US futures

Dow futures -0.10% at 34078

S&P futures +0.7% at 4148

Nasdaq futures +1.6% at 12573

In Europe

FTSE +0.81% at 7826

Dax +1.63% at 15415

Learn more about trading indices

Is the rate hike cycle near its end?

US futures are broadly rising, extending gains from the previous session as investors continue digesting the Federal Reserve’s interest rate decision, as well as rate hikes from the BoE and ECB, as well as the latest round of corporate earnings.

The Fed hiked rates by 25 basis points as expected. However, a less hawkish than expected Fed Chair Jerome Powell helped the NASDAQ jump 2% in the previous session and point to a further 1.6% rise on the open today. A combination of upbeat numbers from tech giant Meta, combined with the Federal Reserve acknowledging that inflationary pressures are falling, is tonic to the market, particularly high-growth tech stocks.

Despite Jerome Powell saying that more work is to be done to rein in inflation, the market instead focused on the acknowledgment that progress had been made and on hopes that the central bank is nearing the end of its rate hiking cycle.

On the data front, US jobless claims were 183k, down from 186k in the previous week. The data highlights the resilience in the jobs market and comes ahead of tomorrow's nonfarm payroll report. Job creation is expected to slow slightly to 190k in January, and wage growth is expected to slow further to 0.3% YoY raising hopes that the Fed could engineer a soft landing.

Corporate news

Meta has jumped almost 20% pre-market, better than expected revenue guidance for lower costs and a $40 billion share buyback. Q4 revenue was 32.2 billion, a 4% fall from the year before but at the top end of guidance. Facebook also cut its 2023 expenses outlook by $5 billion and announced a further $40 billion for share buybacks.

Meta’s results come ahead of earnings from alphabet Amazon and Apple which are due after the close today.

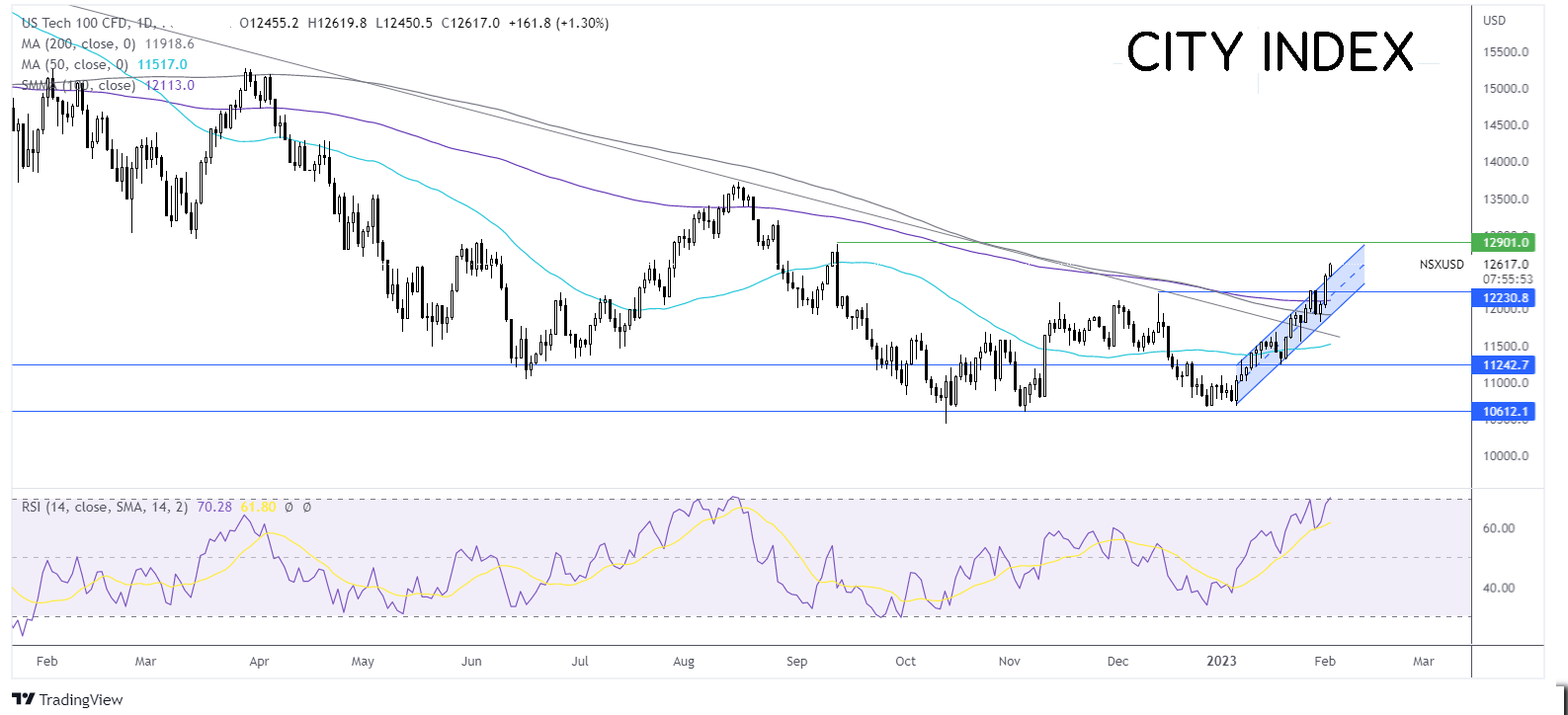

Where next for the Nasdaq?

The Nasdaq has broken out of a rising channel dating back to early January ands pushed over key resistance to trae above 12600. The RSI is on the brink of overbought territory so buyers should be prudent. Resistance can be seen at 12900 the September high. On the flipside, sellers could look for a move back into the rising channel with support seen at 12200, the December high.

FX markets – USD rises, GBP falls

The USD is edging higher after steep losses yesterday following the Fed’s rate decision. The stronger-than-expected jobless claims figures have helped the USD rise from a 9-month low ahead of the non-farm payroll data tomorrow.

GBP/USD is falling after the Bank of England raised interest rates by 50 basis points in line with expectations taking the lending rate to 4% after 10 straight rate hikes. The pound fell as the vote split, 7-2 showed that 1 more policymaker was in favour of keeping rates on hold than in December and secondly, the BoE lowered its inflation forecast to end 2023 at just below 4%, down significantly from 5% previously. Add into the equation the removal of the word forcefully relating to raising rates, and it appears that the central bank could be aiming for a 25 basis point hike in March.

EUR/USD is edging rower after the ECB raised interest rates by 50 basis points as expected taking the interest rate to 3% as policymakers continue to fight high inflation. The ECB hinted that there will be more rate hikes to come. The market expects the ECB’s terminal rate to be between 3-3.75%. The decision comes after the eurozone economy unexpectedly rose in Q4 and as inflation fell to 8.5% but core inflation proved to be sticky.

GBP/USD -0.45% at 1.2317

EUR/USD -0.1% at 1.0980

Oil extends losses

Oil prices are edging lower extending losses from the previous session as oil markets weigh up a weaker USD, rising inventories, and the latest OPEC+ meeting.

Oil prices dropped around 3% on Wednesday after data showed a large build in US inventories. Stockpiles rose by 4.1 million barrels last week, hitting the highest level in 20 months with a total crude build of 34.5 million barrels in just 6 months. The 4.1 million rise was well above the 0.376 million barrel increase forecast.

The fall in oil prices is being limited thanks to the weaker USD dollar and less hawkish than expected Federal Reserve, which raises the prospect of US economy avoiding a recession.

Finally, the OPEC+ meeting saw the Group of oil producers keep output levels unchanged, as expected, and so had little impact on the price.

WTI crude trades -0.43% at $76.20

Brent trades at -0.3% at $82.15

Learn more about trading oil here.

Looking ahead

N/A