US futures

Dow futures +0.90 at 32300

S&P futures +1.3% at 3906

Nasdaq futures +1.2% at 12063

In Europe

FTSE +0.6% at 7598

Dax +1.5% at 15214

Learn more about trading indices

Core inflation rises by more than expected on a monthly basis

US stocks are holding on to gains following the US inflation data and as investors continue to monitor the fallout of the SVB bank closely.

US inflation cooled as expected to 6% YoY, down from 6.4% in January. Meanwhile, core CPI cooled to 5.5% , down from 5.6% as expected. On a monthly basis core inflation came in at +0.5%, slightly hotter than the +0.4% forecast.

The market had been preparing itself for hotter-than-expected inflation, so the in-line numbers were met with a sigh of relief from the stock markets. Futures have held onto gains suggesting that the market is still looking at a 25 basis point hike from the Fed in the March meeting. This is down from the 50 basis point hike expected mid-last week.

Meanwhile, expectations of the Fed holding interest rates unchanged fell to 12%, down from 35% prior to the data. The market started to price in a pause by the Fed in the wake of the SVB collapse.

Shares in regional US banks have steadied in pre-market trading, after steep losses yesterday amid fears of contagion. Regional lenders are likely to remain in the spotlight after warnings about their credit rating could keep pressure on the sector.

For now, traders see yesterday’s selloff as overdone with regional banks such as First Republic Bank and Western Alliance Bancorporation.

Corporate news

For now, traders see yesterday’s selloff in regional banks as overdone with banks such as First Republic Bank and Western Alliance Bancorporation rising. Major banks such as Wells Fargo and Morgan Stanley were also rising.

Uber & Lyft rises pre-market after a California appeals court ruled that they can treat workers as independent contractors.

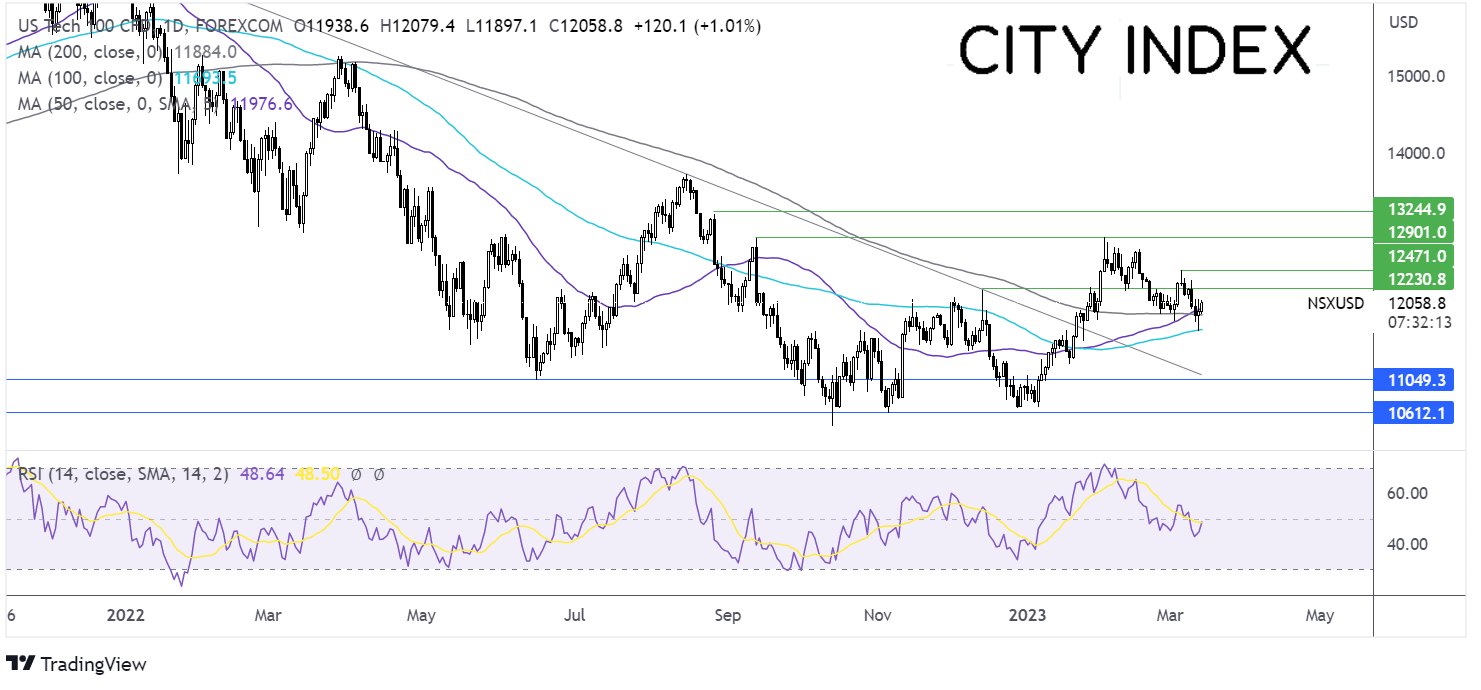

Where next for the Nasdaq?

The Nasdaq rebounds from the 50 sma, rising above the 50 & 200 sma. The 50 sma is crossing above the 200 sma in a bullish signal. Buyers will look for a rise above 12200 the December high ahead of 12900 the 2023 high. Sellers could look for a break below 200 sma at 11900, to open the door to 11690 the 100 sma. A break below here creates a lower low.

FX markets – USD rises GBP falls

The USD is rising after the inflation data, boosted by sticky inflation after core inflation rose, raising bets of a 25 bps hike, while reducing bets of the Fed leaving the hiking cycle on hold.

EUR/USD is falling in a quiet day for the euro, with little in the way of economic data investors are focused on US inflation data and Thursday’s ECB meeting, where the central bank is expected to raise interest rates by 50 bps.

GBP/USD is falling after UK labour market data showed that the unemployment rate held steady at 3.7%. Average pay rose growth slowed to 6.5%, which along with falling vacancies and the fallout from SVB could prompt the BoE to pause rate hikes next week.

EUR/USD -0.17% at 1.0640

GBP/USD -0.16% at 1.2053

Oil extends the sell-off

Oil prices continue to fall extending yesterday's sell-off as the collapse of Silicon Valley Bank fueled fears of a fresh financial crisis. The sell-off in regional US banks yesterday hit risk sentiment with investors selling out of riskier assets such as oil. While the sell-off in equities has paused, oil remains under pressure.

On the supply side, the API is expected to release inventory data later today U S crude inventories are expected to have risen by around 60,000 barrels last week.

Looking further ahead, the OPEC monthly oil report is also due to be released later today, with the IEA report due on Wednesday.

WTI crude trades -1.5% at $73.10

Brent trades at -1.2% at $78,80

Learn more about trading oil here.

Looking ahead

15:00 US inflation expectations