US futures

Dow futures +0.22% at 32226

S&P futures +0.45% at 4085

Nasdaq futures +0.4% at 12637

In Europe

FTSE +1.2% at 7450

Dax +1.2% at 13325

Euro Stoxx +1% at 3870

Learn more about trading indices

Inflation set to cool

US stocks are set for a stronger start building on gains from last week after investors brushed off hawkish comments from Fed Chair Powell and are instead focusing on what is expected to be a cooler inflation print tomorrow.

US inflation is set to be the key driver for the markets this week. CPI is expected to slip to 8% YoY, down from 8.5% in July and 9.1% in June. Another falling inflation print could suggest the start of a trend. While the Fed is still likely to hike rates by 75 basis points in September, it could adopt a less hawkish stance after. This optimism is being reflected in an increased demand for stocks, pushing the indices high and a falling USD.

The upbeat mood is being helped as well by advances by Ukraine in the war. Suddenly investors are opening their eyes to the possibility of a sooner end to the war.

Corporate news:

Apple rises as demand for the new Apple 14 appears to be strong ahead of it hitting, and the pricing will remain unchanged compared to iPhone 13. Demand is said to be slightly ahead of iPhone 13 and ahead of analysts’ expectations.

Disney is rising after activist investor Daniel Loeb gets behind the Disney board and backed off from his previous efforts to spin off ESPN.

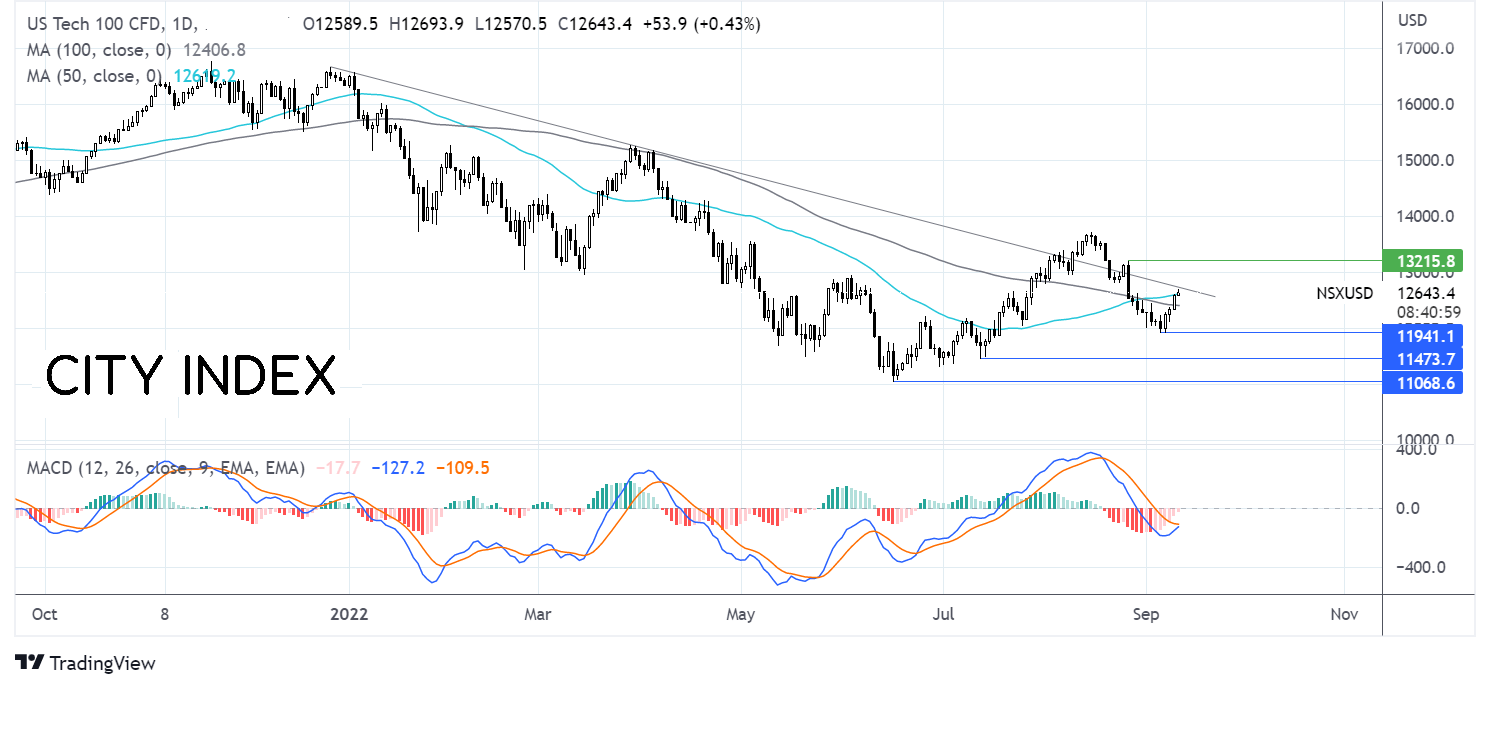

Where next for the Nasdaq?

The Nasdaq is extending the rebound from 12240, retaking the 50 & 100 sma, which along with the bullish crossover on the MACD, hints towards further gains. Buyers need to rise above 12700, the multi-month rising trend line to open the door to13215, the August 26 high. Meanwhile, sellers will be looking for a move below 12400 the 50 sma to open the door to 12000, the September low. A break below here creates a lower low.

FX markets – USD falls, EUR rises

The USD is falling, extending losses from the previous week. With attention now firmly on the US CPI data, hopes are rising that peak inflation has passed and that consumer prices will continue cooling.

EUR/USD is outperforming major peers, boosted by hawkish ECB expectations. The ECB hiked rates by 75 basis points last week and indicated that there were more hikes to come. The economic calendar is quiet today but inflation data from Germany and the eurozone will be in focus this week as well as ZEW German economic sentiment.

GBP/USD is rising as it capitalises on the weaker USD and despite disappointing GDP data. UK GDP rose just 0.3%, rebounding less than forecast after falling -0.6% MoM in June. The Women’s Euro Championship helped the economy, along with second-hand car sales. However, industrial output and construction contracted. There are still worries that the UK will enter into a recession later this year.

GBP/USD +0.9% at 1.1690

EUR/USD +0.95% at 1.0140

Oil edges higher

Oil prices are edging higher on Monday as supply concerns were in focus. Doubts are growing over Iran’s intentions to revive the nuclear 2015 nuclear deal. Several Europe countries have raised doubts over how serious Iran actually is to reviving the deal.

The European Union embargo on Russian oil is due to take effect in a few months’ time. As the date in December movers closer, concerns over tight supply could ramp up. The EU plans to cap Russian oil prices to limit Moscow’s revenue with which it is funding its war in Ukraine.

Meanwhile, keeping a cap on oil prices, China’s oil demand outlook continues to deteriorate as Beijing’s strict zero-COBID policy is expected to keep many from traveling during the holidays, reducing fuel consumption.

WTI crude trades +0.6% at $87.00

Brent trades +0.7% at $93.20

Learn more about trading oil here.

Looking ahead

N/A