GBP/USD rises ahead of BoE’s Bailey

GBP/USD is pushing higher on signs that UK inflation may not cool as quickly as the Bank of England is hoping.

The latest data from the British Retail Consortium showed that fresh food annual inflation in the UK in March was 17%, up from 16.3 in February. Overall food inflation increased to 15% up from 14.5%. The data comes after CPI last week unexpectedly jumped to 10.4%.

The BoE and the Fed both hiked rates by 25 bps last week. The market is pricing in the probability that the Fed holds fire at the next meeting at 70%. This is 50% for the BoE, favouring the pound.

The pound is also being held higher by the upbeat market mood as banking fears fade and as investors look ahead to BoE governor Andrew Bailey speaking later today.

The USD is falling across the board. US consumer confidence data will also be in focus.

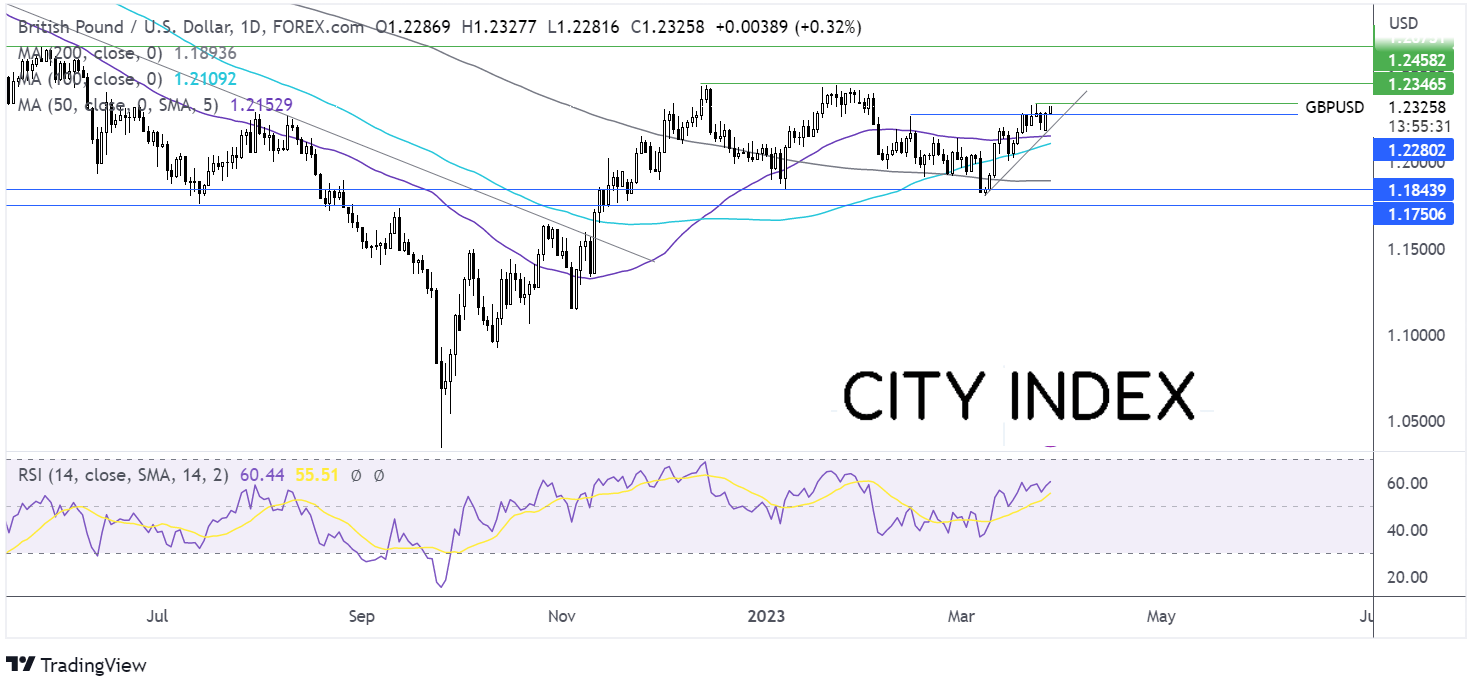

Where next for GBP/USD?

GBP/USD rebounded off the rising trendline support at 1.2190 and has risen above resistance at 1.2270 the February 14 high. This combined with the bullish RSI could see buyers look to test resistance at 1.2348 the March high, ahead of 1.2448 the 2023 high.

Immediate support can be seen at 1.2270. A break below here brings 1.2190 yesterday’s low into focus and then 1.2150 the 50 sma. A break below here negates the near term uptrend.

USD/JPY falls ahead of US consumer confidence data

USD/JPY his falling even as the market mood is improving as recent banking worries continue to fade. The yen which usually benefits from safe haven flows is leading the gains thanks to consolidation of overseas profits by Japanese companies ahead of the end of the Japanese financial year on Friday.

A rise in Japan’s services inflation is also boosting the yen, with investors betting that the BoJ will adopt a less dovish stance going forwards, despite comments from BoJ Governor Haruhiko Kuroda defending easy monetary policy.

Meanwhile the USD, is falling as investors continue to bet that the Fed will pause rate hikes at the next meeting.

Attention now turns to the US consumer confidence reading which is expected to slip for a third straight month to 101 down from 102.9. Weak confidence could further fuel bets that the Fed will adopt a less hawkish stance.

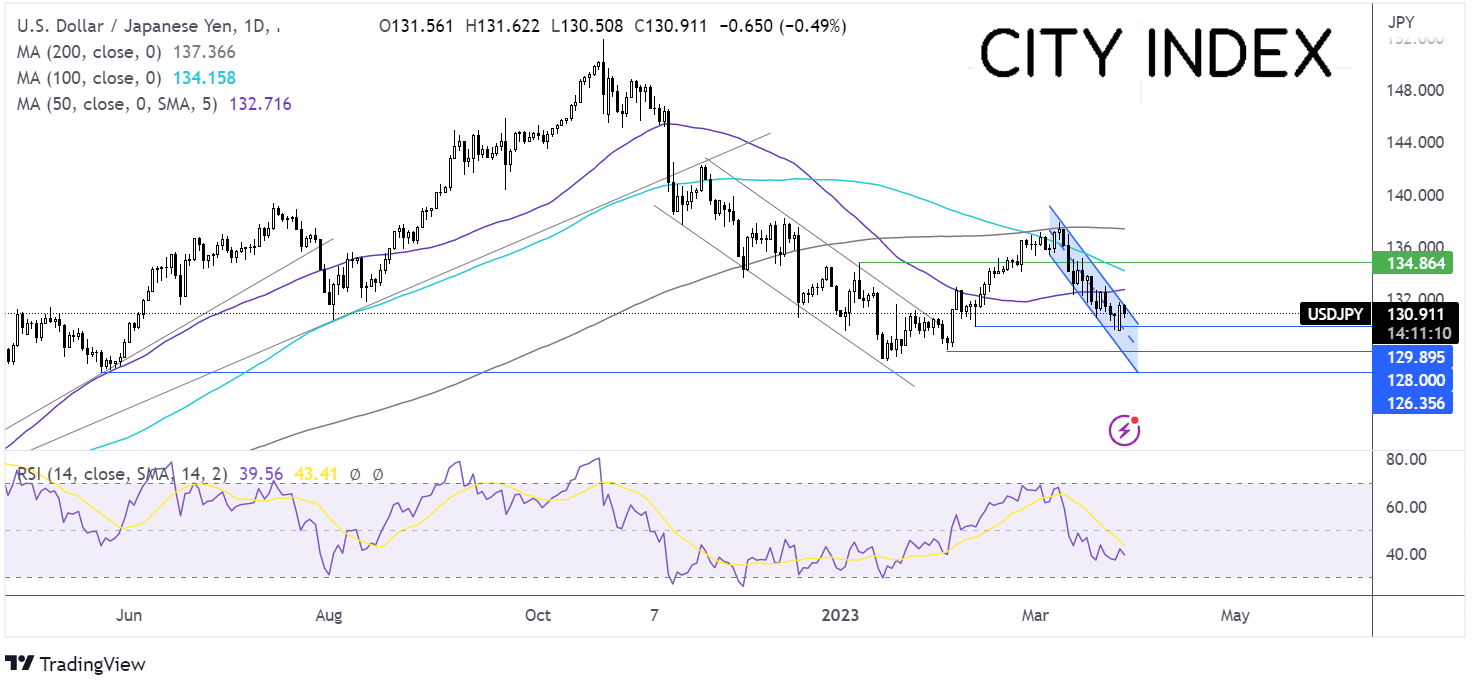

Where next for USD/JPY?

USD/JPY continues to trades within a falling channel. After finding support at 129.65 the price has rebounded and is testing resistance of the upper band of the channel.

Buyers could look for a rise above 131.75 yesterday’s high to extend gains to 132.80 the 50 sma.

Meanwhile sellers could be encouraged by the RSI below 50. Sellers will look for a fall below 129.65 2023 low to create a lower low and extend the bearish trend towards 128.00 the February low.