US futures

Dow futures -0.5% at 32677

S&P futures -0.6% at 3875

Nasdaq futures -0.64% at 11463

In Europe

FTSE +0.58% at 7060

Dax +0.2% at 13274

Learn more about trading indices

Fed in focus in a busy week

US stocks are pointing to a weaker open after strong gains last week. All three main indices posted strong gains last week, with the Dow Jones outperforming, with gains of over 5%. The tech-heavy Nasdaq also managed to rise 2% despite big tech earnings disappointing (except Apple).

Stocks found support from growing expectations that the Federal Reserve could adopt a less hawkish approach to monetary policy after the November meeting, where the US central bank is expected to deliver its fourth straight 75 basis point hike.

However, investors are starting to question the chances of a less hawkish stance in light of strong personal spending data, a robust GDP reading, and rising core PCE figures at the end of last week. The data shows that core inflation is still rising, which could prompt the Fed to stick with its aggressively hawkish position.

There is no high impacting US economic data today. Looking out across the week, this will be a key week for the markets with the Federal Reserve rate decision and US non-farm payroll data due, as well as ISM manufacturing and non-manufacturing figures.

Corporate news:

Tesla falls 1% on reports that it is considering taking a stake in Glencore, the commodities giant.

Apple trades lower pre-market amid concerns that a COVID outbreak in the region of supplier Foxconn may affect iPhone shipments in the key holiday period.

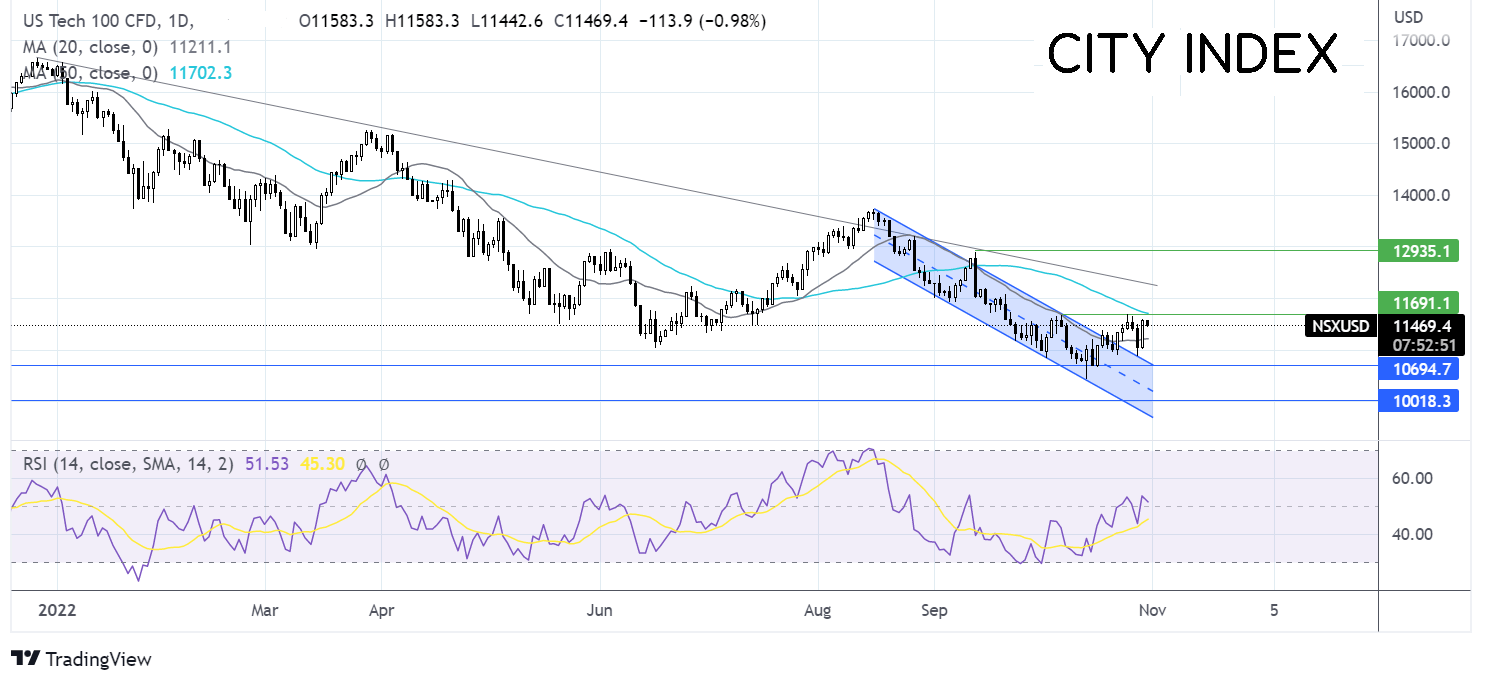

Where next for the NASDAQ?

The Nasdaq recovering from the 2022 low of 10430, the Nasdaq has traded in a holding channel, capped on the upside by 117650, last week’s high and by 10700 on the lower band. The RSI is neutral. Investors may look for a breakout trade with buyers looking for a break over 11700 ahead of 12250 the falling trendline resistance. Meanwhile, sellers could look for a move below 10650 to re-enter the falling trendline and bring 10430 into focus.

FX markets – USD rises, EUR steady

The USD is rising after booking losses of over 1.1% last week. The USD fell as bets rose that the FED could soften its hawkish tone. However, after core pce rose again, personal spending remained strong and Q3 GDP bear forecasts, investors appear to be having second thoughts ahead of Wednesday’s FOMC rate decision.

EURUSD is falling and trades below 0.9950, after briefly rising to 1.0100 last week. The risk-off mood is dragging on the euro even after eurozone inflation came in much hotter than expected at a new record high of 10.7% and after GDP for Q3 rises, avoiding a contraction. Another 75 basis point hike in December looks likely.

GBPUSD is falling, pairing some of last week’s gains. The pound’s relief rally following Rishi Sunak becoming prime minister has run out of steam ahead of the BoE rate announcement on Thursday. According to the ONS the energy support package could help reduce inflation.

GBP/USD -0.7% at 1.1520

EUR/USD -0.47% at 0.9920

Oil falls after weak China factory data

Oil prices are falling, paring gains from last week. Oil prices are heading lower after Chinese manufacturing PMIs missed forecasts raising concerns over the economic recovery in the world’s largest importer of oil.

The sluggish recovery comes as COVID restrictions continue to disrupt performance in China sand given Beijing’s stance, the strict zero-COVID rule looks set to stay.

Also, unnerving investors is news that Saudi Arabia could cut crude prices for Asia for December.

WTI crude trades -1.92% at $85.70

Brent trades -1.83% at $92.56.

Learn more about trading oil here.

Looking ahead

14:30 Dallas Fed Manufacturing Business index

20:20 RBA’s Lowe speaks

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade