US futures

Dow futures -0.07% at 33790

S&P futures +0.03% at 3963

Nasdaq futures +0.03% at 11608

In Europe

FTSE +1% at 7529

Dax +0.3% at 14390

Learn more about trading indices

US GDP beats, ADP misses

US stocks are set for a modestly stronger start amid a buoyant market mood as investors digest the latest GDP and ADP reports and developments in China and look ahead to Federal Reserve Chair Jerome Powell’s speech.

China continues to be a source of optimism for the markets despite elevated COVID figures. The fact that there hasn’t been an additional tightening of curbs despite increasing cases is bringing some hope to the market that China could be moderating the way it deals with Covid outbreaks.

US data is mixed. US GDP was upwardly revised to 2.9%, up from 2.6%, and comes following two-quarters of contraction. Meanwhile, the ADP private payrolls data rose by 127k in November, missing forecasts of 200k and coming in well below the 239k reported in October. The data suggest that weakness could be starting to seep into the labour market. Fed tightening could be starting to loosen the labour market picture, which has been incredibly tight.

Cooling inflation in the US has fueled speculation that the Federal Reserve could slow the pace of rate hikes in the December meeting. However, with inflation still around four times the Fed’s target level, there is still work to be done. Fed Powell will likely reiterate this, as he speaks after several policymakers this week who have leaned towards a hawkish stance. Any hint of dovishness from Powell could well drive an early Santa rally.

Corporate news:

Crowdstrike plunges 17% pre-market after subscription numbers came in below forecasts, and guidance for the current quarter was weaker than expected. Economic uncertainty is prompting customers to delay spending. The warning sent worries across the sector.

Software earnings will continue after the bell with the release of Salesforce reporting.

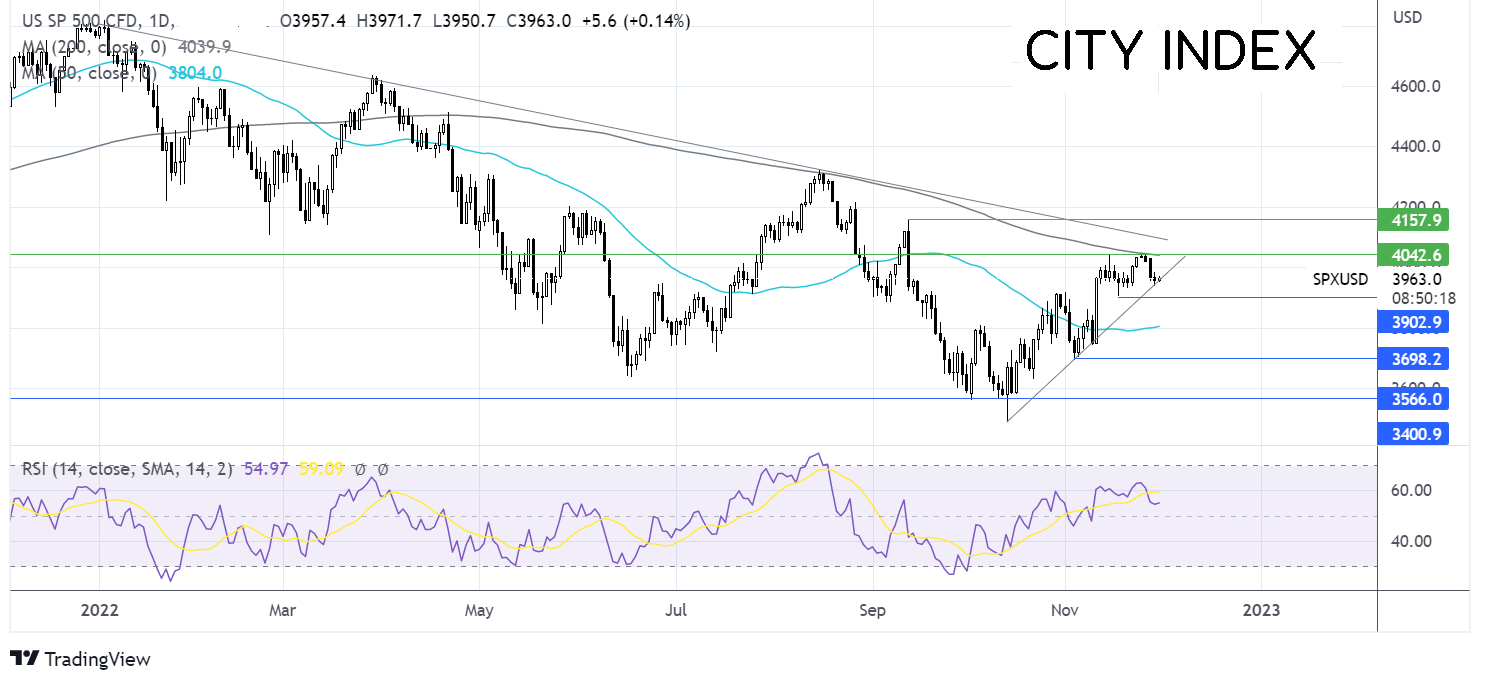

Where next for the S&P500?

After failing at the 100 sma, the S&P500 rebounded lower before finding support on the rising trendline. Should buyers successfully defend the rising trendline, bulls could make another attempt on the 100 sma at the weekly high at 4050. A rise above here exposes the multi-month falling trendline at 4100 and the September high of 4155. On the flip side, failure to defend the rising trendline could see sellers test 3900, the mid-November low before exposing the 50 sma at 3800.

FX markets – USD falls, EUR rises.

The USD is falling as the market mood improves and as attention is turns toward Jerome Powell’s speech.

EURUSD is rising even after eurozone inflation cooled to 10%YoY in November, down from 10.6%. Cooling inflation raises questions about the ECB’s next move. Is a 50 basis point rate hike more likely than a 75 basis point hike? ECB’s Lagarde said that inflation could still rise from here.

GBP/USD is holding over 1.20 despite dismal data. Shop price inflation jumped in November to 7.4%, up from 6.6%, while annual food prices jumped 12.4%. This means already squeezed household incomes will be under an even greater strain.

GBP/USD +0.29% at 1.20

EUR/USD +0.49% at 1.0370

Oil extends gains

Oil is rising, extending gains from the previous session after a larger-than-expected draw on inventories and amid optimism surrounding China and future demand.

According to the latest API data showed that crude oil stockpiles dropped by 7.9 million barrels in the week ending November 25. EIA data is due later today.

According to the IEA, the data has raised supply concerns, particularly as Russian oil production is expected to slow by around 2 million barrels per day by the end of Q1 2023.

However, reports that OPEC+ could keep production unchanged are helping to limit oil gains.

On the demand side, optimism surrounding fewer COVID cases in China and hopes that a faster vaccination programme will see restrictions ease sooner are helping the outlook for oil demand.

WTI crude trades +2.03% at $79.93

Brent trades at +2.3% at $85.99

Learn more about trading oil here.

Looking ahead

18:30 Fed Chair Jerome Powell