US futures

Dow futures +2.35% at 33270

S&P futures +3.6% at 3868

Nasdaq futures +4.2% at 11252

In Europe

FTSE +0.9% at 7285

Dax +2.41% at 14000

Learn more about trading indices

Inflation & core inflation fall

US stocks are surging higher after inflation falls by more than expected and jobless claims rise by more than expected.

US CPI dropped to 7.7% YoY, down from 8.2% in September, as it continues to trend lower from August’s 9.1% peak.

Core inflation which strips out the more volatile items, such as food and fuel, fell to 6.3%, down from 6.6% in September.

The market is now pricing in a probability of the Fed hiking rates by 50 basis points in the meeting on December 14th by 80%, up from 52% prior to the data.

Looking at the labour market, jobless claims also rose by more than expected to 225k, up from 218k.

This is the data that the market has been waiting for: a strong sign that price pressures are falling and weakness could be seeping into the labour market.

Corporate news:

Rivian trades 8% higher pre-market after reporting a smaller-than-forecast loss and a larger-than-expected number of pre-orders whilst reiterating its full-year outlook.

Meanwhile, NIO, is falling pre-market after the Chinese EV maker reported a wider net-loss Q3 as input costs rose sharply, squeezing margins.

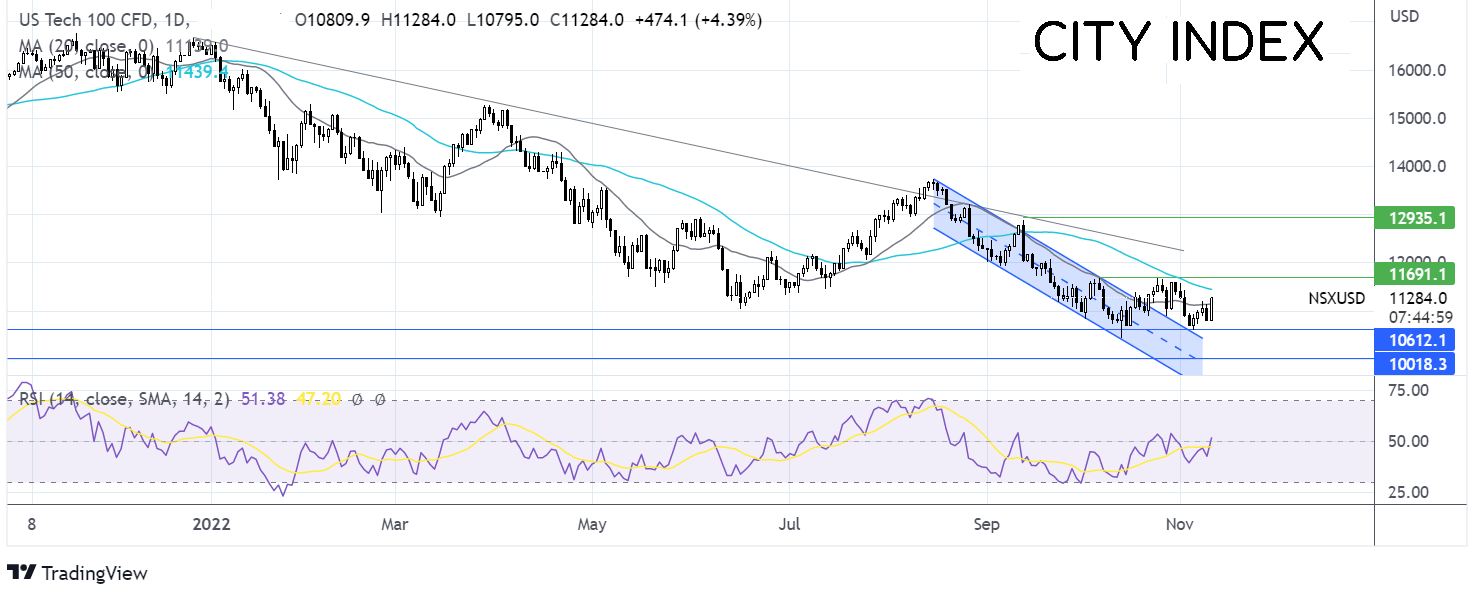

Where next for the Nasdaq?

The Nasdaq remains capped by the 20 sma, trading caught between the 20 sma at 11100 and 10640 on the lower band, the November low. The RSI is just below 50. Sellers could look for a breakout below support at 10600, the November low, ahead of 10430 the 2022 low. Should buyers push over the 20 sma, the 50 sma at 11540 comes into focus ahead of 11700 the October high.

FX markets – USD drops GBP surges

The USD is falling sharply as the market digests the cooler-than-forecast inflation, and re-prices expectations for a less aggressive Federal Reserve

EURUSD is surging on the back of the weaker USD. The price has surged back over parity as the ECB is expected to hike by 75 basis points in the next meeting.

GBPUSD is rising to rebound after steep losses yesterday; even so the outlook for the UK remains bleak. Data shows that the housing market is starting to show cracks and consumer confidence is on the floor. On a positive note, reports that the UK and Europe are close to a breakthrough in a long-running spat.

GBP/USD +2.1% at 1.16

EUR/USD +1% at 1.0115

Oil falls as China COVID fears rise

Oil prices are falling for a fourth straight day amid rising concerns over the COVID picture in China.

Mass testing in Guangzhou, the manufacturing hub, is making the market nervous. This is often the precursor for lockdowns in the country, which continues with its strict zero-COVID policy. Recent rumors that Beijing could be considering exiting the strategy have pretty much been put to bed now, which has been reflected in the falling oil price. This combined with the recent dollar revival, are keeping oil prices under pressure and could continue to do so.

WTI crude trades -0.7% at $84.60

Brent trades -0.5% at $91.6

Learn more about trading oil here.

Looking ahead

N/A