The 20th National Congress of the Chinese Communist Party (Party Congress) kicked off in Beijing on Sunday. This week-long event is held every five years.

In front of around 2300 delegates, Xi Jinping, the party chief and China’s president, delivered a 110-minute work report, or a performance review, of last ten years (two terms), highlighting some areas such as social security & stability, economic development, geological tensions and Taiwan reunification.

And we will keep a close eye on the following agenda in the next few days.

Xi remains in power

Xi is widely expected to secure his third term as party General Secretary, paving the way toward the most powerful party leader in China since Mao Zedong. In fact, China’s parliament, back in 2018, has removed term limits for president in its constitution, which allowed Xi to remain in power for longer.

Something unknown is whether Xi be awarded any new titles not seen in decades since Mao These titles would further cement Xi’s position and grant him much greater control of the party.

Next generation of party leadership

The party congress will reveal the new leadership at the end of this week, which is made up of Central Committee (200+ members), Politburo (25) and Politburo Standing Committee (7-9). As you can tell from the diminishing number, the standing committee is the top decision-making body in China.

The political analysts around the world will be keen to see how many new faces will emerged into the top leadership and, more importantly, who could be Xi’s successor (if any). The age distribution of the Standing Committee will provide us some clues.

Zero-Covid policy

Chinese citizens who have been expecting less Covid restrictions might be disappointed as Xi reiterated zero-Covid policy on the party congress.

While most part of the world has returned to normal from pandemic, China vowed to continue to stick to its mass quarantines, stringent border control and lockdowns in order to save lives. According to the latest data from State of Council, the total number of covid death in China is around 5226, 1/112 of the number in the US.

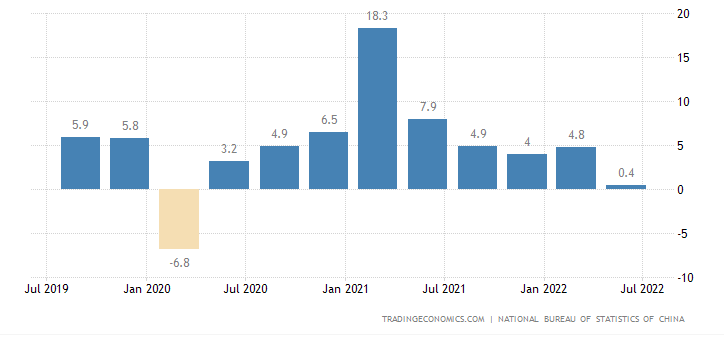

Economic growth

However, zero-Covid policy is not without a cost, especially during a time when geological tensions escalated.

The new leadership is not going to have any honeymoon time as the world’s second largest economy is slowing down. China is deeply troubled by its property sector as well as the intense competition with the US in almost every area. This week’s China Q3 GDP and September activity data will tell us more.

China GDP growth rate Source: tradingeconomics.com

Another challenge, perhaps the biggest one, is how to restore confidence. In other words, to find a balance between economic growth and zero-covid strategy. The stimulus measures can work only when people are willing or feel safe to spend on shopping, invest in capital markets and buy the property.

With that said, once the Covid-related restrictions are lifted or relaxed, one can expect economic recovery at a faster pace with the help of more easing monetary and fiscal policies. That will not happen overnight, at least not like the U-turn of UK tax cut proposal.

Market reaction

Chinese equity market enjoyed the rebound last week ahead of the congress meeting, with the benchmark Shanghai Composite index restoring 3000-point psychological level.

On our platform, clients are currently extremely bullish on China A50, despite the indices struggling at the lowest level since pandemic.

China A50 index 4-hour chart

Two bullish engulfing patterns can be observed on 4-hour chart with RSI showing small degree of divergence, which combined implied an upward risk in short term.

The potential rebound could fade out when it approaches 12,790 (38.2% retracement level of October selloff), 12,920 (14 Oct high and 50% retracement level) and 13,098 (200 MA).

The long-term downward trend is hard to be reversed as long as the zero-covid policy stays. Therefore, a re-visit of recent low of 12,352 won’t surprise the market.

How to trade with City Index

You can easily trade with City Index by using these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade