Key takeaways

- The US ISM Manufacturing PMI survey registered 47.7 in February, slightly up from January's reading of 47.4, indicating the fourth consecutive month of contraction in the manufacturing sector.

- However, the survey showed signs of stabilization, as the new orders sub-index improved to 47.0 from 42.5 in January, and order books improved, although the backlog of unfinished work remained low.

- The survey's measure of prices paid by manufacturers rebounded to 51.3 in February from 44.5 in January, indicating potential inflationary pressures. Meanwhile, the employment index fell to 49.1 from 50.6 in January.

The Institute for Supply Management (ISM) recently released the Manufacturing Purchasing Managers’ Index (PMI) for the United States.

The data shows that the US manufacturing sector has been contracting for the fourth consecutive month in February. However, there are signs that the industry could be stabilizing as the subcomponents of the report, including new orders, production, employment, supplier deliveries, and prices, are showing a mixed picture.

The overall PMI index remained flat at 47.7, just slightly higher than the 47.4 reading in January, and below the Reuters forecast of 48.0. A PMI reading below 50 indicates contraction in manufacturing, which represents about 11.3% of the US economy. Despite the weak PMI readings, the industry could be stabilizing as production rebounded in January, according to data from the Federal Reserve.

The new orders sub-index, which measures demand for goods, showed some improvement, rising to 47.0 last month from 42.5 in January. However, the backlog of orders remained low, indicating that demand is still relatively weak. The production sub-index, which measures output, fell to 47.3 in February, down from 48.0 in January. The decline suggests that manufacturers are slowing production, likely due to weak demand.

The employment sub-index fell to 49.1 in February, from 50.6 in January, indicating a slowdown in factory employment growth. However, the correlation between the employment sub-index and manufacturing payrolls in the government's closely watched employment report has been weak. Payrolls have mostly grown at a solid clip.

The supplier deliveries sub-index remained little changed at 45.2 in February, suggesting that suppliers are still delivering goods to factories at a faster pace than normal. The prices sub-index rose to 51.3 in February, up from 44.5 in January, indicating that manufacturers are paying more for inputs.

Inflation could remain elevated for some time, given the price sub-index's rebound and the ongoing supply chain disruptions. Despite improving supply and softening demand, inflation flared up, with both consumer and producer prices logging big monthly gains in January.

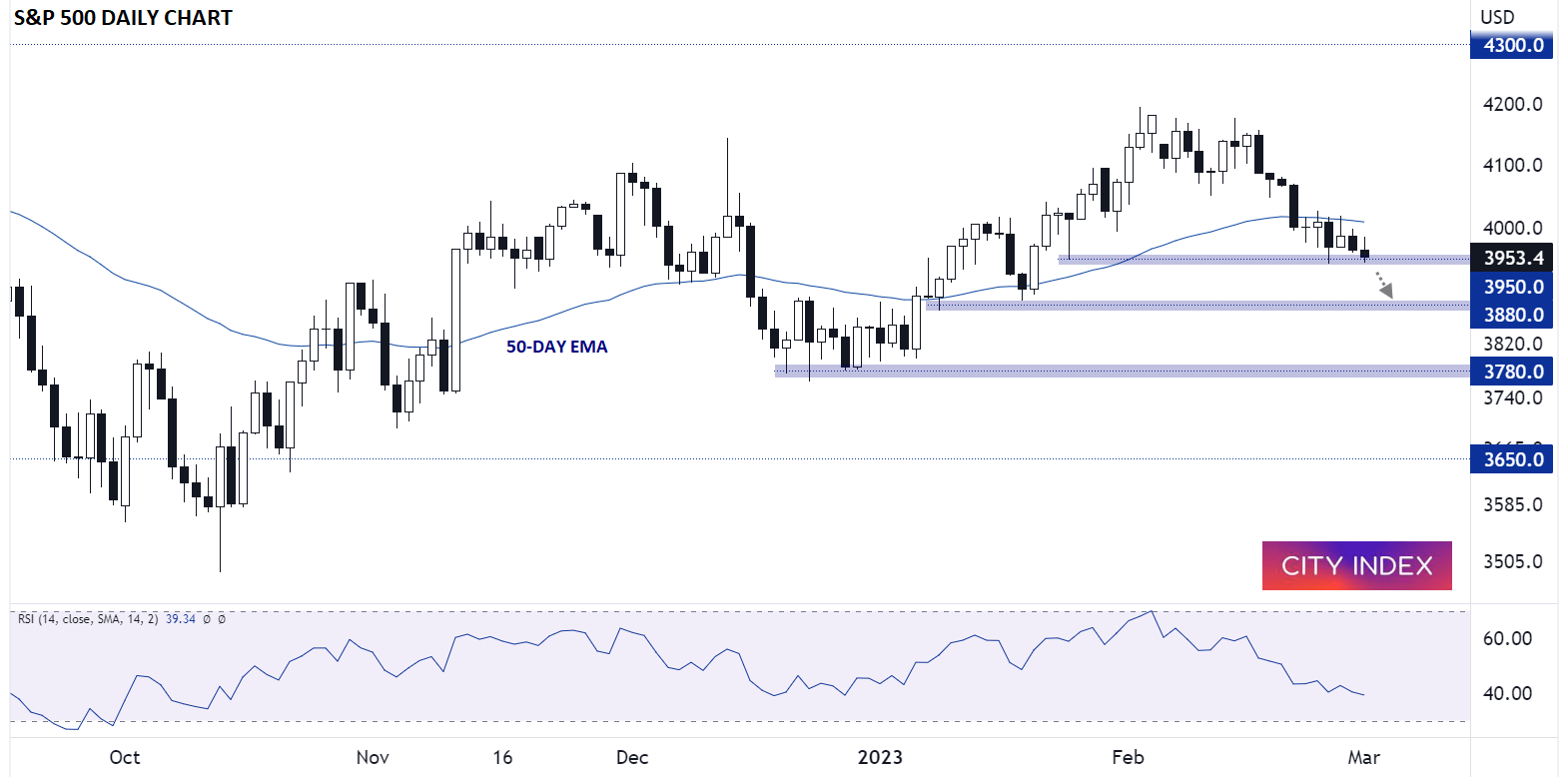

S&P 500 (US 500) technical analysis

US indices are ticking lower early in Wednesday’s trade following the ISM Manufacturing PMI report as traders price in “higher for longer” interest rates from the Federal Reserve. As the chart below shows, the broad S&P 500 is testing Friday’s intraday low near 3,950, a level that also marks the lowest price since January 20th.

With prices now clearly below the downward-trending 50-day EMA, the near-term trend has shifted back in favor of the bears, with a confirmed break potentially exposing the mid-January lows in the 3,880 area, followed by the December lows near 3,780.

Bulls will want to see a bounce off the current support level and a move back above the 50-day EMA near 4010 before having more confidence in continued gains.

Source: TradingView, StoneX

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter @MWellerFX

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade