US futures

Dow futures -1.22% at 29718

S&P futures -1.2% at 3708

Nasdaq futures -1.3% at 11350

In Europe

FTSE -1.7% at 7027

Dax -2.1% at 12270

Learn more about trading indices

Investors continue digesting the Fed meeting

US stocks are heading for losses on the open, adding to losses in the previous session, as recession fears build and the dollar appears to be the only place to hide.

Stocks on Wall Street are heading for steep weekly losses after the Federal Reserve hiked rates by 75 basis points earlier in the week and pledged to keep fighting inflation aggressively.

The market is still repricing and repositioning for the idea that the Fed will keep pushing rates higher for longer and then keep them there.

Attention is now turning to the PMI business activity data for clues on how the US private sector is holding up as the risk of recession rises and as inflation and interest rates rise. The manufacturing PMI is expected to slip to 51.1, which is still expanding. The services PMI is expected to rise to 45 from 43.7, contracting but at a slower pace.

Corporate news:

Costco is falling pre-market after the big box retailer reported a squeeze on margins as higher freight and labour costs eat into margins.

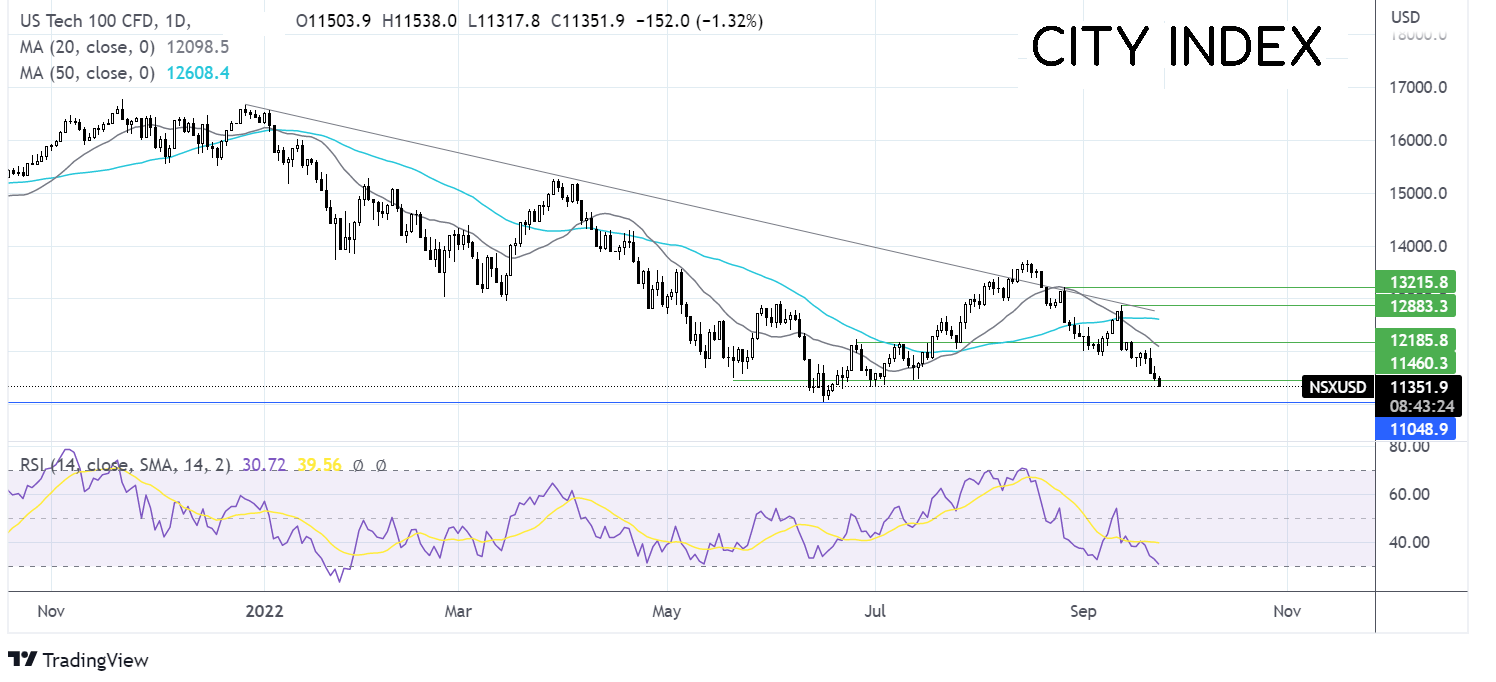

Where next for the Nasdaq?

The Nasdaq has broken below support at 11450 and is powering lower. The 20 sma has crossed below the 50 sma. The RSI also supports further downside while it remains out of the oversold territory. Sellers will look to take out the June low at 11036 to bring 1000 psychological level into target. Buyers would need to rise above 12150 to negate the near-term downtrend.

FX markets – USD rises, GBP tanks

The USD is rising, boosted by hawkish Federal Reserve bets and safe haven flows. Fear is spreading through the market and US dollars are proving to be the best hiding place. US dollar index trades at 20-year highs and is set to rise to 112.00

EUR/USD is falling after PMI data painted a bleak picture. The eurozone composite PMI fell more than expected to 48.2 in September, down from 48.9 in August. The data suggests that the eurozone could already be in recession.

GBPUSD plunges after the Chancellor’s mini budget. Far from soothing concerns over the outlook for the UK economy, Liz Truss and Kwasi Kwarteng’s economic plan for the UK has sent the pound plunging. The announcement of the largest tax cuts since 1972 to boost growth and stave off a recession that has already started has triggered a crash in the pound and the bond market.

The sell-off in UK assets reflects the sheer panic as the new government’s stimulus package will not only grow an already sizeable debt burden, potentially to unmanageable levels but will also add to inflationary pressures.

The BoE, which has been reluctant to hike rates aggressively, will need to roll up its sleeves and fight inflation with larger rate hikes. Expectations for a 1% hike in November are already climbing.

It’s difficult to see how the pound can recover from here. Investors are rapidly pulling out of UK assets, and who can blame them? Drawing comparisons historically, the last big tax giveaway in 1972 resulted in rampant inflation, unmanageable debt, and an IMF bailout.

Suddenly pound parity with the USD looks increasingly likely.

GBP/USD -2% at 1.1056

EUR/USD -0.85% at 0.9750

Oil falls 3%

Oil prices are tumbling lower as recession fears grip the market and the USD marches higher. With central banks across the globe hiking rates, fears of a recession are hurting the demand outlook for oil. Quite simply, slower growth means weaker oil demand.

The downside could be capped by heightened tensions as Russian mobilizes more troops to support the ongoing war in Ukraine. Following Putin’s latest threats, the EU is rushing to agree on an oil price cap. The cap could hit Moscow’s revenue which is helping to fund the war.

WTI crude trades -3% at $80.81

Brent trades -2.7% at $87.1

Learn more about trading oil here.

Looking ahead

14:45 US PMI data

18:00 Baker Hughes