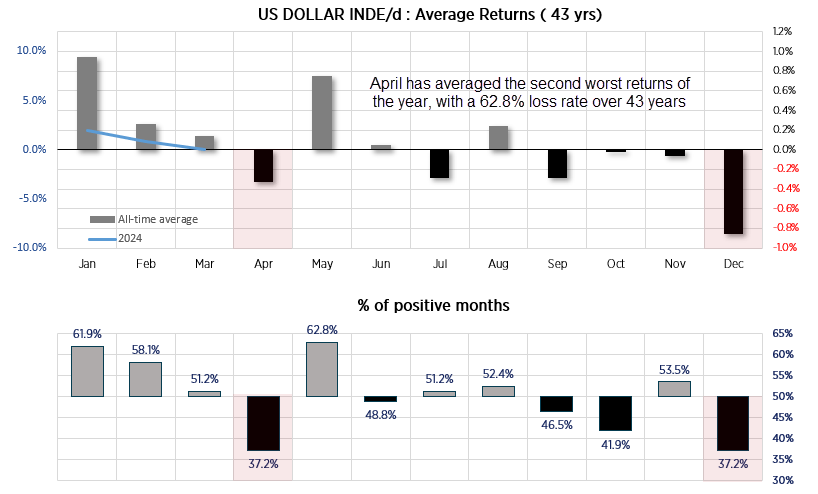

It is touch and go as to whether the US dollar index can rise for the third consecutive month this quarter, as it has stalled around a key trendline and meanders around the open price for March. And a cursory glance at my ‘average returns’ dashboard shows that gains for the US dollar have diminished slightly in February and March. But the real focus is on the US dollar’s tendency to trade lower in April.

US dollar seasonality analysis:

Taking data over the prior 43 years, the US dollar index has averaged a return of -0.33%, closing lower 62.8% of the time. In terms of performance over the year, April is the second worst month behind December, which has an average return of -0.85% over the same period with the same loss-rate of 62.8%.

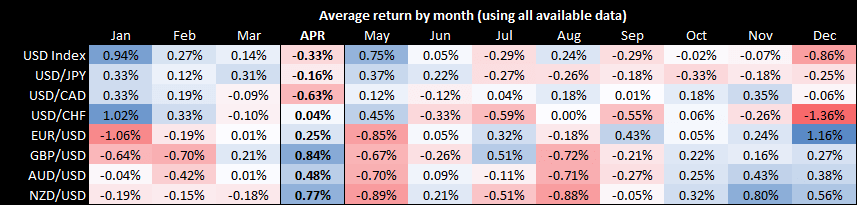

If we look at how individual forex majors have performed relative to the US dollar index, I’ve drawn the following observations:

- The US dollar has been lower against all FX majors, except the Swiss franc (USD/CHF averaged a minor positive return of 0.04%)

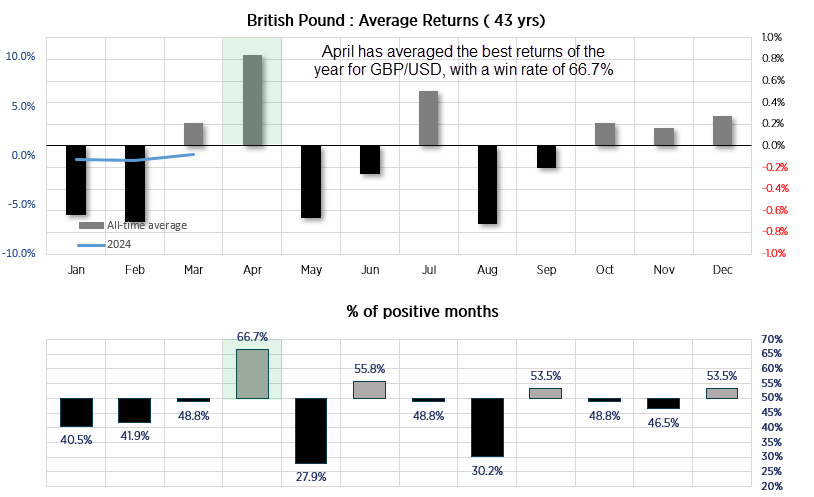

- GBP/USD has delivered the best average returns of 0.84%

- Commodity currencies have performed well in April, sending NZD/USD 0.77% higher, USD/CAD -0.66% lower and AUD/USD was up 0.48%

- A lot of these moves are then reversed in May with the US dollar index averaging a positive return of 0.75%

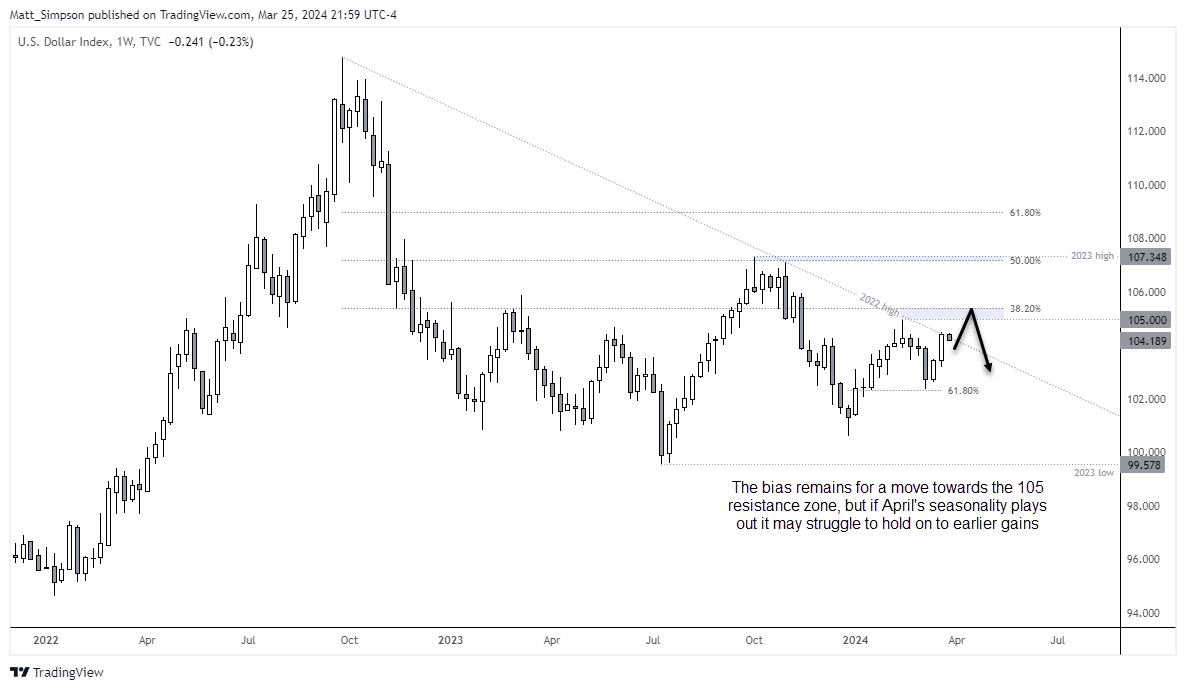

US dollar index technical analysis:

The weekly chart shows that the US dollar index has formed two lower highs since the 2023 low, and two lower highs since the 2023 high. Ultimately prices are coiling on the weekly chart, and the trend of this timeframe could end up going either way.

Yet for now the US dollar index is considering above a break above the 2022-high trendline. As outlined on Monday, my bias is for a move towards the 105 resistance zone, but not before a pullback on the daily timeframe. Yet whether it has the appetite to break materially above 105 / 38.2% retracement level is likely to come down to how hawkish comments are from Fed members.

The dot plot still suggests three cuts, we’ve already had Bostic reiterate his view of just one cut this year. If other Fed members follow suit, the US dollar index could extend it rally above 106.

Yet if its seasonality is to play out this year (which is has a relatively higher probability of finishing lower than it does higher), we might find any such rally short lived and for the market to top out and then trade back below March’s open price.

We’re approaching the end of month and quarter, which also lands on the long Easter Holiday weekend. So that could lead to some erratic price behaviour as we head towards Friday, which should see volumes drop with major exchanges closed.

GBP/USD technical analysis:

April tends to the most bullish month of the year for GBP/USD, with an average return of 0.84% and a win rate of 66.7%. Yet this flies in the face of traders currently trying to price in multiple rate cuts from the BOE this year, and the growing expectation that they may begin to ease before the Fed.

This could at least cap the upside potential for GBP/USD in April, or see it close lower if traders buy the US dollar on bets of only one Fed cut this year. The situation is certainly fluid and likely requires to be followed closely.

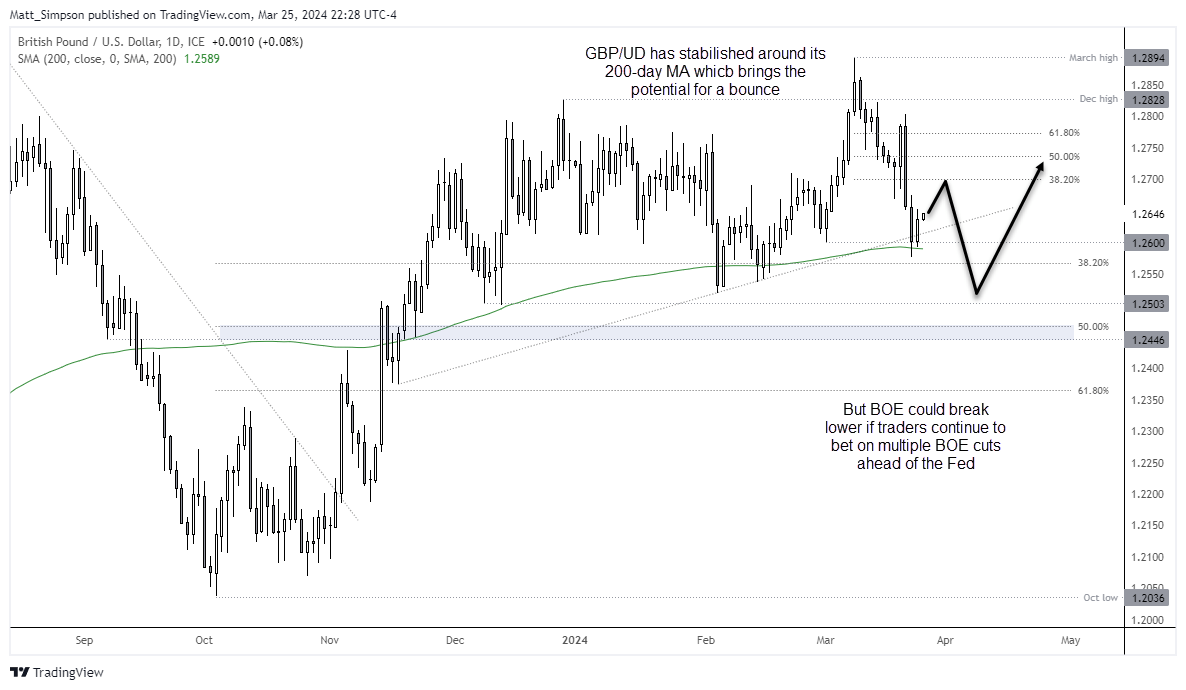

The daily chart shows that GBP/USD has fallen -2.4% since the March high, although prices are stabilising around the 200-day average. A small bullish inside day formed on Monday whilst the US dollar index retraced below resistance, and I see the potential for it to extend its rally today given the extended nature of last week’s declines.

As we enter April, incoming data from the UK and its ability to shape policy expectations will be a key driver for GBP/USD. If the US dollar remains supported, then a move below the 200-day average could be in order. However, if seasonality is to kick in (or bets for BOE easing are trimmed back) then we might finally see GBP/USD bounce and regain some ground in line with its April seasonality.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade