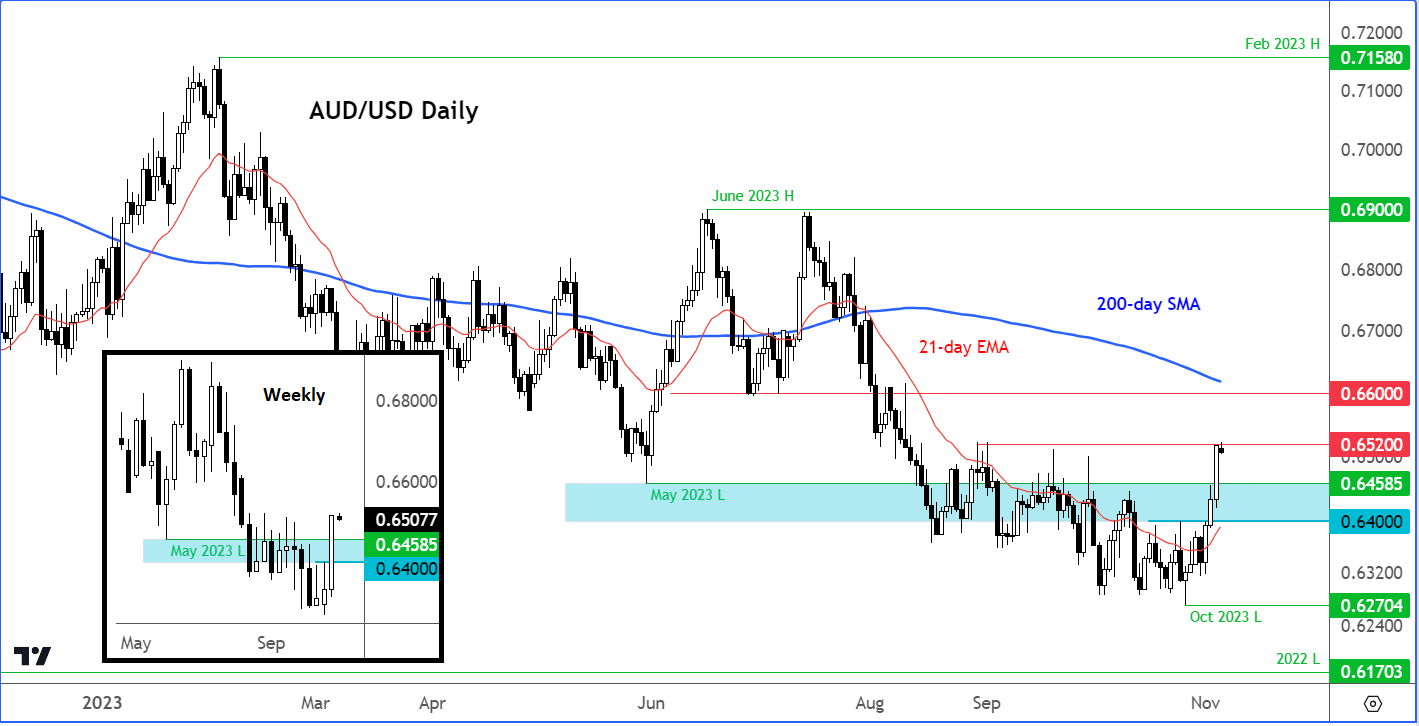

AUD/USD technical analysis

Source: TradingView.com

Following last week’s breakout when the Aussie created an outside weekly candle (see inset on the chart), the onus will be on the bulls now to defend broken resistance levels like 0.6459 (the low from May) and 0.6400 (the high from the previous week). The area between 0.6400 to 0.6459 is therefore the most important support zone to watch, in my view. For as long as the bulls hold their ground here, the short-term path of least resistance would be to the upside.

In terms of potential resistance levels to watch, the 0.6520 level has already been tested but not yet conclusively broken. So, this will be our first key level to watch on the upside. Thereafter we have 0.6600, which was a significant support-turned-resistance level in the past. This level also happens to come in just ahead of the 200-day average.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade