US futures

Dow futures -0.56% at 31735

S&P futures -0.6% at 3838

Nasdaq futures -0.2% at 11806

In Europe

FTSE -2.2% at 7558

Dax -3% at 14948

Learn more about trading indices

Fallout continues despite deposits fully guaranteed

US point to a weaker start extending losses from last week the markets continue digesting the latest developments surrounding the Silicon Valley Bank and as fears of contagion ripple across the market.

Over the weekend, the Fed agreed to step in to guarantee all deposits in SVB and Signature Bank, as well as set up a new liquidity program in an attempt to calm the market and halt contagion fears. The program will allow banks to sell treasury bonds to the Fed at par if they need to raise liquidity, with the aim of bank’s clients not having to suffer for a serious risk management failure.

US futures initially rose strongly after the weekend, then quickly reversed those gains. Anyone hoping that the steps over the weekend would have been enough to stem the fallout will be disappointed. Regional banks are getting hammered as investors dump the stocks.

There have been concerns that the Fee hiking interest rates so aggressively could have a big impact, and now cracks are starting to appear in the financial sector.

Bond yields are falling as the flight to safety overshadows inflation fears and as the markets starts to question the Fed’s ability to hike rates much further. Goldman Sachs has said that it no longer expects a rate hike from the Fed in March, and JP Morgan has said that it only expects a 25 bps hike, rather than 50 bps previously.

Volatility is likely to remain high as investors assess the fallout and await key macro data points such as inflation data tomorrow.

Corporate news

Banking stocks are the hares hit, with regional banks suffering the most. First Republic Bank has tumbled 63%, and Western Alliance 68% pre-market. Meanwhile, the big investment banks are also under pressure with Wells Fargo falling 3% and JP Morgan 1.2%.

Seagen jumps 18% pre-market after Pfizer announced plans to acquire the biotech company in a deal worth $43 billion.

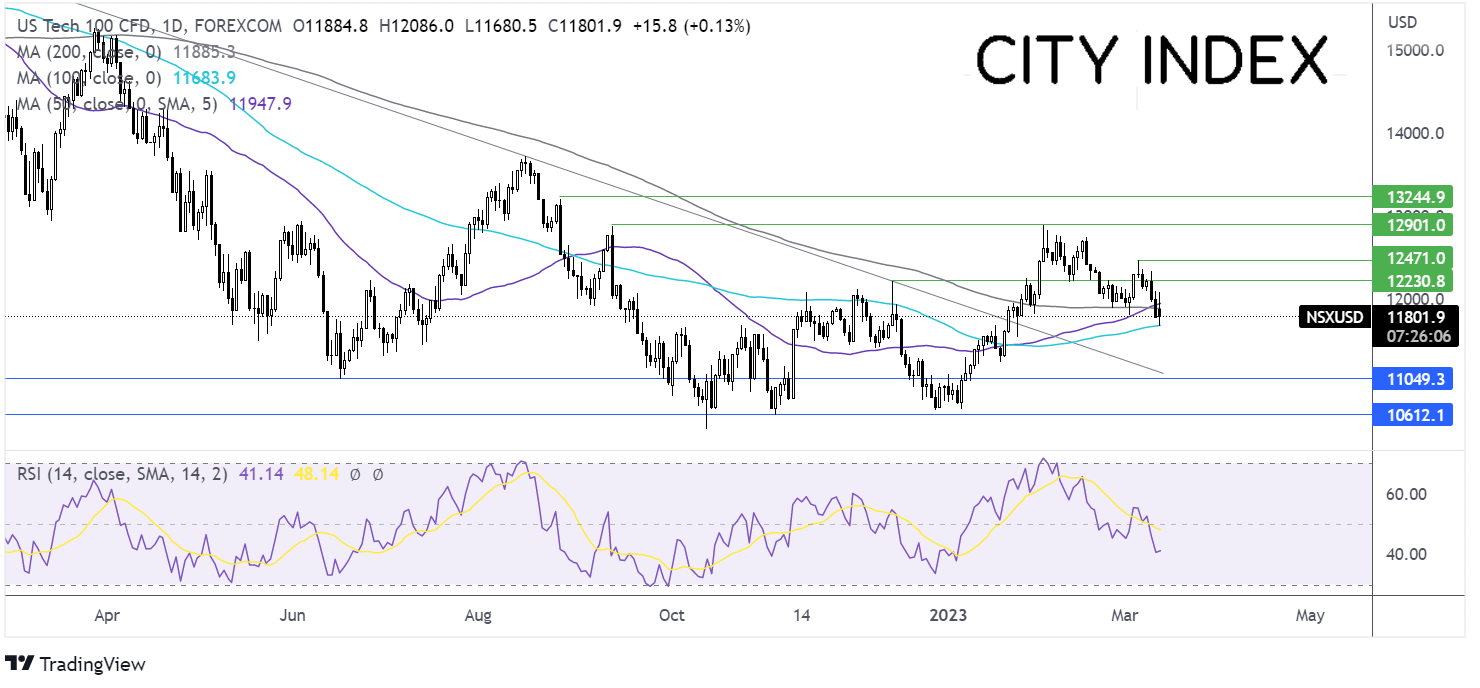

Where next for the Nasdaq?

The Nasdaq fell below the 200 & 100 sma before finding support on the 100 sma at 11680. The RSI remains below 50, which with a close below the 200 sma, could keep sellers hopeful of further downside. Bears will look for a break below 11680 to extend losses towards 11100, the confluence of the falling trendline support and the June 22 low. Meanwhile, should buyers’ manage a close above the 200 sma at 11885, buyers could push higher towards 12200 and 12470, last week’s high.

FX markets – USD flat, GBP rises

The USD is holding steady despite treasury yields falling as investors pare back expectations of a rate hike in March.

EUR/USD is rising as investors look ahead to the ECB rate decision on Thursday. The market is expecting a 50 bps rate hike. However, the market it now viewing 3.5% as the terminal rate in light of the SVB fallout, down from 4% previously.

GBP/USD is rising as sterling capitalizes on the weaker USDD and looks ahead to the UK budget on Wednesday. Data on Friday showed that the UK economy grew at a faster pace than expected in January, rising 0.3% MoM. Expectations of a 25 basis point rate hike in March have eased from being fully priced in down to 75%.

EUR/USD +0.3% at 1.0640

GBP/USD +0.3% at 1.2053

Oil drops to a 2023 low

Oil prices have tumbled over 4%, adding to losses of 3.5% last week, as fears of a fresh financial crisis rattle the market, overshadowing a recovery in Chinese demand.

WTI has fallen to a 2023 low as fares of contagion following the failure of SVB hit risk sentiment. Market sentiment was already fragile amid fears of further tightening by the Fed and by high crude oil inventories. The latest developments and the prospect of contagion means a recession in the US could be closer than expected,

WTI crude trades -4.9% at $73.10

Brent trades at -4.73% at $78,80

Learn more about trading oil here.

Looking ahead

15:00 US inflation expectations