US futures

Dow futures +0.12% at 32940

S&P futures +0.21% at 4138

Nasdaq futures +0.25% at 12914

In Europe

FTSE -0.13% at 7470

Dax +0.18% at 13206

Euro Stoxx 0.29% at 3660

Learn more about trading indices

US durable goods are softer than forecast

US stocks are pointed to a quietly higher open in cautious trade after US durable goods orders and ahead of Federal Reserve Chair Jerome Powell’s speech at Jackson Hole at the end of the week.

Central bankers head to Wyoming for the annual conference, and investors are hoping that Powell will give further clues about the size of the September rate hike and the path for monetary policy across the final quarter of the year.

Recent Fed speakers have been notably hawkish, emphasizing the need to control inflation and pouring cold water on hopes of a dovish pivot from the US central bank, even amid signs that the US economy could be cooling.

On the data front US, durable goods orders were flat in July at 0%, down from 2.2% in June. This was below the 0.6% that analysts had forecast.

The data comes after PMI data yesterday showed that the US economy is cooling after the service sector activity contracted at a faster pace than forecast.

Looking ahead, housing data will be in focus, with pending home sales expected to fall 4% in July as higher interest rates cool the housing market.

In corporate news:

Peloton rises by 7% pre-market on news that it has agreed on a deal with Amazon to sell its equipment through the online retailer’s platform.

Nordstrom trades 14% lower after cutting both profit and revenue forecasts. This suggests that consumers are reining in spending as the cost of living rises.

Still to come earnings from Nvidia, Salesforce, and Snowflake.

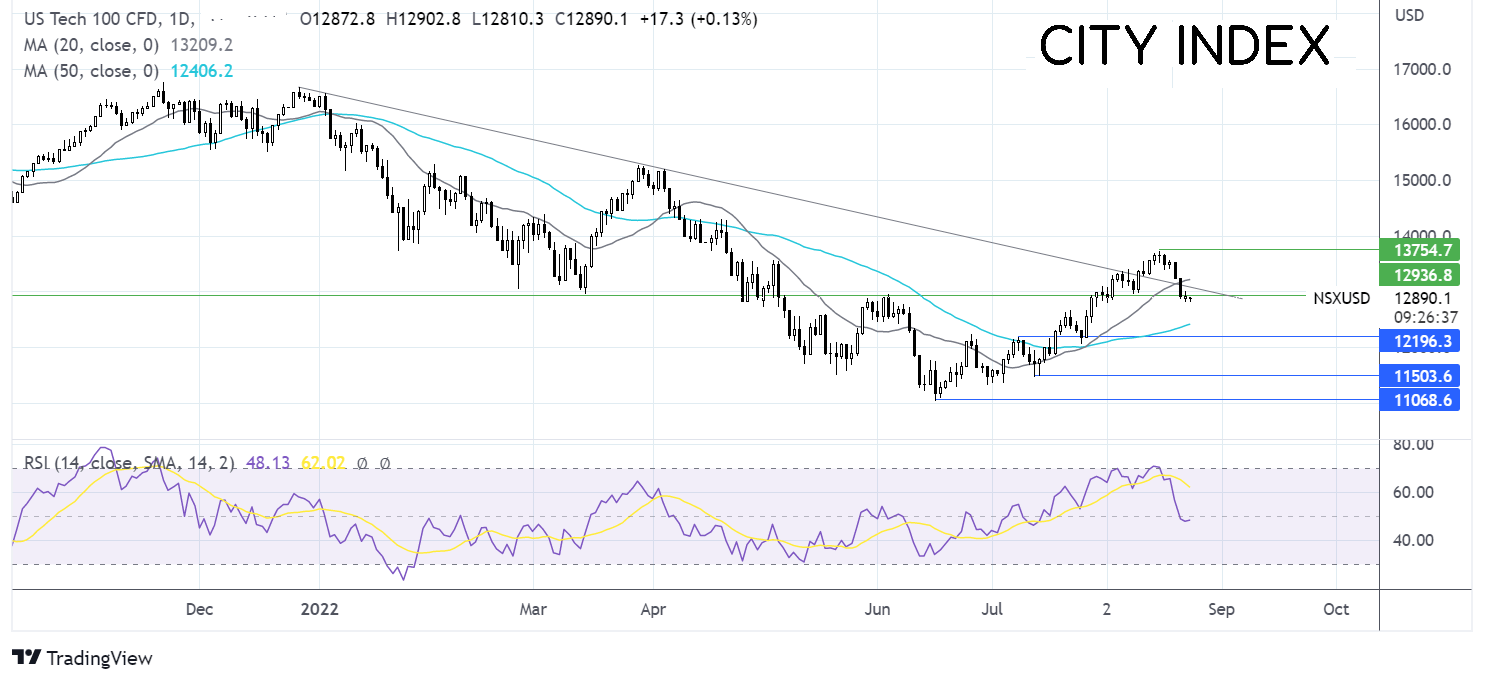

Where next for the Nasdaq?

The Nasdaq ran into resistance at 13725 and has rebounded lower. The fall below the 20 sma and the multi-month falling trendline, coupled with the bearish MACD, keep sellers hopeful of further losses. The 50 sma has been exposed and offers support at 12430, ahead of 11500, the mid-July low. On the flip side, it would take a move above 13725 to create a higher high and change the bearish outlook.

FX markets – USD rises, EUR falls

The USD is rising, paring some losses from the previous session. Hawkish comments from Fed Minneapolis President Neel Kashkari warned that the biggest risk was underestimating price pressures and reiterated the bank’s commitment to bringing inflation under control. No sign of a dovish pivot here – which boosted the USD.

EUR/USD rose yesterday but still closed below parity. The euro is falling again today as concerns over the gas crisis and recession fears hit demand for the common currency. The euro is unlikely to make a sustained and meaningful recovery against the USD until the energy crisis shows signs of easing, which could take years.

GBP/USD is falling back towards 2022 lows as sentiment sours further. Money markets are pricing in interest rates at 4% by 2023, up from 1.75%. However, far from cheering this, fears of a recession keep the pound out of favour against the stronger USD.

GBP/USD -0.4% at 1.1783

EUR/USD -0.39% at 0.9935

Brent rises to $100 per barrel.

Oil prices are rising, extending gains from the previous session after Saudi Arabia hinted that OPEC+ could consider cutting oil output to stabilize the price.

Oil prices have come off recently amid fears of a global economic slowdown hurting the demand outlook. Reading between the lines, her OPEC is keen to push the prices back over $100 per barrel.

The comments come as talks to revive the Iranian nuclear deal are reportedly making progress, which could mean that sanctions could be lifted, and Iranian oil will come flooding back to the market. OPEC is likely giving itself some wiggle room with these comments. Any output cuts will most likely coincide with the return of Iranian oil.

API data showed a larger than forecast draw in inventories. EIA data is due later.

WTI crude trades +0.85% at $94.25

Brent trades +0.9% at $100.15

Learn more about trading oil here.

Looking ahead

15:00 US pending home sales

15:30 EIA crude oil inventories