This morning's release of March quarter Australian inflation data smashed already elevated expectations. The stunning beat firms up the chances that the RBA will raise interest rates at its monthly board meeting next week for the first time since 2010.

Headline CPI rose by 2.1% QoQ and 5.1% YoY, shattering the median consensus for a rise of 1.7%qoq or 4.6%yoy. The RBA's preferred measure of inflation, the trimmed mean, increased by 1.4% QoQ and 3.7% YoY, well above the market's expectations of 1.2%qoq and 3.4%yoy.

Core inflation is now 70bp above the RBA's 2-3% target band, and the quarterly gain is the strongest movement since the series began in 2002. The annual trimmed mean was the highest since 2009.

The stunning beat increases the chances that the RBA will raise interest rates by 15bp at its monthly board meeting next week for the first time since 2010, just three weeks before a Federal Election.

The RBA last lifted rates during an election campaign in 2007, and the incumbent Howard government promptly lost the election three weeks later.

While the acceleration was broad-based, the most notable rises were across food (a result of recent floods in Northern NSW and Southern QLD), transport, housing and fuel.

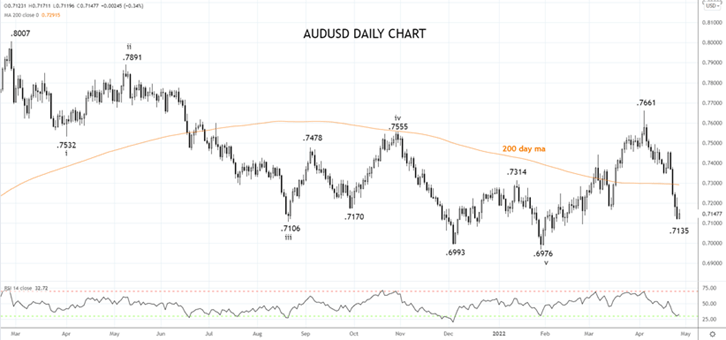

After the release, the AUDUSD bounced from .7150 to a high near .7170 before sliding back to .7150. This is because the driver of the AUDUSD in recent sessions has been the rapid depreciation of the CNY.

The Chinese currency has fallen almost 3.5% over the past seven days on growth concerns emanating from China as the lockdown in Shanghai enters the fourth week and looks set to spread to Beijing.

USDCNY had a more sedate date yesterday, settling around 6.55 after the PBoC's FX RRR cut by 1%, viewed as an effort to slow down the depreciation rather than draw a line in the sand.

USDCNY is expected to continue higher towards 6.65 in the coming weeks. This should see the AUDUSD test support between .7050 and .6950, providing a medium-term buying opportunity for the AUDUSD.

Source Tradingview. The figures stated are as of April 27th 2022. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade