US futures

Dow futures -0.04% at 29220

S&P futures -0.05% at 37415

Nasdaq futures -0.1% at 11470

In Europe

FTSE -0.61% at 6926

Dax -0.4% at 12250

Learn more about trading indices

Fed speakers in focus

US stocks are set to open lower on Tuesday after the Nasdaq recorded its lowest closing level since September 23020 yesterday. The futures have picked up off session lows, but investors remain cautious. Recession fears rise and ahead of Thursday’s inflation report and the start of earnings season on Friday.

Recession fears are rising in the US, with the Conference board forecasting a 96% chance of a recession in the US over the coming 12 months, most likely in Q4 of 2022 and Q1 of 2023. JP Morgan’s CEO Jaimie Dimon forecast that the US economy will fall into recession in the coming 6-9 months.

Yesterday Federal Reserve vice chair Lael Brainard yesterday reiterated the Fed’s commitment to raising interest rates and fighting inflation. However, she also acknowledged the risks the Fed faces.

Today there is no high impacting US economic data. Instead, there are plenty of Fed speakers which could provide further insight into the Fed’s next moves.

According to the CME Fed watch tool, the market is pricing in an 81% probability of a 75 basis point hike in November.

Corporate news:

Meta is set to open 1.6% lower, its weakest level since January 2019 ahead of the Meta Connect event.

Tesla trades lower pre-market at a 3-month low after Morgan Stanley cut delivery forecasts after the Q3 delivery miss.

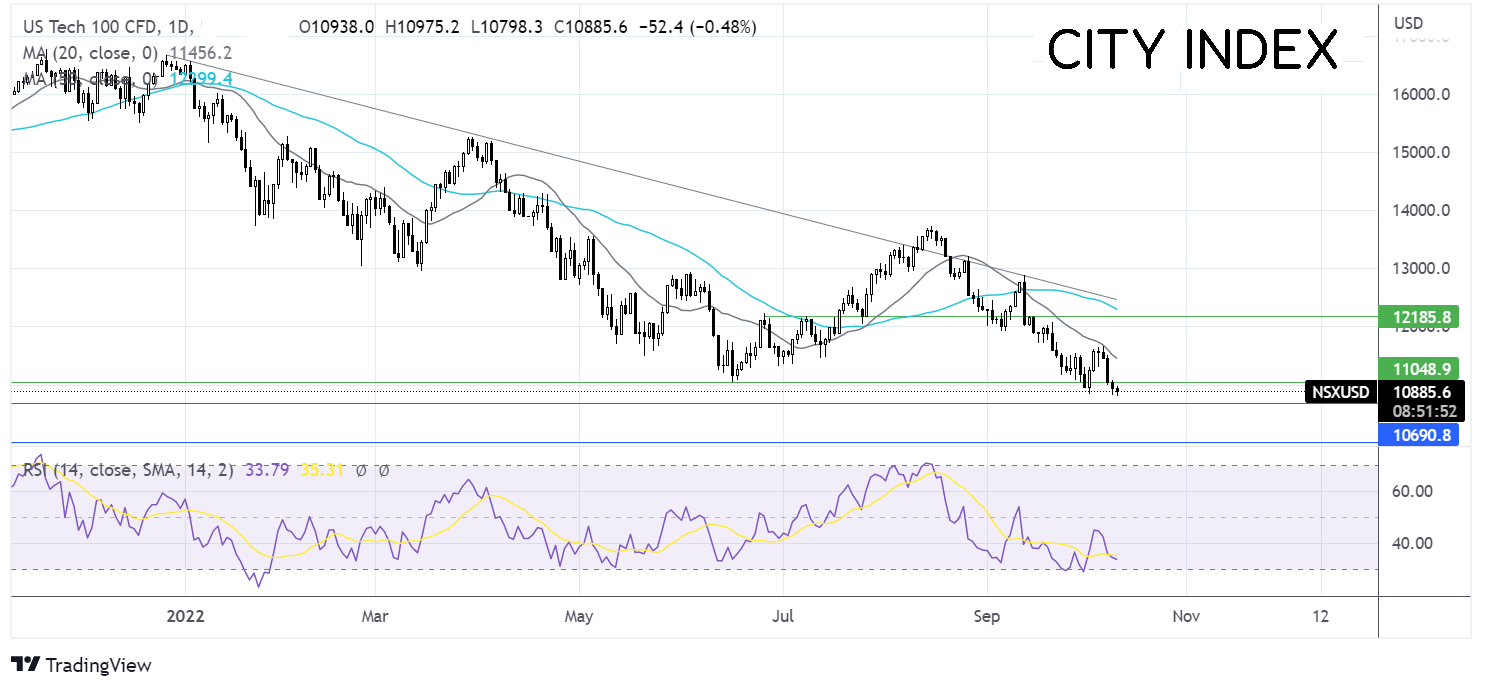

Where next for Nasdaq?

The Nasdaq continues to trade below its 20 sma. It’s taken out the previous 2-year low at 10830. The RSI points to further losses while it remains out of oversold territory. Sellers will look to take out today’s low of 10800, to extend losses to 10650 September 2020 low and beyond here 10000, the psychological level. Meanwhile, buyers will look for a move over the 20 sma at 11450 to bring 11670 into focus, the October high.

FX markets – USD rises, GBP falls

The USD has pared earlier gains. Rising bond yields after the bond market re-opened lifted the greenback. Recession fear

EUR/USD is rising after rebounding off a 12-day low as the USD rally loses steam. There is no major eurozone economic data today.

GBPUSD has risen off session lows and is looking cautiously towards 1.11 as investors digest an unexpected fall in unemployment and further intervention by the BoE. The UK central bank made another emergency move amid risk to financial stability, widening its bond purchases to index-linked gilts just 4 days before the end of the self-imposed bond buying period. While gilt yields have eased from their highs, this is a crisis of faith which ultimately, the Chancellor needs to resolve.

GBP/USD +0.18% at 1.1070

EUR/USD +0.18% at 0.9726

Oil holds steady ahead of OPEC+

Oil prices are heading lower as demand concerns rise. With recession fears once again in focus the demand outlook has deteriorated, pulling prices lower. The IMF warned of a growing risk of global recession on Monday.

These worries and worries over the demand outlook are being further fueled by worries over rising COVID cases in China. Testing has once again stepped up in Shanghai and in some other large cities as China shows no signs of ditching its zero -COVID stance.

Finally, the stronger dollar, which has been oil’s Achilles heel for some time, is hurting demand as buyers with other currencies find oil more expensive.

WTI crude trades -2.1% at $88.70

Brent trades -2% at $93.50

Learn more about trading oil here.

Looking ahead

16:30 Fed Harker to speak

17:00 Fed Mester to speak

19:35 BoE Governor Bailey to speak