This has made crude oil ideal for range-trading, although I do see the potential for at least a run above the January highs and for it to tag $80.

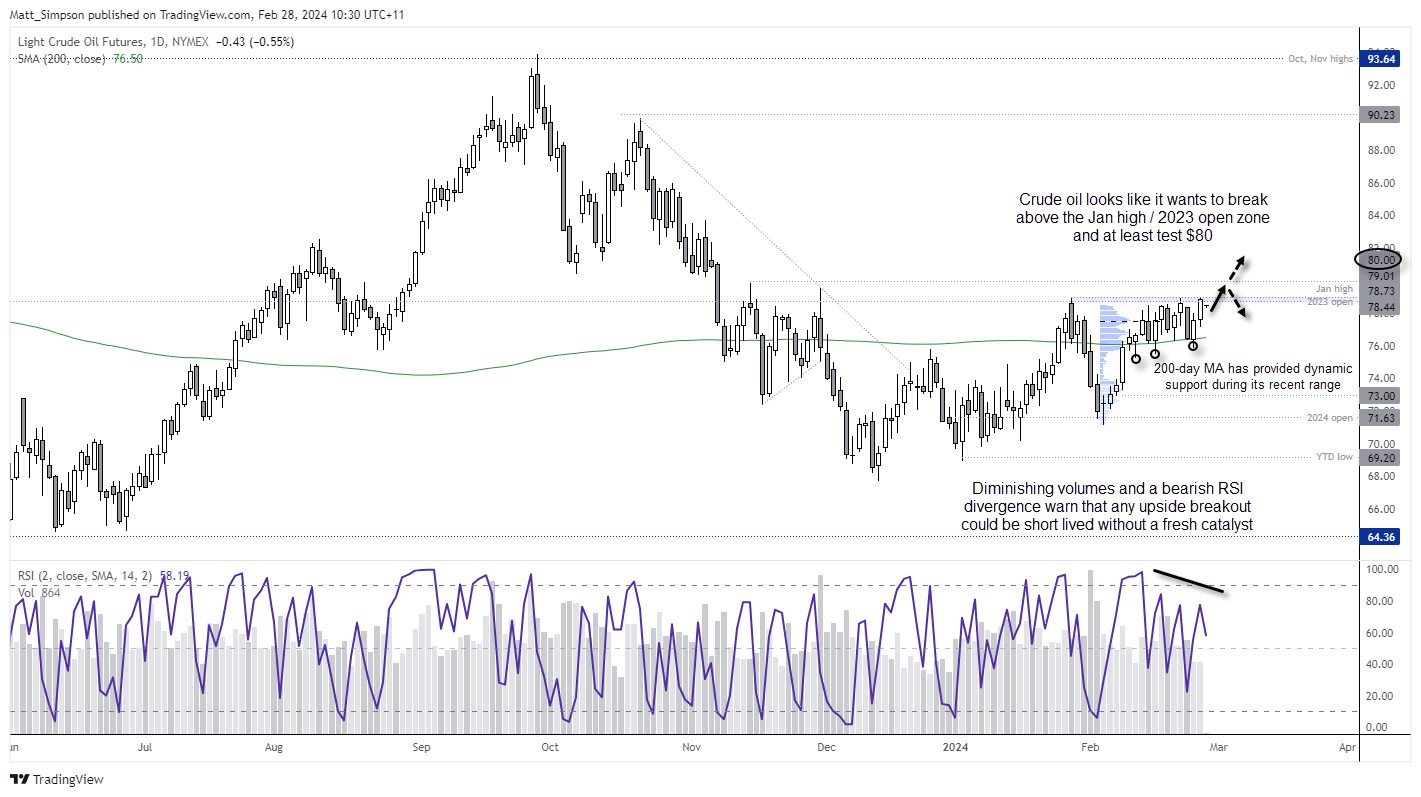

WTI crude oil technical analysis (Daily chart):

Price action does appear to be placing the Jan high / 2023 open zone under pressure for a potential breakout.

- WTI crude has just posted its two best days over the past 11, heading into resistance

- The 200-day average has provided dynamic support multiple times during the past two weeks

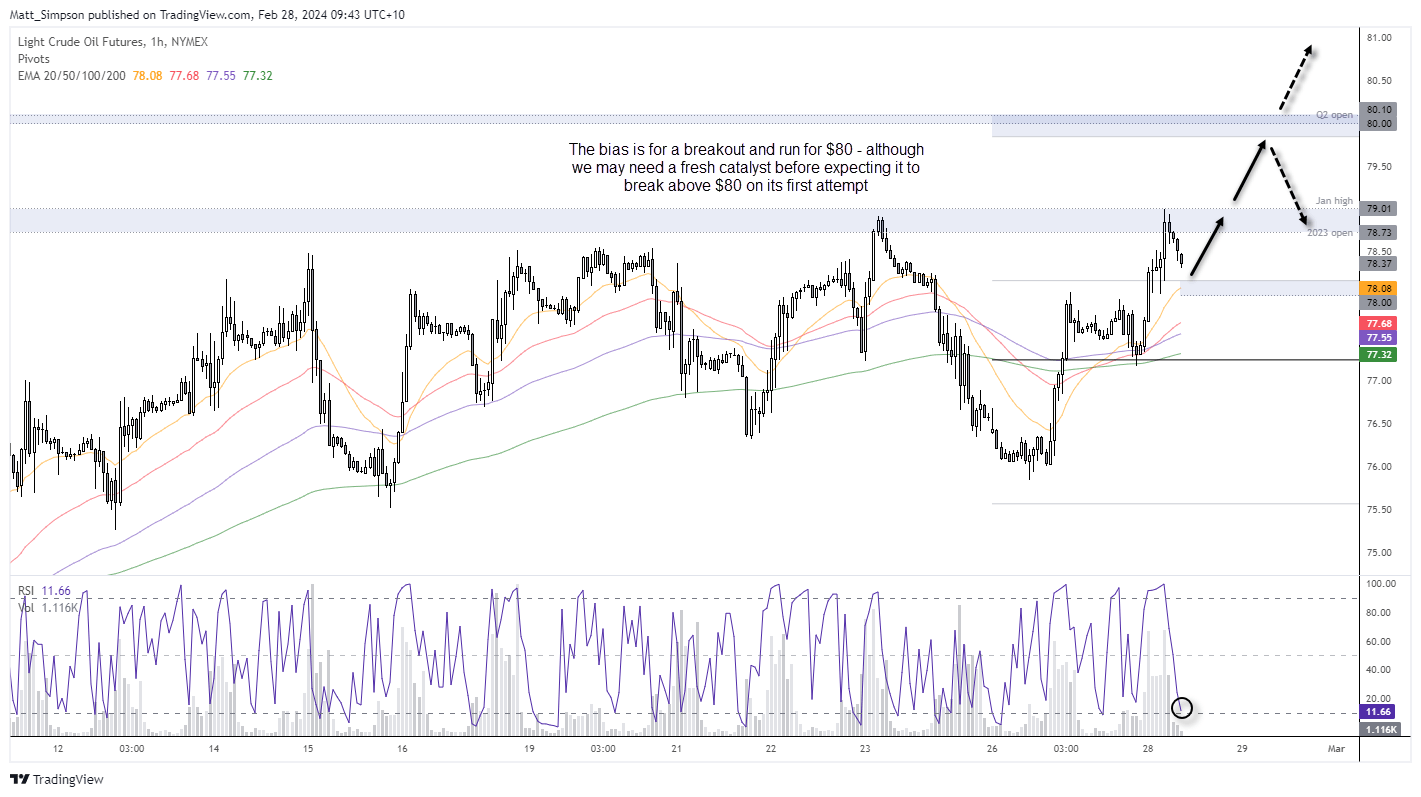

- Bullish momentum on the 1-hour timeframe appears to be strong heading into the highs

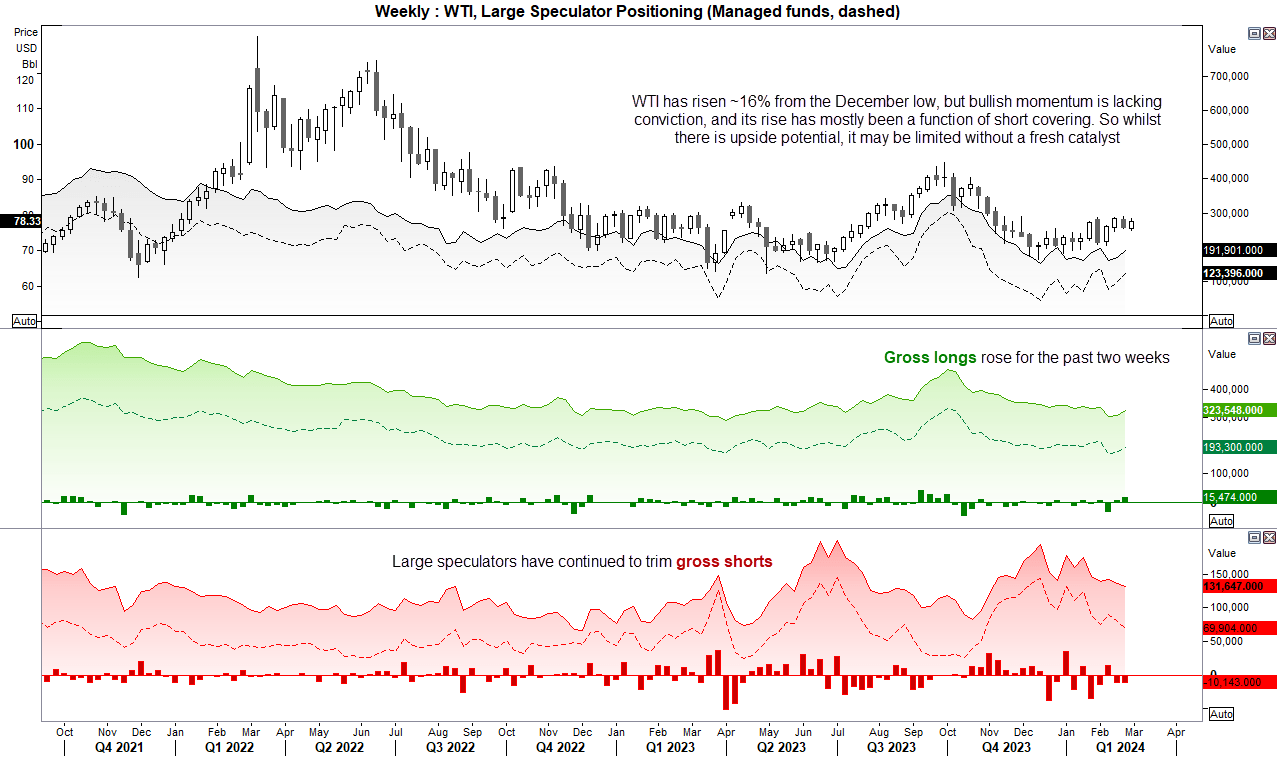

- Large speculators and managed funds have continued to trim shorts and recently increased longs

However, also take note that daily trading volumes are falling and a bearish RSI (2) divergence if forming, so a breakout and move to $80 might even be a ‘last hurrah’ before price revert back to within the current range. Also note that the rise in recent weeks has mostly been a function of short covering.

WTI crude oil technical analysis and market positioning (weekly chart):

What makes me reserved regarding the potential for runaway gains is that the weekly chart is making hard work of developing a bullish trend. And without a fresh catalyst following a 16% rally from the December lows, perhaps it may struggle to make a break and hold above $80. But that doesn’t mean it can’t give it a good go with a shakeout around these cycle highs first.

WTI crude oil technical analysis (1-hour chart):

A strong rally has formed on the 1-hour chart for WTI crude oil. Prices tested the January high on Tuesday on headlines that OPEC+ were considering extending their oil output cut which prompted concerns of tighter supply.

Prices have since retreated from Tuesday’s high, so we’re looking for evidence of a swing low above the $78 handle / weekly R1 pivot point at $78.18. Bulls could seek dips around or above this potential support zone in anticipation of a break higher and target the resistance zone which includes the weekly R2 pivot, $80 handle and Q2 open.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade