The FOMC day finally arrives, and the markets are steady amid expectations the Fed will reduce the pace of hiking further. US index futures have held onto the gains made yesterday with the dollar remaining undermined against the euro, pound and yen.

The FOMC is widely expected to raise rates by 25 basis points today at 7pm GMT, lifting interest rates to a target range between 4.50% and 4.75%. If this is the case, it would mark another downward step after the 50 basis points in December, following four 75 basis-point hikes earlier last year.

Fed Chair Jerome Powell is likely to keep further hikes on the table and lean against bets they will cut later this year, something which may get interpreted as being hawkish. But as we have seen in recent Fed meetings, the market has been quick to dismiss the Fed’s hawkishness and price in a lower terminal interest rate. Are we going to see a similar response this time, too?

Well, ahead of the FOMC, sentiment remains positive on Wall Street. Yesterday saw the major US indices recover strongly after being lower on the session. Index futures have remained stable, suggesting more gains could be on the way before the FOMC announcement.

Weaker-than-expected data on Tuesday re-enforced expectations that the Fed will be more inclined to stop its hiking cycle sooner. Employment Cost Index, a key measure of wage inflation, rose by 1% q/q, which was weaker than expected, while the latest Chicago PMI reading (44.3 vs. 45.1 expected) and CB Consumer Confidence index (107.1 vs. 109.1 expected) both also disappointed. Traders were also unwilling to bet against the market ahead of the big tech earnings and FOMC decision, taking place later today.

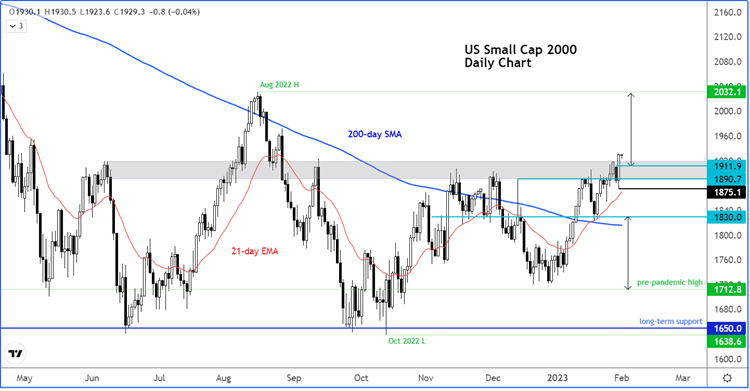

As a result of the recovery on Tuesday, the technical bullish bias was maintained for the major indices. Interestingly, and despite more signs emerging that the US is potentially heading into a recession, small-cap and domestically focused stocks rallied to send the Russell index above a key resistance zone.

As can be seen, our US Small Cap index (Russell proxy) created a bullish engulfing candle and broke above an important resistance band starting around 1890 in the process:

Now, for as long as the low of yesterday’s range doesn’t give way on a daily closing basis in response to the FOMC decision later, this should keep the bulls in charge. If that’s the case, we may see follow-up technical buying towards the August 2022 high at around 2032 in the days to come.

However, if the FOMC decision triggers a risk off response and we get a close below yesterday’s bullish engulfing candle, then this could see the bulls rush for the exits, sending the market plunging towards the 200-day average at around 1816 next.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade