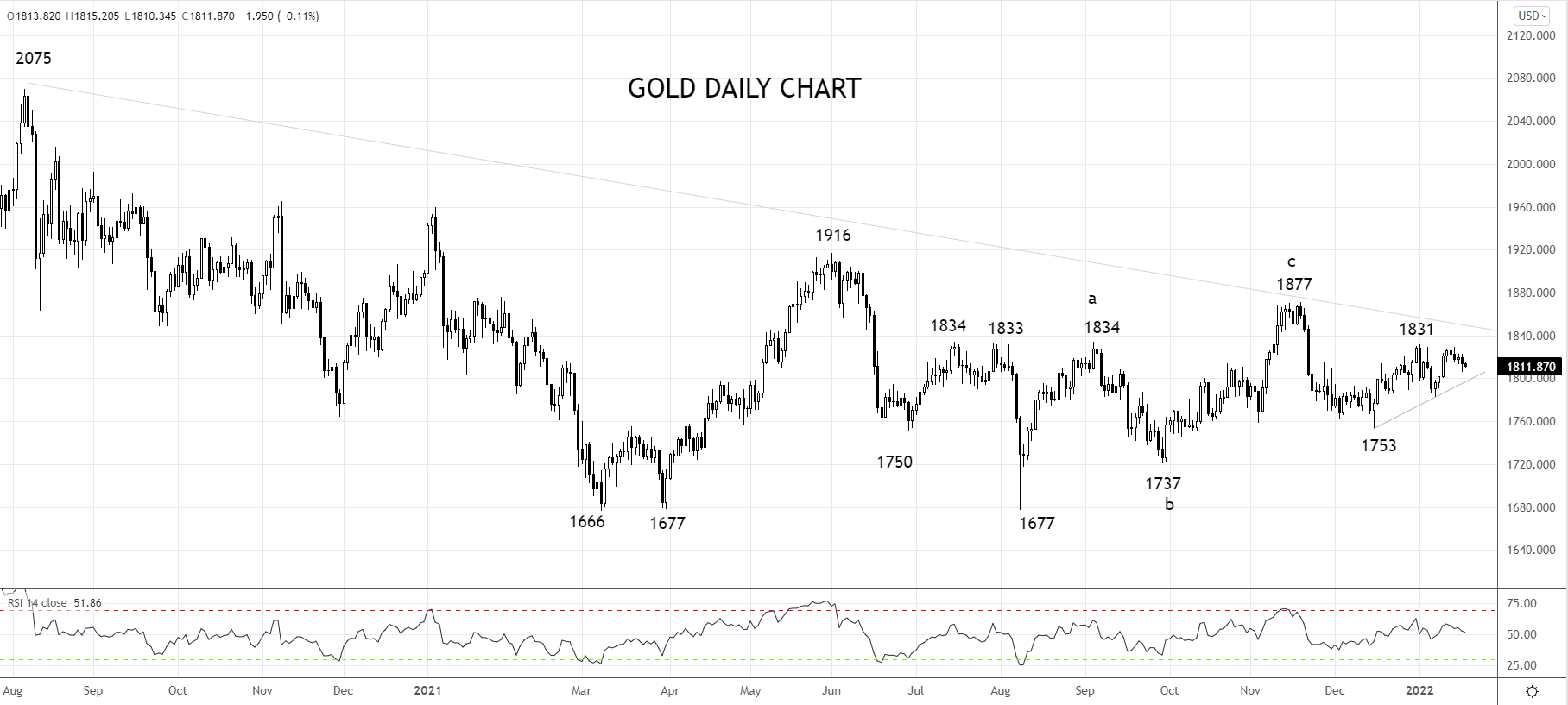

In late November, the renomination of Fed Chair Powell over Fed Governor Lael Brainard was considered a hawkish development. U.S. real yields rebounded higher, and gold wasted little time collapsing below $1800 before finding support near $1753 in mid-December.

Since mid-December, real yields have rallied further away from the deeply negative levels of November. Evidence of how far they have come, U.S. 10-year real yields (the interest rate adjusted for inflation) closed overnight at -59bp.

The dominant view that real yields are the key driver of gold is now under review. Is gold set to move lower, dragged down by rising real yields. Or are other factors now in the driving seat and set to take gold higher?

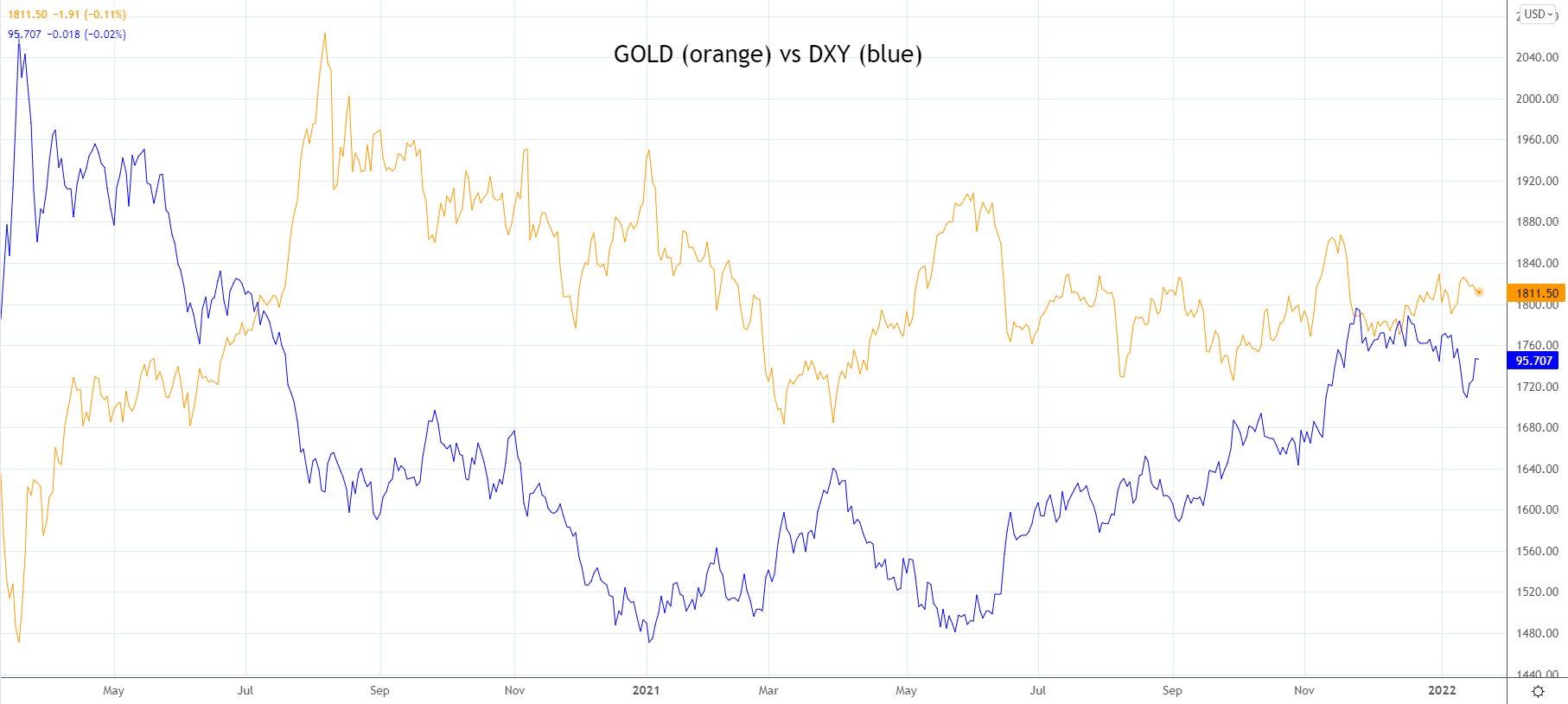

Potentially the fall in the U.S. dollar in early 2022 has provided support for gold (the two are negatively correlated). However, the U.S. dollar Index, the DXY, is now just a stone’s throw from where it started the year. Hence support from a weaker U.S. Dollar is being eroded.

Another possibility is with inflation printing near 40-year highs at 7%, there is a growing fear of debasement of fiat currency. Investors, including central banks, are again accumulating gold.

Technically the $1830/$1850 level looks to be a useful pivot (bullish above bearish below) in the battle for gold.

Should gold see a sustained break and close above the $1830/50 resistance, the picture would start to brighten for bullion. Until then, the risks appear skewed to the downside.

Source Tradingview. The figures stated areas of January 19th, 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade