- USD/JPY analysis: US GDP, Core PCE and BoJ policy among risk events this week

- Focus turns to sticky inflation and elevated interest rates narrative

- USD/JPY technical analysis point above 155.00

The US dollar looked to extend its recent gains as it advanced against the likes of the pound, euro and yen, and fell against commodity dollars amid a mild rebound in equity markets first thing on Monday as the markets priced out some geopolitical risk from the Middle East. Over the next few days, data is also expected to reclaim its position as the primary market influencer, along with tech earnings. FX traders will look forward to the release of US GDP and core PCE figures in the second half of the week. A strong set of US data will likely prevent a softening of the dollar’s momentum. For the USD/JPY and other yen crosses, there also a Bank of Japan policy meeting to take into account on Friday. It remains to be seen whether Japanese authorities will take a firm stance regarding the USD/JPY exchange rate, particularly around the 155.0 mark. All this makes the USD/JPY the currency pair of the week.

USD/JPY analysis: Focus turns to sticky inflation and elevated interest rates narrative

FX traders have been readjusting their positions following a robust streak of US data. Investors are no longer expecting the Fed to consider June for the initial interest rate cut. If they were to reconsider June, incoming data in May will need to see a sharp downturn. Right now, traders are only attaching a 15% probability to a June cut, down significantly from around 70% a month ago. For July, they are attaching a 48% probability of a cut, and around 66% for September. This means that traders are now looking beyond the summer for the first rate cut.

This week’s upcoming data releases will only help to fine-tune these expectations. We have both US economic growth data and the Fed’s favoured gauge of inflation coming up. There’s also some insignificant array of Treasury auctions scheduled this week, which will serve as a significant gauge of investor appetite for bonds and whether yields have reached their maximum for the year.

Federal Reserve Chairman Jerome Powell cautioned last week that a robust US economy might justify keeping rates at their current levels for an extended period as necessary, emphasising that inflation had exhibited a lack of progress towards their objectives. If GDP comes in stronger than the 2.5% q/q annualised pace expected, then this will keep the dollar bears at bay on Wednesday. The other, potentially bigger, worry is sticky nature of inflation. If core PCE exceeds expectations, this will mean elevated interest rates are likely for longer in the US.

So, the dollar is likely to remain supported on the dips until at least the release of the above-mentioned data, which should apply further upward pressure on the likes of the USD/JPY and USD/CHF.

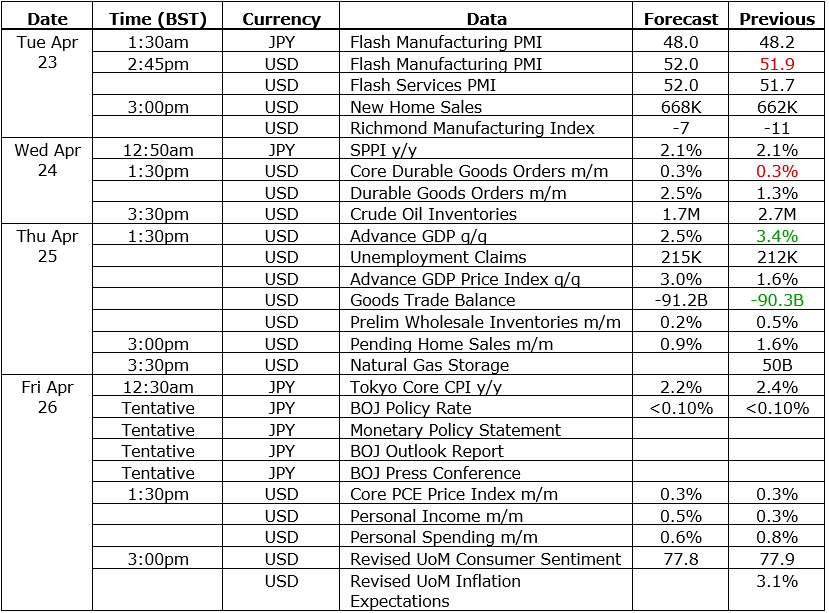

Here’s a list of the other important data releases to look forward to, specifically for the USD/JPY pair (containing data from both the US and Japan):

PCE inflation could determine short-term direction for US dollar

Core PCE is expected to print another strong 0.3% month-over-month reading on Friday. If so, this will likely mean elevated interest rates are going to stay with us for longer. The PCE data will have an influences on the Fed’s upcoming policy decisions. After a strong US CPI print, they will be looking – hoping, even – for a weaker print on the PCE measure of inflation. Otherwise, the US dollar could push further, especially considering that both interest rate expectation of other major economies, such as the ECB and the BOC, have recently taken a more favourable turn for the greenback. Additionally, the escalation of geopolitical risks in the Middle East has only added to the US dollar’s overall bullish tone.

Nevertheless, as markets gradually adjust their expectations from multiple Fed rate cuts to possibly only a couple or none for the rest of the year, it raises questions about the true influence of Friday’s PCE inflation data. The magnitude of market response to any data unveiling relies heavily on an element of surprise, whether positive or negative. However, given that PCE inflation data tends to exhibit less volatility compared to headline CPI figures and market sentiment leaning towards minimal rate adjustments, a bullish surprise might not wield as much impact as a downside surprise. A potential weaker reading could prompt those bullish on the dollar to find a convenient reason to exit their trades.

Yet, until the PCE data is unveiled, the bullish sentiment surrounding the dollar is unlikely to undergo significant changes, implying that the dollar is poised to remain well-supported for the next few days.

USD/JPY analysis: BoJ policy is another risk event this week

Meanwhile, the focus is also turning to the Bank of Japan’s policy decision on Friday. The Japanese government has repeatedly expressed concern regarding the ongoing devaluation of the yen, as traders persist in favoring higher-yielding foreign currencies over JPY despite the Bank of Japan's first rate hike in March, marking a 17-year gap. Despite the Policy Rate returning above zero for the first time in 8 years, it failed to impede the yen's depreciation. Traders sought a firmer commitment from the BoJ toward additional policy tightening. However, no further tightening is anticipated at this meeting, with investors indicating less than a 50% probability of a 10bp hike by July, as reported by Bloomberg. This issue necessitates attention from the BoJ; otherwise, the only remaining option to bolster the yen is through foreign exchange intervention, an action that is increasingly probable.

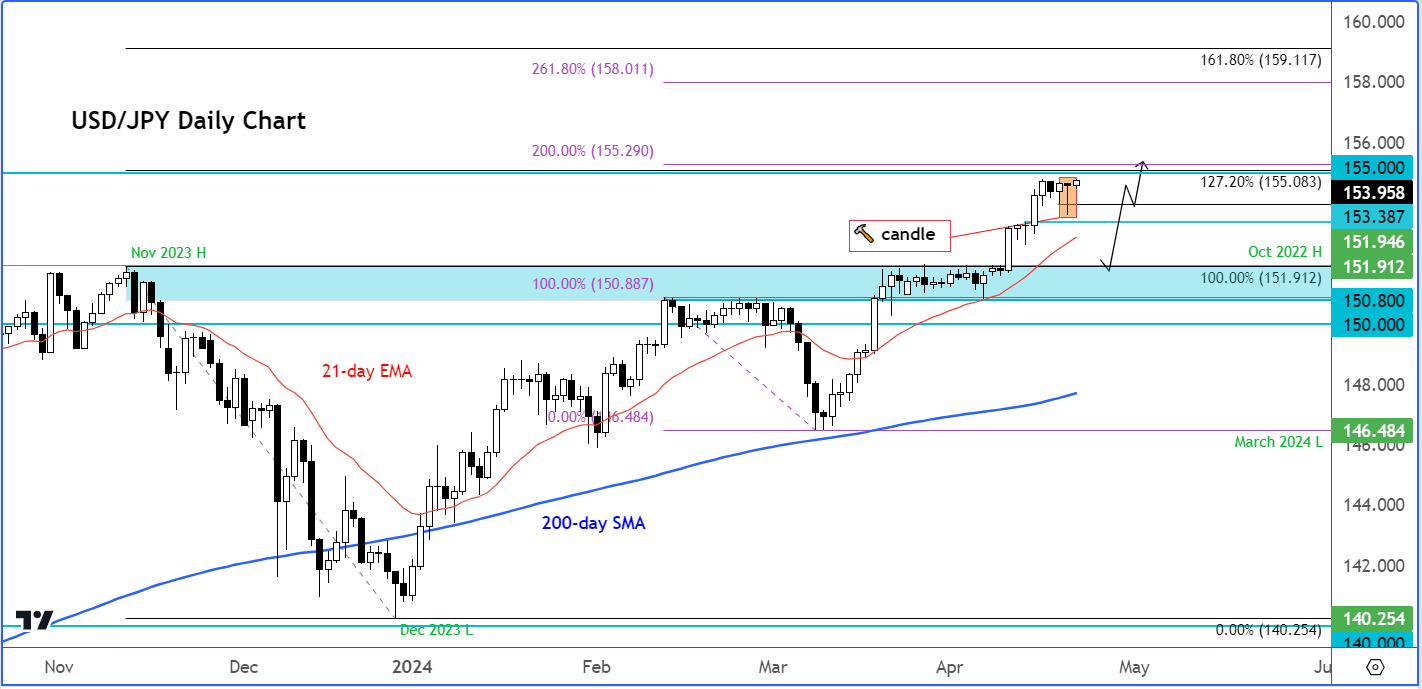

USD/JPY technical analysis point higher

Source: TradingView.com

The USD/JPY's rebound from its lows on Friday helped to create a hammer on the daily chart. If the UJ manages to now hold above the head of that hammer, around 154.67, it could indicate a possible continuation towards, and potentially beyond, the 155.00 mark, where intervention by the Japanese government may occur. Support levels are seen around 154.00, followed by around 153.35. Long-term support resides in the range of 151.90 to 152.00, a zone that previously served as significant resistance in October 2022 and November 2023, with lesser resistance observed in late March and early April of this year.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade